Lynda2475

Suspended

- Joined

- May 1, 2009

- Posts

- 9,395

- Qantas

- Platinum

- Virgin

- Red

- Oneworld

- Emerald

Medibank has poor web design which means its very easy to buy a multi-trip policy that does not cover the whole world, as the only way to get to a multi-trip policy seems to be to do a single trip first, then click the link at the top for multi which then re-uses the destinations only from the first trip you entered.

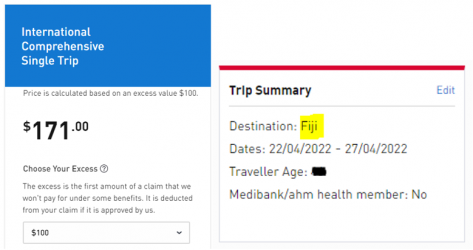

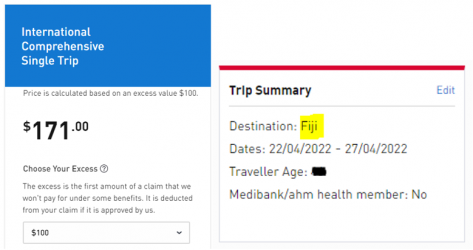

So If I start with my Fiji Trip (6 nights) - $171 seems ridiculous:

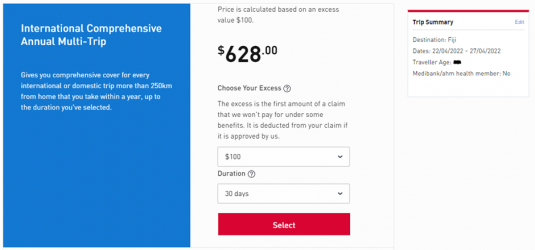

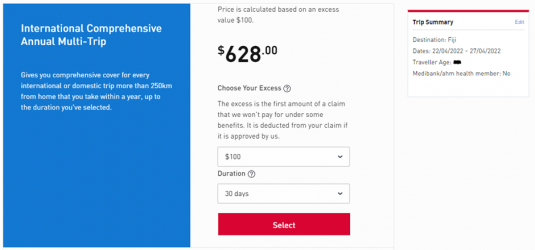

it then gives an annual policy pricing which includes Fiji only:

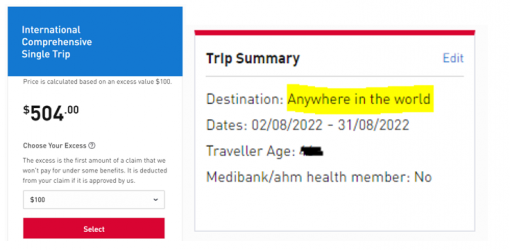

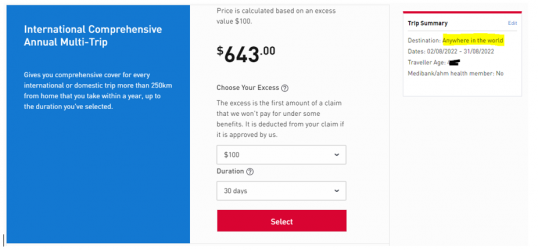

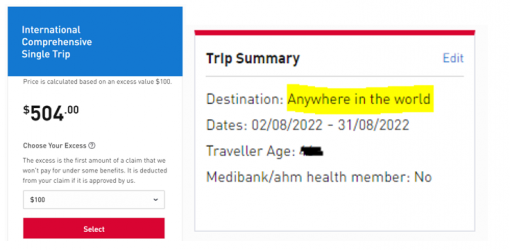

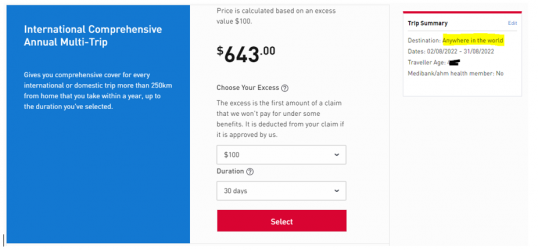

Whereas if I start with my August UK and US trip and choose world wide (as any trip including the USA or Africa costs the same as world wide) then I get:

A better design would be to have you pick the date you want the multi-trip policy to start which is usually the purchase date and then enter the regions you want cover for.

I suspect many put in their first trip and then dont realise that the multi-trip policy pricing is based only on that location/s and could get out if their other trips go elsewhere.

So If I start with my Fiji Trip (6 nights) - $171 seems ridiculous:

it then gives an annual policy pricing which includes Fiji only:

Whereas if I start with my August UK and US trip and choose world wide (as any trip including the USA or Africa costs the same as world wide) then I get:

A better design would be to have you pick the date you want the multi-trip policy to start which is usually the purchase date and then enter the regions you want cover for.

I suspect many put in their first trip and then dont realise that the multi-trip policy pricing is based only on that location/s and could get out if their other trips go elsewhere.