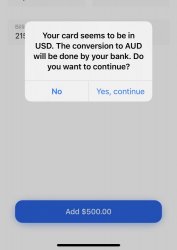

Another data point for Revolut to Citi USD to Amex.

Was charged $3.93 for Revolut to Citi - which we are now aware of.

But was charged $15 for Citi to Amex transfers. Followed the same steps like last time but ended up short on payments received at Amex. This time the amount was around USD 1200. I'm confused

Was charged $3.93 for Revolut to Citi - which we are now aware of.

But was charged $15 for Citi to Amex transfers. Followed the same steps like last time but ended up short on payments received at Amex. This time the amount was around USD 1200. I'm confused