IRS agent told me letter was posted around 15th Sep but i still don't receive the letter yet at my Australia address.I don't know when they sent it but it took a bit over 2 months from the date I sent an application until I received it in my letter box. Heard it takes longer now because of COVID.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Strategy to obtain US Amex

- Thread starter ithongy

- Start date

- Featured

I tried at the end of last year and it took months to get a rejection. I'm not planning anymore applications since I went the HSBC route to get a bank account. Funnily enough, I recently received a letter form the IRS chasing up my application. Not sure what to do next - I think I should follow through with it so I have it for next time I need something. What method has worked best of other AFFers? I understand the Amazon route is gone.

I would take ‘posted’ with a grain of salt. He would likely have no idea when it was posted. Probably just quoting the date on which the letter was generated.IRS agent told me letter was posted around 15th Sep but i still don't receive the letter yet at my Australia address.

is there anyway to figure out when the letter actually get posted?I would take ‘posted’ with a grain of salt. He would likely have no idea when it was posted. Probably just quoting the date on which the letter was generated.

Unless it has tracking, which I would assume not, then I would just add several days to a week after the letter generation for it to hit the USPS system, which is severely overloaded anyway. I’ve variable results with the speed of letters from the USA. Anything from 1-3 weeks.is there anyway to figure out when the letter actually get posted?

blacksultan

Established Member

- Joined

- May 1, 2017

- Posts

- 2,554

Just FYI Amex US is offering 3 additional points /$ ( no limit ) for 3 months if you successfully refer someone for a card .

Out of curiosity, I just googled that sentence. There were heaps of hits. Some say they’ve been getting that message for years and have just ignored it. Someone said they clicked it and then closed, and that was that, others say that they provided their income. Lots of other comments. There was some conjecture about the purpose. I haven’t seen anything adverse about completing/not completing, as yet..... Anyone else get this message at the top of their US AMEX dashboard? I am a bit scared to click it... lol

It hasn’t happened on my Aspire, although I’ve only had it since January this year.

Last edited:

Finale

Active Member

- Joined

- Aug 17, 2009

- Posts

- 931

Anyone else get this message at the top of their US AMEX dashboard? I am a bit scared to click it... lol

Got that a few times. By having more income, they could offer more limit and vice versa. It will go away eventually. clicking it willl just take you to an update income page you can find in Account Services. I just ignored it. For some bank like Chase, I heard updating income could get you more limit automatically (at later date) without having to ask which is normally a hard pull in your credit file.

what do you mean by confirm digitally? you need to send the scanned copy of the ITIN letter to amex?That is correct. I believe ITIN is more for an identity verification. Citi and Chase asked me to send a copy. Amex also wanted me to confirm but can be done verbally/digitally.

Finale

Active Member

- Joined

- Aug 17, 2009

- Posts

- 931

what do you mean by confirm digitally? you need to send the scanned copy of the ITIN letter to amex?

no need to scan. Just need to type the number again and confirm during checking application status online.

Cool. This means I don’t need to wait my ITIN letter to arrive at my letter box before I can use it with amex.no need to scan. Just need to type the number again and confirm during checking application status online.

Didn't manage the get the notarycam sent to amex. But the card have managed to arrived safely in myus. Amex didnt include the apt number but somehow myus have allocated to my account and have mailed the card to my address last month.

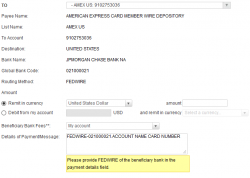

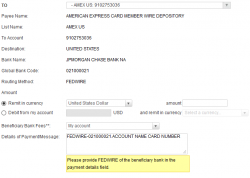

I'm planning to pay my account through my citibank australia global account and want to make sure I'm doing it properly to ensure the funds actually go through.

In the details of payment box do I put: FEDWIRE-021000021.ACCOUNT NAME CARDNUMBER or just ACCOUNT NAME CARDNUMBER? Edit look like it was confirmed in the previous page.

Also how long does it usually take to transfer?

Thanks to everyone that have messaged in this thread without you I wouldn't have gotten my amex card.

I'm planning to pay my account through my citibank australia global account and want to make sure I'm doing it properly to ensure the funds actually go through.

In the details of payment box do I put: FEDWIRE-021000021.ACCOUNT NAME CARDNUMBER or just ACCOUNT NAME CARDNUMBER? Edit look like it was confirmed in the previous page.

Also how long does it usually take to transfer?

Thanks to everyone that have messaged in this thread without you I wouldn't have gotten my amex card.

Last edited:

Roughly 24 hours.Also how long does it usually take to transfer?

Applied for a Marriott Bonvoy Brilliant card and was approved on the spot with a comparatively smaller credit limit of $3100, but that's fine

This was my second Global Transfer from Amex AU.

Tried applying for the Bonvoy card since this seems to be awesome promotion.

onemileatatime.com

onemileatatime.com

This was my second Global Transfer from Amex AU.

Tried applying for the Bonvoy card since this seems to be awesome promotion.

Best Travel Credit Cards

Traveling the world for nearly nothing is easily done with the right credit cards. These are our top picks to earning the most miles & points

blacksultan

Established Member

- Joined

- May 1, 2017

- Posts

- 2,554

How did you apply? Phone or online?

Nova credit or log in through existing user id?

Has anyone been able to apply through global transfer and using a referral link?

Nova credit or log in through existing user id?

Has anyone been able to apply through global transfer and using a referral link?

Applied for a Marriott Bonvoy Brilliant card and was approved on the spot with a comparatively smaller credit limit of $3100, but that's fine

This was my second Global Transfer from Amex AU.

Tried applying for the Bonvoy card since this seems to be awesome promotion.

Best Travel Credit Cards

Traveling the world for nearly nothing is easily done with the right credit cards. These are our top picks to earning the most miles & pointsonemileatatime.com

Online.How did you apply? Phone or online?

Nova credit or log in through existing user id?

Selected the check box that said I hold card from a different country which then prefilled some information.

PointsLife1

Member

- Joined

- Jan 30, 2020

- Posts

- 196

So you have now done this twice using global transfer from Australia. I believe we all have done it this way first time around but have not been game to do it again.Online.

Selected the check box that said I hold card from a different country which then prefilled some information.

I’d probably like to give it a go, once I make up my mind on the best card for me, already holding the Aspire.So you have now done this twice using global transfer from Australia. I believe we all have done it this way first time around but have not been game to do it again.

Become an AFF member!

Join Australian Frequent Flyer (AFF) for free and unlock insider tips, exclusive deals, and global meetups with 65,000+ frequent flyers.AFF members can also access our Frequent Flyer Training courses, and upgrade to Fast-track your way to expert traveller status and unlock even more exclusive discounts!

AFF forum abbreviations

Wondering about Y, J or any of the other abbreviations used on our forum?Check out our guide to common AFF acronyms & abbreviations.

Recent Posts

-

Executive Nightlife Guide for Tokyo (NYE 2025) - Private Access

- Latest: Ken Tokyo Guide

-

-

-

Currently Active Users

- flyguy77

- JessicaTam

- cityfan

- madrooster

- Bindibuys

- NSun

- baragh

- ThatMrBlake

- henleybeach

- There'sOnlyOneJimmy

- RB001

- jonboixxx

- Townsend

- Rasta

- wentworthmeister

- mimosa1

- mouseman99

- SYD

- Popeinoz

- openseat

- ivanhoe

- swellington

- Mqrko

- k_sheep

- MB123

- Rich

- Ken Tokyo Guide

- wenglock.mok

- pyffii

- tgh

- CaptJCool

- astrosly

- Dsaykao

- MEL_Traveller

- Flyerqf

- Melka

- FrequentFlyer85

- Q Class Plebeian

- JJS

- Scr77

- MooTime

- RooFlyer

- Vipers

- markis10

- m535607

- zig

- Serge77

- rcn

- albyd

- nick.wall

Total: 868 (members: 57, guests: 811)