Hi all, I’m on my second post COVID trip overseas and have had to research this a lot, as getting my own cover was a contract requirement. It’s also covered a lot in the FB forum I subscribe to on getting travel ban exemptions.

I’ve also spent a lot of my working days in do not travel countries over the past few years. TI has always been available for such, but through bespoke insurers at a bespoke price. Generally I’ve been under contracts where the contractor negotiates and pays a price and covers personnel. I got a quote for Mrs pineapple once for a four day stopover in KBL which was more than the airfare! Most insurers won’t cover you for ‘do not travel’ destinations, which added to the difficulty of getting cover. It’s like the Fed Govt did this on top of the travel ban to make life easy for insurers. It really makes the official travel advice for the many who have travelled meaningless.

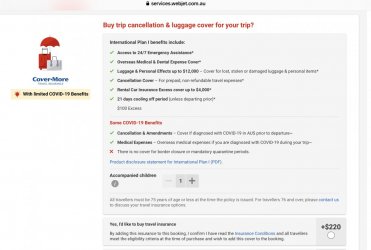

I think the game will change in AUS once the general do not travel advisory is removed, and saw something on Covermore’s website a few weeks ago saying ‘watch this space’. Looks like they’ve released something now.

Not sure if the airlines are still offering policies, EK had an excellent policy included in the ticket price which covered multiple events. The others IIRC tended to cover only COVID, run out after 30 days or so, and you needed separate TI for everything else.

I'm currently on an extended trip in Europe (left Australia in July) and found a reasonable policy & price with these guys:

WorldTrips Travel Insurance

I think that is the Atlas Travel policy, which I investigated for my current trip. It appeared to be fine. As its prime market is US, conditions were based on State.gov and CDC advisories, which didn’t have the Aust ‘don’t go anywhere’ advisory.

did not know that you could purchase TI once a trip has started,

There’s long been products for backpackers who get scared when they realise the world is a scary place. Also for expats who go on holidays that don’t start in Australia, which excludes almost all the Australian insurers. I have taken out several policies with

World Nomads, but they aren’t any good for COVID coverage.

Safety Wing is another, but I keep reading FB comments that it only works if you take it out after you leave Australia. It’s policy reads very like the Atlas Travel one. For this trip I went with the currently very popular

Heymondo, which is reasonably priced and had reasonable cover.

I would be more concerned with the fact it is now a known problem ie Covid related issues are not unexpected/unforeseen.

Every known disease is a known problem and there is always the risk of getting one. Your cover is usually invalidated if you already have the disease. The difference with COVID is that it is a pandemic and a lot of policies exclude cover for pandemics. And at the moment there are a lot of risks around travel bans and exclusions which as noted above are often not covered. Eventually it will move from being classed a pandemic to just endemic, and life will move on.

I mentioned I went with Heymondo, which had a bit of a conflict between its do not travel exclusion and its covid cover. Below the email exchange on that point.

Note that I’m a punter, not in the industry and this is shared experience, not advice. My advice is do your homework and read the PDS!

Just checking re COVID cover ex Australia. Australia has issued a "do not travel" advisory to anywhere in the world. Australia has also issued a ban on citizens travelling overseas, but I will be departing under an exemption from the ban issued by the Australian Government.

Exclusions in ARTICLE III. A of the general conditions excludes

Any claim incident derived from a trip to a specific country or area where a relevant governmental body or authority in the country of origin and/or destination had advised against travel due to an epidemic or pandemic, without the preventive and/or mandatory measures designated for this purpose.

However your online help in relation to COVID-19 says

- Does Heymondo insurance cover even if government authorities (for example the FCDO) advise against travel? All Heymondo insurances are valid regardless of the recommendation that the competent authority of your country of origin may make. Therefore, this recommendation will not limit the coverage of our insurance in any case. The only uncovered destinations are countries in a situation of armed conflict.

In response to your message, we confirm that all travel insurance plans you see on our website cover medical assistance even in the event of a Coronavirus infection, regardless of government recommendations, regardless of the traveler's citizenship and regardless of the travel destination.

Once you have purchased the insurance, you will receive a COVID coverage certificate issued by the insurance company by email along with the certificate of the policy.

Regarding our T&C document, I'd like to drive your attention to the last sentence of the paragraph.

· without the preventive and/or mandatory measures designated for this purpose.

This means you are not covered for Pandemics if you do not respect the rules (social distance, wearing mask, PCR done if required, Vaccine done if required and so on).

So, in a nutshell, our travelers are fully covered for COVID while respecting preventive measures.