- Joined

- Jun 20, 2002

- Posts

- 17,852

- Qantas

- LT Gold

- Virgin

- Platinum

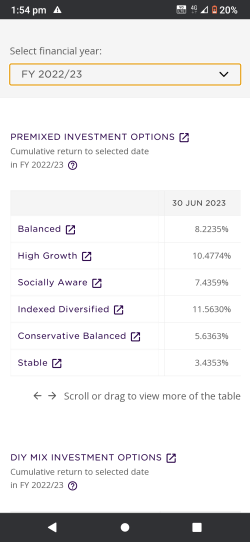

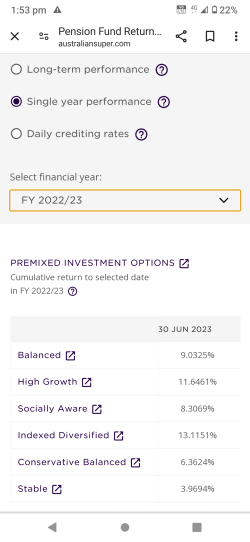

@Pushka did you consider that the tax on investment earnings within an income stream product is zero, versus 15% (although it can be reduced) within the accumulation phase? Parking the majority of the funds into a retirement income stream product will therefore earn you more versus maintaining it in an accumulation account, notwithstanding that you are obliged to take out the minimum drawdown based on your ages. Doing an income swap strategy (taking pension income tax free and salary sacrificing up to the contribution caps) whilst still working is an excellent idea.