get me outta here

Senior Member

- Joined

- Nov 18, 2011

- Posts

- 8,247

- Qantas

- LT Silver

I just tried to log into virgin and could not get in at all. Is it completely off the air now?

I just tried to log into virgin and could not get in at all. Is it completely off the air now?

AFF Supporters can remove this and all advertisements

I just tried to log into virgin and could not get in at all. Is it completely off the air now?

I'm also on the frontline and you are way too pessimistic.I can tell you now that this is more than "just a virus". As a human race we have no immunity to the virus and its "slippery" nature is making it difficult to contain. This virus literally clogs your lungs, suffocating you to death. If you are after proof, ask me, I'm on the frontline.

International travel is going to be severely affected until an adequate preventative measure is developed.

So, back on topic - Any thought on whether Sir RB will inject some of his personal fortune to assist, take a larger stake?

I’m not going to be drawn into the SQ debate but where are NZ getting the money from?My feeling is VA will definitely fall over with the government not providing bail out loans after receiving whispers of other airlines waiting in the wings.

My short priced favourite is for NZ being government preferred, just ahead of SQ with possibly a partnership between the two particularly if the NZ government, holding over 50% of NZ's shares isn't keen on the higher risk reward all in option.

A long shot would involve a private equity firm somehow still having access to easy money and acquiring VA as a going concern with existing shareholders diluted to around a 5-10% interest.

BIG QUESTION - other than for 'Chairman's Club' access why do State & Federal Govts continue to pay double to treble the per flight cost by using Qnatas nearly to the exclusion of VA?

BIG QUESTION - other than for 'Chairman's Club' access why do State & Federal Govts continue to pay double to treble the per flight cost by using Qnatas nearly to the exclusion of VA?

Guess that's just another reason why we'll never have a Federal ICAC....

Based on invoice seen last November - true not a big sample but can only go by what I was shown by a frustrated public servant.Wow, You really don't know, do you?

First off just on normal commercial fares, tell me where qantas is triple of what VA costs - especially with the same fare flexibility.

Second, you do know that WOAG have government fares. A B class SYD-CBR commercially could cost around $600 where as a B class governement fare is around $160ish.

Based on invoice seen last November - true not a big sample but can only go by what I was shown by a frustrated public servant.

Virgin kicked an own goal by asking for 1.4B to help their overseas parents avoid kicking in, the Govt only has to wait it out and they could still be the owners for $1.

A lot of media guesswork involved aswell.I think the leaking of it + the subsequent (unofficial) Government responses that they won't get a bail out have been far more damaging. Its not clear to me what game the Government is playing in doing that, when they could have just refused privately ... maybe different factions in the Government playing it out publicly.

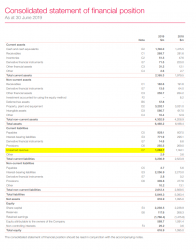

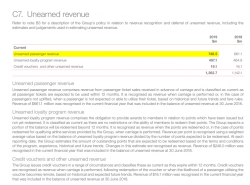

Pretty sure they have had it for some time. I think it seems from equity raising from shareholders.Incidentally - the $1 billion that was on hand at the end of last year ... does anyone know whether that was debt/equity financed cash (e.g. from the Velocity transaction and future expansion); or was it cash tied to booking that are no longer going ahead?

Pretty sure they have had it for some time. I think it seems from equity raising from shareholders.

The money they raised via bonds for Velocity went to the private equity company.

I believe sales of future flights which are paid by credit cards are held in a fund. Virgin only get the money when you fly.

Remember: Shareholders are unsecured.