You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Superannuation Discussion + market volatility

- Thread starter JohnK

- Start date

- Joined

- Jan 26, 2011

- Posts

- 30,145

- Qantas

- Platinum

- Virgin

- Red

My bad. I should have used this

- Joined

- Jan 26, 2011

- Posts

- 30,145

- Qantas

- Platinum

- Virgin

- Red

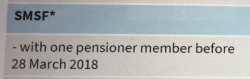

Why then? That will catch a lot of people out.To be clear, it was March 2018 - so too late if not on the pension as of 11 months ago!

View attachment 152865

- Joined

- Jun 20, 2002

- Posts

- 17,842

- Qantas

- LT Gold

- Virgin

- Platinum

get me outta here

Senior Member

- Joined

- Nov 18, 2011

- Posts

- 8,246

- Qantas

- LT Silver

Looks like those market rises reflect the damp squib of specific recommendations for bank 'punishments'. It's back to the bank boards now who got us into this greedy mess in the first place. Will be interesting to see what equity prices do as the effects if any, role out.

A good friend died after he lost everything in the Storm Financial, BOQ etc debacle. The protections put in place after that appalling behavior were then watered down by a change of govt. Here we go again.

A good friend died after he lost everything in the Storm Financial, BOQ etc debacle. The protections put in place after that appalling behavior were then watered down by a change of govt. Here we go again.

- Joined

- Jan 26, 2011

- Posts

- 30,145

- Qantas

- Platinum

- Virgin

- Red

Other than a slap and the threat of criminal charges that will never happen, the Banks got out of it pretty easily.

- Joined

- Jan 14, 2013

- Posts

- 6,592

- Qantas

- Qantas Club

- Virgin

- Red

- Oneworld

- Sapphire

- Star Alliance

- Silver

Good news for super balances at least. Seems like the mortgage brokers are the only group taking the heat at the moment.

tgh

Established Member

- Joined

- Apr 23, 2006

- Posts

- 3,762

Good news for super balances at least

Indeed … buoyed by the possibility of keeping my franking credits and todays market surge, I just might have a small "imbibation" tonight

Otoh...It is a bit sad that my net worth is no longer associated with enterprise or applied intellect.. rather it is a by product of International market gamers and the whims of politicians…..

Indeed … buoyed by the possibility of keeping my franking credits and todays market surge, I just might have a small "imbibation" tonight

Otoh...It is a bit sad that my net worth is no longer associated with enterprise or applied intellect.. rather it is a by product of International market gamers and the whims of politicians…..

rogerkambah

In memoriam

- Joined

- Aug 3, 2012

- Posts

- 1,056

Why then? That will catch a lot of people out.

Of course, that's the idea.

Notice they don't say that those receiving ICs at this date are unaffected.

- Joined

- Jun 20, 2002

- Posts

- 17,842

- Qantas

- LT Gold

- Virgin

- Platinum

get me outta here

Senior Member

- Joined

- Nov 18, 2011

- Posts

- 8,246

- Qantas

- LT Silver

Fin Review says today to go into bonds and it will replace any lost income very quickly.

Let's play who's the famous presenter!Is that Grant Hackett

get me outta here

Senior Member

- Joined

- Nov 18, 2011

- Posts

- 8,246

- Qantas

- LT Silver

In this case more like infamous after many unfortunate occurrences.

Let's play who's the famous presenter!

Last edited:

- Joined

- Jun 20, 2002

- Posts

- 17,842

- Qantas

- LT Gold

- Virgin

- Platinum

It’s an interesting product that may suit certain types of investors and situations, particularly those that can’t access superannuation and have a high MTR. They aren’t the only manufacturer with an open Insurance Bond in the marketplace (another 4 IIRC), but they gave a number of very interested options/benefits they designed that weren’t around in the early days of the insurance bonds (early 80’s). I’ve got a bit of research and reading still to do on the product

tgh

Established Member

- Joined

- Apr 23, 2006

- Posts

- 3,762

QFWP.. can you point me towards any backup for the Plato statement about ALP Policy / exemptions for pension phase smsf's.

I can't find anything at all

edit .. So answering my own question ….the Plato presentation refers to recipients of government pensions.

SMSF's in pension phase lose all their franking credits...

… aaaand of course.. hybrids lose their attraction.. the prices haven't tanked.. .. yet….

I can't find anything at all

edit .. So answering my own question ….the Plato presentation refers to recipients of government pensions.

SMSF's in pension phase lose all their franking credits...

… aaaand of course.. hybrids lose their attraction.. the prices haven't tanked.. .. yet….

Last edited:

Become an AFF member!

Join Australian Frequent Flyer (AFF) for free and unlock insider tips, exclusive deals, and global meetups with 65,000+ frequent flyers.AFF members can also access our Frequent Flyer Training courses, and upgrade to Fast-track your way to expert traveller status and unlock even more exclusive discounts!

AFF forum abbreviations

Wondering about Y, J or any of the other abbreviations used on our forum?Check out our guide to common AFF acronyms & abbreviations.