A good article in Macro-business

The refund of franking credits was the cream on the cake plus double some, it's similar to the crafting of financial arrangements to access at least $1 of age pension to access the free health care card.

I note negative geared property post retirement is not given as a tax credit. Those losses are carried by the owner concerned ...

So who pays the taxes when this all happens ?

..

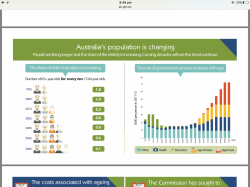

View attachment 120445

I like the infographic on here.

Superannuation Policy for Post-Retirement - Productivity Commission

At 85 we spend from taxes ave $55,000 per person per year and most these people are on super / age pension tax free and concessional non-super income with normal tax-free threshold plus SAPTO who pay no income tax.

I CANT do that working., take a second income stream and apply a second tax-free threshold. It gets loaded on top at the higher marginal rate

Neither, upon taking super as a defined benefits recipient will it be tax-free and were it over $1.6 m transfer cap ($100,000 pa) will it be tax-free and way too high to entertain accessing age pension nor health care card.

What we could also notice is what works for couples doesn't for singles (lower income Test) and some will lose age pension when their partner dies....

The positive part with the age pension figures is they have currently flatlined so despite 1,206,000 turning 65 between Censuses, Of the net 670,000 (570,000 died) only 264,000 went on age pension

Note the govt kicked a pile of high asset folk off it, taper rate change from $3 to 1 to $1.50 to 1 plus savings on defined benefits scheme being dropped from 50% to 10%, and won the 2016 election.

Figures Age pensions paid. Number over 65

June 11. 2.225 million. Census 3.012 mill. 73.8%

Sept 13 2.359 million

Sept 14 2.423 million 1.43 mill on full rate

Sept 16 2.556 million. 1.49 mill on full rate Census 3.676 mill 69.5%

Sept 17 2.489 million 1.55 mill on full rate. 67.7%

Source DSS (data.gov.au) &

Census

About 1.28 million turn 65 by the next Census so that adds around another 720,000 -730,000 onto the potential applicant list... ouch. 280,000 extras...

So who's going to pay for all this ?