- Joined

- Dec 18, 2020

- Posts

- 514

- Virgin

- Platinum

- Oneworld

- Sapphire

- Star Alliance

- Gold

I’ve got some sympathy for that view, but ….But I have come to the view that there's little benefit in spelling it out to newbies who aren't prepared to do the work themselves. There's more than enough information already in this thread if you're willing to read it from start to finish, which is what I did over the course of a month before I even considered starting.

When I first started looking at this thread about 18mths ago, there was half the number of pages. It took a long time to read through and I was still left with questions. I’ve noticed now that there is a fair bit of duplication which makes research just that bit more convoluted

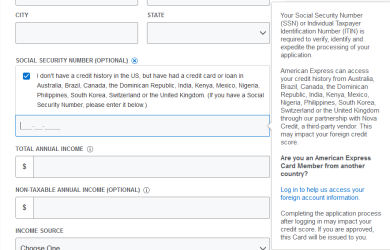

i was toying with the idea of compiling a ‘how to’ step-by-step guide, putting it in this thread to be corrected by the true experts (I only have two US Amex and no ITIN or SSN, so still a - happy - novice) and then putting it up on a stand-alone thread.

Then people can be armed with basic knowledge before coming to this thread and asking more informed questions.

I just haven’t yet had time to get started …..

Post automatically merged:

ThanksIt’s a U.S. one opened ages ago when they were setting these up for Australians and you just needed to have a checking account open (opened in person at a branch). They had a list of cards they’d set up under this program.

They don’t do this anymore unfortunately.

Shame