You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Credit Card Offers Westpac Altitude Platinum Offers: 80,000 Qantas/Velocity Points or 120,000 Altitude Points (expires 30/4/25)

- Thread starter GSP

- Start date

I just applied for this today - very quick - conditional approval was granted pending income verification. I applied for the lowest limit of $6K as I will just do the $3K minimum spend and then cancel when the QFF points come through.

Tried the "income scraping" option for income verification - even though my bank was listed - the login failed so I just did the upload of documents.

Tried the "income scraping" option for income verification - even though my bank was listed - the login failed so I just did the upload of documents.

http_x92

Active Member

- Joined

- Sep 29, 2020

- Posts

- 622

- Qantas

- Gold

- Virgin

- Red

Looked at the terms and conditions of the bonus points and they said it will be credited within 90 days of hitting $3000 spend. So potentially we might need to wait for 2-3 statement period to get it transferred over to Qantas.

Looked at the terms and conditions of the bonus points and they said it will be credited within 90 days of hitting $3000 spend. So potentially we might need to wait for 2-3 statement period to get it transferred over to Qantas.

Came here to comment too, as for me it's been more than three statement periods and I hit the $3000 about 45 days in. This seems like an excessive delay - I wonder if it's to slow you down from you cancelling your card too early? I would assume my account has to stay open this 90 day period.

http_x92

Active Member

- Joined

- Sep 29, 2020

- Posts

- 622

- Qantas

- Gold

- Virgin

- Red

Yeah I think playing it safe and keeping the card open until the bonus points gets transferred is the best option.Came here to comment too, as for me it's been more than three statement periods and I hit the $3000 about 45 days in. This seems like an excessive delay - I wonder if it's to slow you down from you cancelling your card too early? I would assume my account has to stay open this 90 day period.

http_x92

Active Member

- Joined

- Sep 29, 2020

- Posts

- 622

- Qantas

- Gold

- Virgin

- Red

I rang up the Altitude rewards centre and they said I have met the spend criteria for the bonus points but its just a matter of playing the waiting game. Maybe a tactic so card holders don't churn the card too quickly.Westpac are pretty poor at ensuring customers are awarded their respective points. This is the second time that I might have to follow up a points promotion.

- Joined

- Feb 23, 2015

- Posts

- 6,190

- Qantas

- Platinum 1

- Virgin

- Platinum

- Star Alliance

- Gold

Not sure if anyone's experienced the same or if this is a once off, but my SO's recent Westpac sign-up bonus needed manual invention from the Altitude rewards team to get Qantas points credited.

She applied and was approved in early December, then hit min spend within a week of receiving the card. T&C stated points would arrive within 12 weeks of meeting spend criteria, but the Altitude team refused to start looking at it until around the 14 week mark (claiming it could take up to 90 days + an additional week for the points to credit to Qantas)

At the 14 week mark we raised it again, two business days later she received an email to say the points had been manually credited to her and would arrive in late April on the next points sweep - approx 18.5 weeks or 130 days after meeting the minimum spend.

She applied and was approved in early December, then hit min spend within a week of receiving the card. T&C stated points would arrive within 12 weeks of meeting spend criteria, but the Altitude team refused to start looking at it until around the 14 week mark (claiming it could take up to 90 days + an additional week for the points to credit to Qantas)

At the 14 week mark we raised it again, two business days later she received an email to say the points had been manually credited to her and would arrive in late April on the next points sweep - approx 18.5 weeks or 130 days after meeting the minimum spend.

CaptainCurtis

Established Member

- Joined

- Oct 8, 2013

- Posts

- 1,425

Similar experience for me - the 12 weeks passed, so I lodged a complaint through the app. They came back to me a few days later to say that I had held another Westpac card within the 12 month exclusion period and therefore wasn't eligible for the points. It was in fact 12.5 months prior, backed up by the date on my cancellation letter and the date the new application was lodged. The points took about a week to post after making this clear to them.Not sure if anyone's experienced the same or if this is a once off, but my SO's recent Westpac sign-up bonus needed manual invention from the Altitude rewards team to get Qantas points credited.

She applied and was approved in early December, then hit min spend within a week of receiving the card. T&C stated points would arrive within 12 weeks of meeting spend criteria, but the Altitude team refused to start looking at it until around the 14 week mark (claiming it could take up to 90 days + an additional week for the points to credit to Qantas)

At the 14 week mark we raised it again, two business days later she received an email to say the points had been manually credited to her and would arrive in late April on the next points sweep - approx 18.5 weeks or 130 days after meeting the minimum spend.

and I have been waiting for 12 weeks now since meeting the spend criteria (as per their T&Cs) and have got nothing so far, gearing up for a conversation next week.I just got given a second round of 75k points even though I already received the inital batch without a hitch. Check your accounts to see if this is a widespread glitch.

Just got mine on Tuesday as well, even though the qualifying spend finished back in Feb, I think. Finally!

Also, I had requested a second card for my partner, though the credit is in my name only. She used it a bit to help me meet the minimum spend.

We were thinking of churning and having my partner apply for the card next, does anyone know if that will work? It says, "New cards only. Bonus points offer not available if you’ve held a Westpac rewards card in the last 12 months. T&Cs apply." Then in the actual T&C's, "Existing Westpac customers who currently hold an Earth Classic, Earth Platinum, Earth Platinum Plus, Earth Black, Altitude Classic, Altitude Platinum or Altitude Black credit card, or who have held one in the last 12 months, are not eligible for this offer." However does "holding" a card just refer to being the primary account holder, or to additional cardholders as well?

Also, I had requested a second card for my partner, though the credit is in my name only. She used it a bit to help me meet the minimum spend.

We were thinking of churning and having my partner apply for the card next, does anyone know if that will work? It says, "New cards only. Bonus points offer not available if you’ve held a Westpac rewards card in the last 12 months. T&Cs apply." Then in the actual T&C's, "Existing Westpac customers who currently hold an Earth Classic, Earth Platinum, Earth Platinum Plus, Earth Black, Altitude Classic, Altitude Platinum or Altitude Black credit card, or who have held one in the last 12 months, are not eligible for this offer." However does "holding" a card just refer to being the primary account holder, or to additional cardholders as well?

Last edited:

http_x92

Active Member

- Joined

- Sep 29, 2020

- Posts

- 622

- Qantas

- Gold

- Virgin

- Red

Usually when it comes to bonus points offers no problem signing up as an additional card holder and still getting the bonus points. Not sure for Westpac though.Just got mine on Tuesday as well, even though the qualifying spend finished back in Feb, I think. Finally!

Also, I had requested a second card for my partner, though the credit is in my name only. She used it a bit to help me meet the minimum spend.

We were thinking of churning and having my partner apply for the card next, does anyone know if that will work? It says, "New cards only. Bonus points offer not available if you’ve held a Westpac rewards card in the last 12 months. T&Cs apply." Then in the actual T&C's, "Existing Westpac customers who currently hold an Earth Classic, Earth Platinum, Earth Platinum Plus, Earth Black, Altitude Classic, Altitude Platinum or Altitude Black credit card, or who have held one in the last 12 months, are not eligible for this offer." However does "holding" a card just refer to being the primary account holder, or to additional cardholders as well?

Danger

Suspended

- Joined

- Jun 19, 2006

- Posts

- 7,819

What are people's thoughts on the current offer: 90K points and a fee of $200 in the first year for $4K in 90 days?

GSP

Established Member

- Joined

- Jun 17, 2016

- Posts

- 1,429

What are people's thoughts on the current offer: 90K points and a fee of $200 in the first year for $4K in 90 days?

I think it's got whiskers on it, it is actually $250 fee and $300 including QFF link up and earn rate isn't fantastic and given it was free before takes the gloss off. There are better offers elsewhere

Actually, I just looked up and if you are an existing customer you get that $250 first year waived (still have the $50 QFF fee). So it is quite attractive if you set yourself up with a ordinary savings account, login into the portal and apply for the card via that link and bobs your uncle and mary's your aunt.

Danger

Suspended

- Joined

- Jun 19, 2006

- Posts

- 7,819

I think it's got whiskers on it, it is actually $250 fee and $300 including QFF link up and earn rate isn't fantastic and given it was free before takes the gloss off. There are better offers elsewhere

Actually, I just looked up and if you are an existing customer you get that $250 first year waived (still have the $50 QFF fee). So it is quite attractive if you set yourself up with a ordinary savings account, login into the portal and apply for the card via that link and bobs your uncle and mary's your aunt.

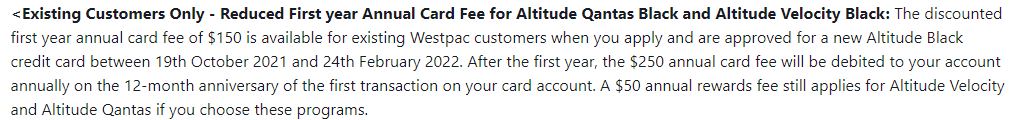

I only see this (reduced fee to $150 + $50, not $0):

blacksultan

Established Member

- Joined

- May 1, 2017

- Posts

- 2,291

Does anyone know if they are strict with the income requirements? ie if you are not rejected for qf black will they accept you for platinum qf on same application?

Become an AFF member!

Join Australian Frequent Flyer (AFF) for free and unlock insider tips, exclusive deals, and global meetups with 65,000+ frequent flyers.AFF members can also access our Frequent Flyer Training courses, and upgrade to Fast-track your way to expert traveller status and unlock even more exclusive discounts!

AFF forum abbreviations

Wondering about Y, J or any of the other abbreviations used on our forum?Check out our guide to common AFF acronyms & abbreviations.

Currently Active Users

- Mutilla2

- Brissy1

- swampy452

- Cottman

- eting

- mrflyby

- Vekor

- meadowfield

- n7of9

- ellen10

- Auzzieflyer

- mbell1510

- Pug1

- kiwitripper64

- tomlee1986

- 1erCru

- Pete98765432

- MattA

- Quickstatus

- Hawk529

- hwy

- Grrr

- brissie

- wenglock.mok

- TonyDoh

- gaz0303

- Le_Champion

- KSC

- anemone1296

- kpc

- ole nimeton

- points

- offshore171

- jrfsp

- sykoticx

- Dmac59

- snabbu

- VantageXL

- Highway23

- simmomelb

- Forg

- Harrison_133

- desafinado74

- randompunter

- Voele

- Justinf

- blacksultan

- bluelink279

- pyffii

- Black Duck

Total: 406 (members: 61, guests: 345)