JohnK

Veteran Member

- Joined

- Mar 22, 2005

- Posts

- 44,199

Of course someone wins. But many also lose. There'll come a time when people won't want to buy at the higher share prices and then we'll be in trouble.And someone must therefore win.

Of course someone wins. But many also lose. There'll come a time when people won't want to buy at the higher share prices and then we'll be in trouble.And someone must therefore win.

No. The price stays the same.Of course someone wins. But many also lose. There'll come a time when people won't want to buy at the higher share prices and then we'll be in trouble.

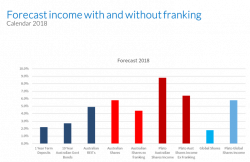

From Don Hamson of Plato fame, a specialist Australian share fund manager who invests in a rotational basis into shares that only pay franked dividends:

Plato will adapt their strategy if the (Labour removal of franking credits) policy does change to include more active dividend rotation as no 45 day rule would apply anymore. A lot of water to pass under the bridge before this comes into place – ie ALP winning election, need to get senate and cross bench approval (who have said they won’t approve in current format).

Also there will be an influx of companies looking to flush out franking credits via buy-backs or special dividends in the period before a potential removal of franking. [QF WP - that's a possible reason to stay in these shares to participate in those offers.]

View attachment 144451

Share markets are pyramid schemes. Property has also been heading that way. There are interesting times ahead.No. The price stays the same.

Interesting article from Morningstar this morning, 1st para reproduced below: Franking changes won’t deter stock investors:

Franking changes won’t deter stock investors - Morningstar.com.au

Franking changes won’t deter stock investors

Nicki Bourlioufas | 19 Nov 2018Text size |

|

Page 1 of 1

Various experts believe Australian dividend stocks will remain popular if a Labor government is elected and follows through on its proposed changes to dividend imputation credits.

Morningstar's head of equity research and practitioners within financial planning and funds management – for both equity and fixed income funds – hold this view, even as uncertainty prevails regarding other potential flow-on effects.

The Labor Party has said it will abolish cash refunds for surplus franking credits from 1 July 2019 if it wins government. Under this policy, franking credits would still be claimable as a tax deduction on income, but surplus credits won’t be refunded.

Some pensioners will be exempt from the rule. Individuals and funds currently receive a refund of franking credits if the franking credits they receive on dividends exceed their total tax payable. Those not paying tax, including superannuation funds where members are in pension mode, would be the most advantaged.

Shouldn’t the bold read as ‘most disadvantaged’?

They’ve said there won’t be grandfathering. Well, an article the other day said that.I think it is correct due to the grandfathering. More grist for an interesting discussion. But, we do need to see what the actual proposed policy looks like without the scarry preempting. A party with this sort Hawke/Keating change will need to lay it out and possible water it down before the election.

They’ve said there won’t be grandfathering. Well, an article the other day said that.

This is generally true.“Super funds where most Australians have their retirement savings will be largely unaffected by this proposal because the imputation credits are exhausted offsetting tax liabilities of the fund,” he said.

Ok, that is true but many super funds will be impacted. Many here have an SMSF where there is little opportunity to do this. As I posted upthread it’s almost entirely aimed at SMSF.Yes, quite a lot of differing views depending on the writer. Although it is early days on the policy which is out there to illicit views and consequences, I suspect that the majority of people who are in super funds, or on govt pensions will not see much difference.

I have none of the quals and experience of others in this thread though and am happy to be corrected.

Here is an 'old' quote from CEO David Whiteley of Industry Super Australia from March 18. Not sure how many billions and billions of $ they manage.

"Industry Super Australia (ISA) is supportive of the change, depending on where the additional revenue is directed.

ISA said the policy would have “little or not impact” on the superannuation of most Australians, and the revenue could be re-invested to modernise the super system.

ISA CEO David Whiteley said the proposal was sensible, and could improve fairness in the super system"

“Super funds where most Australians have their retirement savings will be largely unaffected by this proposal because the imputation credits are exhausted offsetting tax liabilities of the fund,” he said.

Its the date of the policy announcement. Check the date on the AFR link.Interesting the article serfty quoted starts, "After today, the exemption will not apply to SMSFs". Not sure w

Its the date of the policy announcement. Check the date on the AFR link.

Basically, it means if Labour are able to enact their legislation, relevant changes will be backdated to the March date of the announcement.

I thought I read it would apply from July 1 2019 onwards. So this FY year is fine.They can do that? There may be some govt policy experts on here who can advise on backdating. An opposition announcing a policy a year out from an election expecting to be fully formed, well that's an interesting idea.

The trouble is that average Joe Blow ignores anything Super related and they don’t seem to get that anything to do with shares will impact on them. Labor has pretty much made it all about ‘big business’ needs to pay and that message gets heard but not the butterfly consequences.Some further information that I have to hand about the proposed Labor changes...

Large super funds to be hit by franking credit changes

Poorer retirees to be hardest hit by ALP franking credit changes

I've got some charts from Plato as well, let me dig them out