What is the theoretical constraints on this? Assuming Qantas points as an equalizer:

1.125 QF @ 2.1% fee Yakpay + 1 pt per $10 rewards (Amex plat AU)

1.5QF/USD = ~1 QF/AUD @ 1.45% fee direct pay ATO (AMEX Plat. Biz on purchases over 5k USD)

On 100k AUD:

AUAmex = (100,000*.021)/(1.125*100,000 + 100,000/10) = 0.0171

USAmex = (100,000*.0145)/(1 * 100,000) = 0.0145

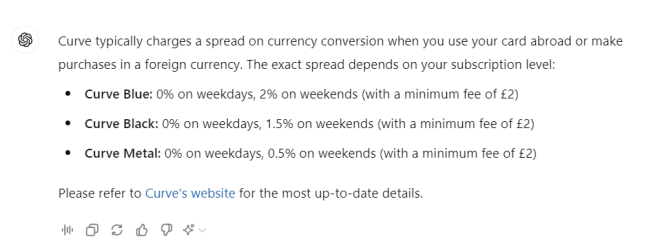

But if you assume 1% spread, 0.3% FX fee on something like Wise:

(100,000*.01+100,000*.003+100,000*.0145)/(1 * 100,000) = 0.0275

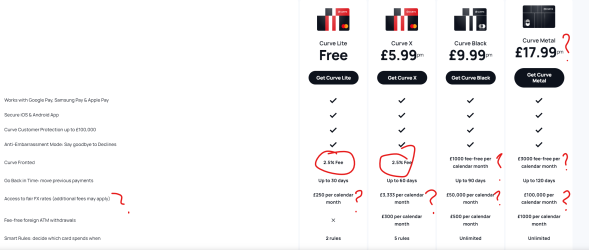

Has the spread reliably been 1%, though? Because that seems to be what kills it. Swear I've seen in this thread it can be much lower than that. Still - you'd have to get spread down to 0.25% and repayment FX fee to 0 to get it to be on par with AU Plat Amex.

I was hoping something like the C1 Venture X @ ~1.33333 QF/AUD would be a smart idea but the % Fees for ATO direct pay are close to 2%

Other payment details | Australian Taxation Office . Yakpay is no-go for Intl. cards either.

Basically not worth it as far as I can see.