- Joined

- Apr 11, 2012

- Posts

- 950

What exports other than minerals and food. we just don't make anything any more. We don't even turn our minerals in metals. still think .85 to .88 is about right....

What exports other than minerals and food. we just don't make anything any more. We don't even turn our minerals in metals. still think .85 to .88 is about right....

Been through too many booms and busts in the mining and metals industry, the .49c dollar looked good!!! I will stick by my 0.85 to 0.88 as "fluff and guff" industries like financial service don't drive the economy aka USA. Even worse is Australia has become too expensive, when its cheaper to get you hair cut in London than in Melbourne!

So something going on every day?

Sorry cant help but laugh. Yesterday investor confidence was high. Today investor confidence is low. Tomorrow investor confidence is high for other reasons. And then investor confidence low again, and then high again and so on.

Yes I am naive but I find it strange that investor confidence can change that many times a week or even that many times a day.

Austerity .... so sick of hearing that word in the UK.

i suppose it depends how you classify it... but interest rate drops have a massive effect on the value of the dollar. our currency was appealing when rates were high, not so much after the latest cut....

What exports other than minerals and food. we just don't make anything any more. We don't even turn our minerals in metals. still think .85 to .88 is about right....

There are also reams of reports showing that the next global 'boom' will be an agricultural one......There are also significant 'value-add' components (manufacturing!) attached to these. Agriculture is more than just food and both employs more and pumps in more to the economy than exports do. The stereotype of the simple farmer types or uncomplicated products is not a fair one.

Another thing often forgotten in discussions of the Australian economy is just how much superannuation has done to stimulate it as well. Super funds are awash with cash to invest and basically make Australia a shareholder economy. Although not unique to Australia, the scale is certainly larger than most countries.

Everyone talks about mining being the be all and end all but no-one talks about the slow and painful reforms of the last 20-30 years that are finally bearing fruit in the Australian economy. It just so happens we've been whacked with good fortune twice over. The mining boom really peaked (in terms of what it gave to Australia) during the Howard years, the current mining 'drop' isn't production as much as lower infrastructure development (and there are plenty of other things to build, and a lot of superannuation funds desperate to find projects to fund - construction will make up for it). The foundational strengths that meant we didn't go under in the GFC, a strong service sector replacing the manufacturing economy - that's still going (despite rhetoric).

.... It was only post-GFC that people fully understood the resilience and strength of the Australian economy and started viewing the AUD as a safe-haven. It wasn't because China's buying our dirt. Mining might make a lot of money, but not all of it circulates back through to Australia. It employs relatively few people, and frankly tax breaks and corporate structures mean it doesn't pay its fair sure into the actual Australian economy either, not at the level other industries do. All a collapse in exports will do is remind Australia that there are other parts of the economy as well.

Also, if the LNP can keep their hands off the NBN when they get in Australia's traditional enemy (the tyranny of distance) will also be defeated, and we'll start seeing another boom as people across Australia are able to develop start-ups and a service industry boom begins. It could (*should*) be the start of a rural service industry renaissance.

It might pop under 0.90 temporarily (though I doubt it). But you'd better prepare for a parity future. I am and recommending all my clients do too.

Excuse the long-winded replies - I've finally found a thread related to my work and I get a bit over-excited

Main part of our problem is that we don't have a government (from any persuasion) with any vision for the future. There are plenty of niche markets and high tech. industries that we could be producing for the world market (viz. Cochlear) but we don't have a "leader" who has any interest; it's as if "we" are being told what our role in life is.... and producing cars in Australia is not such an industry!

I'm going to spin a slightly different view on this, some of you will appreciate, some of you will dismiss it.

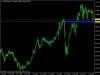

From a technical chartist point of view.

Just 1 point. The 0.93 -0.95 ish range is fairly pivotal. I wasn't surprised about a reaction at this point, and as of last night, it was a fairly strong reaction. If it stays above 0.94 then it will trickle higher, if it falls below, its headed south.

View attachment 16448

Some of us consider telecommunications infrastructure to be one of those "necessary services", and that Howard's sale of Telstra [infrastructure] was one of the largest of a whole litany of poor policy choices.Agree about vision, some people think its about "picking winners" like the NBN or windfarms, but governments have a proven ability to pick the noisiest losers - like car manufacturing. Would be good if a political party was honest enough to say that "we cannot pick winners, we will provide the following necessary services and collect the following taxes to fund these services and then get out of the way and leave it to market economics as to where economic growth comes from."

What exports other than minerals and food. we just don't make anything any more. We don't even turn our minerals in metals. still think .85 to .88 is about right....

The markets are pricing in a coalition victory and a switch to austerity?

Sounds like a bit of a bet each way, the inference being if it does slide it will be quick