Yes RAM I was in business from 1979 so as an importer and exporter I have seen a lot. I do credit my late mother for making our business invest in production tooling by telling me importers cause Australian jobs to go overseas.

With the world turning to computer and manufacturing automation it will become increasingly more difficult for full employment of everyone.

RAM - 2002 - Ex-Chinese Govt t-shirt factories went from 12,000 T-shirts/worker a year to 500,000 within 1 year of 'gift' of operation to connected official's family. Guess how many workers were cut...

and today..

http://www.marketwatch.com/story/foxconn-replaces-60000-humans-with-robots-in-china-2016-05-25?siteid=nwhpm

Apple Inc.

AAPL, +0.79% supplier Foxconn Technology Co.

2354, -0.14% has replaced 60,000 human workers with robots in a single factory, according to a report in the

South China Morning Post, initially published over the weekend.

This is part of a massive reduction in headcount across the entire Kunshan region in China’s Jiangsu province, in which many Taiwanese manufacturers base their Chinese operations.

I went on a Swiss manufacturing tour and there were almost zero production staff. Massive high tech production off robot machines is what I saw.

Maybe 0.7644 was ok but you always want to do better.

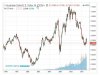

Which way is the Aust Dollar headed long term...

Local Jobs - total cost to the economy analysis IS NEVER DONE.

The multiplier effect is huge. Consider some item, say a 3 seater couch. Sold for $500 at a low-mid range shop. Their mark up around 25% - so they paid $400 for it. Not exact example but near enough...

Made in Aust - $400 goes to manufacturer. Their cost of delivery around $10 (part of larger delivery to store). Cost of materials around $110 - wood & metal Aust sourced/made, material made in China (cost $25). Wages $70. Power/rent/water etc - $20. Other overheads $70 (including Workcover etc), sales cost $35 and profit before depn etc = $130.

So on 1st round of the $500 spent -

$475 stays in Australia. The workers spend their wages and that money then helps pay wages, buy goods etc for other Australians. Typical

multiplier (reason for $900 GFC tax payment) if used for Aust produced goods = 9x or $4,500 added to GDP

Made overseas - $400 goes to overseas manufacturer (90% furniture now imported from China). Their cost of delivery around $10 within Australia (part of larger delivery to store). Cost of materials around $60 - wood from rain forest metal & material made in China. Wages $20. Power/rent/water etc - $15. Other overheads $30 (no worker safety cover nor allowances etc), sales cost $15, shipping cost China to Aust in 40 ft teu $35 and profit before depn etc = $215.

So on 1st round of the $500 spent -

$110 stays in Australia. The workers spend their wages and that money then helps pay wages, buy goods etc for other Australians. Typical

multiplier if used for overseas produced goods = 0.4x or $200 added to GDP.

Did any of you see this ever appear in the papers following the $900 payment? No. There was some coverage on the $900 paid to people who were living (or had died) overseas

but nothing about this impact.

Why? Because it does not result in change to the status quo and lead to consultants making money. If consultants (across the entire cost spectrum) do not make money then there is not anyone feeding lobbyists. Nor are there donations to Political parties of all colours. In the US (pre-internet) a privately fund organisation affiliated to no political party tried to work out over a 4 year presidential cycle -

How many individuals actually donated money to a political party or lobbying group of some form.

Going through all company filings, electoral declarations etc (did not cover municipal elections) they arrived at a figure of less than 75,000 people for the US.

Think about that, in relation to what has been revealed within Australia in the last few years of hidden and not so hidden political donations and benefits received? 4Corners on Monday certainly proved that it is possible for a donor to most major parties to coincidentally get over $500m in Federal Govt subsidies. Compared with donations of less than $1m by that party. 23 meetings with various Fed Gov ministers in a small period of time to boot.

So think that 75,000 people bank-rolled the major US political parties (over a four year period) that covered the $10 donations through to the $75m ones.

In Australia I suspect (from having done some work on it but only 20 hours worth) if you made the cut off $100 then it would be less than 5,000 over the 3 year Fed term (includes donations to State Party as well btw). The top 10 donors to each major party make up to 90% of total donations by value btw.

The figure for 2012/13 was over $300m to all registered political parties (Fed, State and Local) in Australia. $6m every week.

View attachment 71443

Now that's members.

Party officials less than 1/20th of that at best. So does make you wonder where that $6m every week goes to doesn't it?

Curiously enough it is next to impossible to track down how many paid party officials there are for ANY of the major politicial parties.

I wonder why that is?

(

Extreme sarcasm intended for those in any doubt).