pyramidforce

Member

- Joined

- Jan 19, 2023

- Posts

- 286

Re HSBC World Elite vs Premier credit card in the US...

The HSBC elite website mentions unlimited Priority Pass but the PP link in the terms and conditions doesn't even work when you click on it. My Googlefu reveals that it offers the access through loungekey instead.

$395 USD is honestly a reasonable price for full access priority pass / a loungekey equivalent if it is indeed what the card comes with. Would anyone by some chance happen to have an Elite card / can advise how good the PP is?

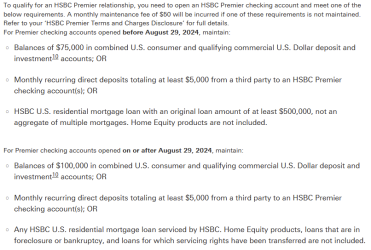

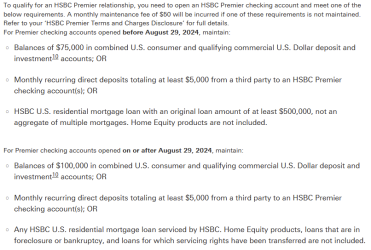

Edit: yikes I don't think I saw this last time I looked. USA HSBC has removed the "holds premier status in another region" (I think? Maybe it was just somewhere else and I'm blind again, wouldn't be the first time) requirement and now has some scary $50 fee thing? Has this always been there?

The HSBC elite website mentions unlimited Priority Pass but the PP link in the terms and conditions doesn't even work when you click on it. My Googlefu reveals that it offers the access through loungekey instead.

$395 USD is honestly a reasonable price for full access priority pass / a loungekey equivalent if it is indeed what the card comes with. Would anyone by some chance happen to have an Elite card / can advise how good the PP is?

Edit: yikes I don't think I saw this last time I looked. USA HSBC has removed the "holds premier status in another region" (I think? Maybe it was just somewhere else and I'm blind again, wouldn't be the first time) requirement and now has some scary $50 fee thing? Has this always been there?

Last edited: