@nightelves for me the benefit is being able to redeem my MR points in the US program - they have a broader range of redemption partners and airlines and KF is still 1:1 - though as has been highlighted, that might not mean much when SQ devalue their points table - you have 1:1 but require a whole lot more points.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Strategy to obtain US Amex

- Thread starter ithongy

- Start date

- Featured

nightelves

Active Member

- Joined

- Jan 11, 2016

- Posts

- 977

Oh wow did not know you could do that. Has there been any news of a devaluation from SQ?@nightelves for me the benefit is being able to redeem my MR points in the US program - they have a broader range of redemption partners and airlines and KF is still 1:1 - though as has been highlighted, that might not mean much when SQ devalue their points table - you have 1:1 but require a whole lot more points.

First there was St George Amplify which changed theirs from 2:1 to 3:1 - I thought that just aligned it with parent Westpac's rate of 3:1 on its Westpac branded Altitude program.

Amex has also changed SQ to 3:1 from 2:1 - there is some conjecture that the price SQ charges for points has gone up. I'm thinking maybe Amex has used the opportunity to reprice its most popular transfer partner to 3:1 to "meet the market". We'll see what everyone else does. I suspect then whatever the next most popular transfer partners (say CX, will be next to move to 3:1 to match the bank programs if the change wasn't fuelled by a price rise). I guess we'll know shortly. That's my theory anyway.

Moving to the US program, I'm hoping to stay ahead of it but you never know. Guess it would have been smarter to do it when the $A was higher.

Amex has also changed SQ to 3:1 from 2:1 - there is some conjecture that the price SQ charges for points has gone up. I'm thinking maybe Amex has used the opportunity to reprice its most popular transfer partner to 3:1 to "meet the market". We'll see what everyone else does. I suspect then whatever the next most popular transfer partners (say CX, will be next to move to 3:1 to match the bank programs if the change wasn't fuelled by a price rise). I guess we'll know shortly. That's my theory anyway.

Moving to the US program, I'm hoping to stay ahead of it but you never know. Guess it would have been smarter to do it when the $A was higher.

Franko Costa

Active Member

- Joined

- Aug 18, 2011

- Posts

- 830

@nightelves this is what I wrote back in Jan about Hilton, but essentially you get an uplift on all your points if you transfer your MR from AU to US

"This is slight off topic and maybe everyone knows this already, but we get ripped off for Hilton points. Our conversion rate is 2:1 whereas US is 1:2!!!

If I had 100k Amex points, that would be 50k Hilton points in Australia. However, if I transferred them to US at a rate of 0.7 (if anyone has transferred recently please lmk the rate), and use those 70k US Amex points to get 140k Hilton points. That's 50k vs 140k - just crazy (unless I am missing something). This doesn't even count any special transfer offers either that might come up in the US"

"This is slight off topic and maybe everyone knows this already, but we get ripped off for Hilton points. Our conversion rate is 2:1 whereas US is 1:2!!!

If I had 100k Amex points, that would be 50k Hilton points in Australia. However, if I transferred them to US at a rate of 0.7 (if anyone has transferred recently please lmk the rate), and use those 70k US Amex points to get 140k Hilton points. That's 50k vs 140k - just crazy (unless I am missing something). This doesn't even count any special transfer offers either that might come up in the US"

It’s all upthread. However, on transfer AU to US you will get “more bang for your buck”. I am about to do this with my AU MR.… what the benefit of transferring AU MR to US MR be?

Patience, Grasshopper… I requested points transfer last week from AU MR to US MR - the FX rate continues to deteriorate and haven't seen any points move yet. How long does this take?

http_x92

Active Member

- Joined

- Sep 29, 2020

- Posts

- 700

- Qantas

- Gold

- Virgin

- Red

Went for the Marriott Bonvoy Bevy and I get... the pop up jail for my 3rd GT, and I have been making loads of transactions on the Surpass and Aspire. Could also be the bonus from the retention offer (10k HH). Ah well.

- Joined

- Feb 23, 2015

- Posts

- 6,818

- Qantas

- Platinum 1

- Virgin

- Platinum

- Star Alliance

- Gold

Went for the Marriott Bonvoy Bevy and I get... the pop up jail for my 3rd GT, and I have been making loads of transactions on the Surpass and Aspire. Could also be the bonus from the retention offer (10k HH). Ah well.

Did you use a referral link?

http_x92

Active Member

- Joined

- Sep 29, 2020

- Posts

- 700

- Qantas

- Gold

- Virgin

- Red

Did you use a referral link?

Used my Amex AU profile, switched to the US site and did it with GT. Pretty much direct on the site. Would admit that I used the Hilton resort credit twice and the Airline Incidentals 3 times on the Aspire. Maybe thats why. Its okay I guess...

Tiki

Established Member

- Joined

- Jul 21, 2004

- Posts

- 1,764

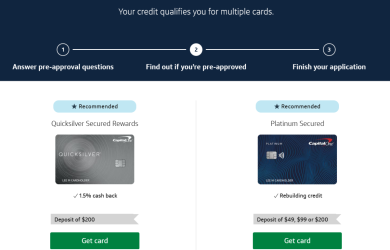

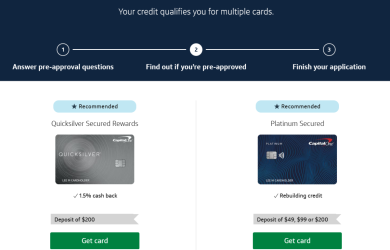

Looks like Cap 1 Venture is off the table. I specifically said I wanted travel rewards and sign up bonus and this is all they prequalified me for. And this is with all 3 credit scores in the 780's. SECURED cards after 40 years of perfect credit card history! They probably don't like that I got 2 new cards in March and April.

Tiki

Established Member

- Joined

- Jul 21, 2004

- Posts

- 1,764

It gets worse. I was confident of an approval for the Amex Green so I applied using an AFF member's link. Got stuck in pop-up jail. They were happy to give me the card, just not the SUB and who knows how long this bonus will last?

I opened a DL gold last year and closed it to avoid the annual fee. Then I opened a HH Surpass which I am keeping and paying the fee for the Priority Pass.

Not sure if I should try for the Bonvoy Bevy (don't care about Bonvoy but would transfer to airlines) but the annual fee is a bit high $250 USD and I have to do 6 stays before 31 Jan 2024 which is a bit difficult considering my only trip before then is to more remote places where there aren't Bonvoy hotels.

I opened a DL gold last year and closed it to avoid the annual fee. Then I opened a HH Surpass which I am keeping and paying the fee for the Priority Pass.

Not sure if I should try for the Bonvoy Bevy (don't care about Bonvoy but would transfer to airlines) but the annual fee is a bit high $250 USD and I have to do 6 stays before 31 Jan 2024 which is a bit difficult considering my only trip before then is to more remote places where there aren't Bonvoy hotels.

Last edited:

Are you paying a monthly fee?If so, how much?I currently use US Global Mail, and i am generally happy with them, customer service is very responsive and friendly, and they accept credit / debit cards and all kinds of mail. My Cap 1 debit and credit cards arrived safely and was later forwarded to my Aussie home address.

(I subscribe to their Houston address)

The only cons are that, they charge you if you want additional scans of your mail (The free scan is only for the envelope) and their DHL and Fedex costs are very expensive. (Cheapest option is the USPS international first class mail)

I'm thinking of using them in future for getting C1 and Chase cards, but their monthly fees of US$15 (if billed monthly) is a exbortiant.

desafinado74

Active Member

- Joined

- Sep 13, 2015

- Posts

- 930

Are you paying a monthly fee?If so, how much?

I'm thinking of using them in future for getting C1 and Chase cards, but their monthly fees of US$15 (if billed monthly) is a exbortiant.

Hi Maverick1,

I paid the annual fee instead of the monthly option. And i use their Houston address.

Stuff do get delivered safely and their customer service is great, but like you said, they are expensive, compared to their competitors For me, the peace of mind matters more, so i am willing to put up with their higher costs.

Thanks mate. Ya if I don't find anything else reliable then I'll try using them on an on/off basis. Signup for few months when I need a card and then close the account till next application which maybe 4-6 months away. Not sure if that would work or cause any other issue.Hi Maverick1,

I paid the annual fee instead of the monthly option. And i use their Houston address.

Stuff do get delivered safely and their customer service is great, but like you said, they are expensive, compared to their competitors For me, the peace of mind matters more, so i am willing to put up with their higher costs.

desafinado74

Active Member

- Joined

- Sep 13, 2015

- Posts

- 930

Yes, see if you can find a cheaper and reliable competitor first. (There are some suggestions from Expat Americans on Reddit) I think, the main thing is, to put a real address under the "Residential address", and then use the mail forwarder's address under "Mailing address". A real address could be a friend's address or even a random hotel or homeless shelter address (I read some expat Americans using this trick and so far so good)Thanks mate. Ya if I don't find anything else reliable then I'll try using them on an on/off basis. Signup for few months when I need a card and then close the account till next application which maybe 4-6 months away. Not sure if that would work or cause any other issue.

I'm in the exact same situation but only have the Aspire. Have you been making transactions on your Aus card? Reason I ask is I got the Aspire a few years back and have changed passports since then so a different number so unless they only use the name and birthday for reference, I'm guessing US Amex wouldn't be able to link the application to my current US account?Went for the Marriott Bonvoy Bevy and I get... the pop up jail for my 3rd GT, and I have been making loads of transactions on the Surpass and Aspire. Could also be the bonus from the retention offer (10k HH). Ah well.

Do you mind me asking how much you are spending on your US cards? I'm only really using the Aspire when I stay or eat at Hilton and using their annual certificate so I'm clearly in the unprofitable category for them.

Might explain why I’m in pop up jail too. I spend maybe $US1000/month on my green and nothing on my other US Amex card. All my spending goes on AU card. I can’t justify putting spending outside of the bonus categories on it. Doesn’t make sense to me with the current poor and deteriorating exchange rate. I guess on the flip side, I’m in pop up jail which means no SUB for me.

blacksultan

Established Member

- Joined

- May 1, 2017

- Posts

- 2,563

One way to check is if card is listed in credit report like core credit by Equifax .I'm in the exact same situation but only have the Aspire. Have you been making transactions on your Aus card? Reason I ask is I got the Aspire a few years back and have changed passports since then so a different number so unless they only use the name and birthday for reference, I'm guessing US Amex wouldn't be able to link the application to my current US account?Which makes me wonder if they are looking at spend on the Aus card instead?

Do you mind me asking how much you are spending on your US cards? I'm only really using the Aspire when I stay or eat at Hilton and using their annual certificate so I'm clearly in the unprofitable category for them.

Don’t think changing passports means fresh credit report is created . People change passports all the time .

sorry few more questions - on C1 cards, did you first get a debit card and after few months of history with C1, got the CC? Did you apply it online from Aus using VPN etc or was it onshore?Yes, see if you can find a cheaper and reliable competitor first. (There are some suggestions from Expat Americans on Reddit) I think, the main thing is, to put a real address under the "Residential address", and then use the mail forwarder's address under "Mailing address". A real address could be a friend's address or even a random hotel or homeless shelter address (I read some expat Americans using this trick and so far so good)

I got approved for Amex Marriott Biz card couple of days ago. I applied using my ITIN. Amex is supposedly less strict with Biz card vs personal. If you value Bonvoy and stay a fair bit with them then is definitely a keeper as it pays for itself. However, the 35k Certificate will be little painful to use.amen to that - I'm trying to use the time to identify my strategy. I already have:

- AMEX Green

- AMEX Bonvoy (ex SPG)

- Citi Premier

I don't want to go overboard especially with AFs, I've closed my St George Amplify so have that AF to spend on new cards. I see these cards as additional "keepers"

- Capital One Venture (2x everywhere)

- CSP - I understand I'll need it to convert points from Ink cards to Chase UR points otherwise, I think the Premier is sufficient for me.

- Thinking about AMEX Marriott Business Card - will get me to 30 nights with my other Bonvoy card (can I get away with ITIN only or do I need EIN for these :business" cards, esp for Chase? Thinking not enough to get to Platinum without some stays - not yet there in terms of going the Marriott Brilliant as it's a Huge AF ($A1,000).

- various Chase Ink cards over time as churners

Am I on the right track, what cards outside of the Chase Ink cards should I be looking at to "churn" as I think the above are far too many cards as "keepers".

Any advice appreciated

Become an AFF member!

Join Australian Frequent Flyer (AFF) for free and unlock insider tips, exclusive deals, and global meetups with 65,000+ frequent flyers.AFF members can also access our Frequent Flyer Training courses, and upgrade to Fast-track your way to expert traveller status and unlock even more exclusive discounts!

AFF forum abbreviations

Wondering about Y, J or any of the other abbreviations used on our forum?Check out our guide to common AFF acronyms & abbreviations.

Currently Active Users

- AustraliaPoochie

- Aeryn

- PLANT

- fletty

- dazzaj_71

- AndrewCowley

- justinbrett

- scaredeycat

- totalf1

- aus_flyer

- jase05

- SOPOOR

- Nanachi

- Frustratedflyer62

- grilled_cheeze

- Lofty

- PineappleSkip

- bcworld

- Hawk529

- sudoer

- Chrism13

- Beachy55

- Bolter

- billmurray

- Thomas088

- jasrulz63

- Zinger

- jkbaus

- JYK

- flyingfan

- Br@nsky

- pauly7

- ayebee

- tazzo

- ShelleyB

- AV8

- Wanderlust_tim

- CaptJCool

- michaelk

- Human

- markis10

- am0985

- TheCollecter

- mjt57

- dizzie131

- Rich

- simmomelb

- stevenaus

- Graham Atkinson

- ms1

Total: 1,303 (members: 72, guests: 1,231)