- Joined

- Oct 13, 2013

- Posts

- 16,210

Just rec'd my tax bill for going over the transfer balance cap. It is 15% of what I earned on the excess exceeded for 01/07/2017 - 22/01/2018. It was a high earning phase. i'd like to hear if people are successfully appealing.

Actually you get taxed on the combined total of the notional earnings of the excess amount compounded daily plus excess transfer

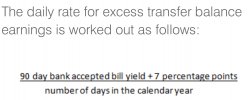

The formula for calculating the notional earnings is fairly punitive. Currently the ATO is assuming you are earning 9% pa calculated and compounded daily on the excess!!!!!