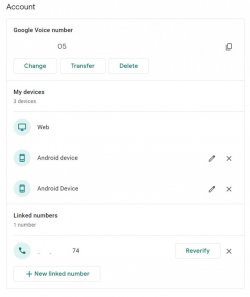

Are you able to receive Chase Txt? When I called using Google Voice, my T mobile credit dropped. I checked my phone and it showed on my Phone and GV recent call history. I just connected the GV with my T mobile. Did I miss something. Do I have to pay a one of license fee or something for Google voice so that I can make free calls and txt using GV.

The keyword here is long term. I think the length of history plays a big part. If one has a short history but starts applying for too many cards,spend too much or recycling the limit, the computer could flag the account for review.

I just read a story of someone who got approved by Chase (CSP) and 2-3 other cards from different banks on the same day. Later he applied for Freedom, got rejected and Chase decided to close his CSP account. He got his account back with lower limit or something. Reason was too many new accounts.

Another person had about a year of history and didn't apply for any card after Chase but account closed and looked like it was because of the applications a few weeks back that weren't showing on his credit file at the time he did Chase application. The reason Chase gave was too many new accounts as well.

I think it got worse after Covid. Banks are more strict. They probably do a regular soft pull where they can see everything like how many accounts you have, how many inquiries, how much balance you carry etc so I think it's still good to be careful if you are new to them.