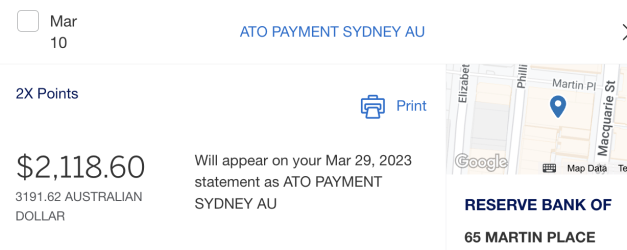

This thread just gets longer and longer with no end in sight. Waiting for a delayed flight at the moment and just want to reflect on the journey for me.

I have 7 cards at the moment which is the culmination of

endless calls on crackling phone lines at odd hours, numerous address changes (due to provider cutting service), verification failing, SMS not coming through and the nervous tension as you wait for approval.

Having gotten your card, you find the credits constantly changing and new hacks needing to be discovered to make good use of them especially as Australians.

My partner often asks me why I spend so much time on this, I just say you shall see - cue the Ritz-Carlton, the St Regis and the Park Hyatts and more of the pointy end of the plane. The annual certificates and bonuses that fall down from the sky being my saving grace.

Just yesterday as I go into the C1 portal to transfer my points, I get this dreaded message as I try to trigger my phone SMS verification:

- The number is not registered to your name.

- The number is not a US based number.

- The billing address does not match what we expected.

- The number is billed to someone else.

- The number is a VOIP or WiFi based service.

All the annual fees and spend I do, back to square 1 I go. What a journey.