SYD

Enthusiast

- Joined

- Oct 5, 2009

- Posts

- 11,592

- Qantas

- Platinum

- Virgin

- Gold

- Oneworld

- Emerald

In NSW, a Seniors card from age 60 (and not working full time), is as good as free travel for life!Who gets FREE public transport for life?

In NSW, a Seniors card from age 60 (and not working full time), is as good as free travel for life!Who gets FREE public transport for life?

Ditto For SAIn NSW, a Seniors card from age 60 (and not working full time), is as good as free travel for life!

Assuming that the bus actually shows upSouth Australian Seniors Card members can travel for free

on Adelaide Metro buses, trains and trams – all day, every day.

Well to be “fare” Mali did deliver on the election promise. The only catch of course is you actually have to use public transportAssuming that the bus actually shows up

When I wrote to Mali the reply I got was that the service was adequate.

We do in SA with Seniors card regardless of financial status.Which super tax cuts? I don’t remember any recent legislation in this area?

Who gets FREE public transport for life?

For those with no debt it's a really nice thing ... although sometime the hoops needed to maximise earning on some products seem silly. e.g. the ING 5.5% at call with it's deposit, balance and transaction criteria.The earning rates for annuities have improved with the jump in interest rates.

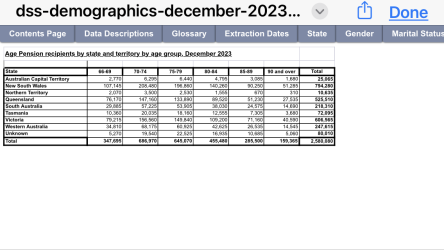

And December 2023 figures have 5,000 less Age Pensioners with a further reduction of new entrants by 22,000 (and this before any final uplift of Age pension age to 67 enables 6 months worth of backlog cases to be assessed after 1 Jan 2024)Well September 2023 figures dropped on 1 December

Age pension have dropped

Some to do with no new entrants until 2024….

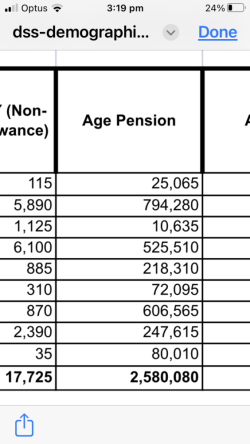

View attachment 356290

13,000 less

View attachment 356289

22,000 less in 66-69

Each year roughly an extra 260,000 come eligible less 130,000 deaths

And the figures are going nowhere ….

That's correct. It's one of those unfortunate cracks that's easy to fall into when managing things yourself. A mistake you're unlikely to make twice!Oh dear, something terrible happened to me.

Every year, I make the max concessional contribution for both my wife and I (self employed).

I was with Super provider A.

I switched to Super provider B.

I did not submit the concessional contribution form while with provider A.

Provider A cannot accept the form as funds are no longer with them.

Provider B cannot accept the form as contribution was before the switch.

Accountant advised that there is nothing we can do.

Cannot claim tax deduction.

There is no recourse.

So sorry to learn of your bad experience John. I am from Adelaide but have recently moved to the Gold Coast. My super has been managed by Calder Wealth Management for about 15 years now and they are the most honest and trustworthy financial company that I have ever dealt with. Their fees are probably as low as any available and their long term returns are amazing. They can service anyone in most parts of Australia and I would thoroughly recommend them to you. Just look them up on the net and give them a call - you won't regret it I assure you; regardsThe superannuation rort has been a nice little earn for some financial advisers thanks to suckers like me.

I worked for a company between 2003 and 2005 and the superannuation funds were with Colonial Mutual. When I left the company the superannuation funds were then transferred from the company superannuation account to Colonial Mutual superannuation account. That was over 10 years ago.

Fast forward to today and I look at superannuation account to find the balance has decreased from previous year. Why? Only 0.28% growty for the year. Ok so why decrease in balance? Not only are they charging me an administration fee but they are charging me a financial adviser fee. A financial adviser who I have never seen or spoken to ever and they have been taking a cut from my superannuarion. Seriously?

Called today and was told that I needed to call Colonial Mutual to remove the financial adviser from my account. Seriiusly? Yes I know I should have noticed earlier but whst a nice little rort going on there. Why aren't these things audited?

Asked for exit forms. The consultant couldn't care less and emailed me the forms.

I'd hate to think how much superannuation I have wasted in useless fees. If there are no contributions to a superannuation account they shouldn't be charging admin fees. What are they doing that requires a fee to be charged?

Now what? Think my daughter is going to be angry with her dads carefree attitude to money.

No, don’t need the same taxation benefits, would be happy to pay marginal rates.In exactly the same way, with same taxation benefits, nope impossible

Best you could do would probably be an ETF

Keep in mind the last 12 months has been very good for most investments with most super funds/investment options well over 10%