drron

Veteran Member

- Joined

- Jul 4, 2002

- Posts

- 37,501

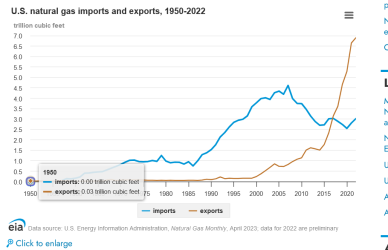

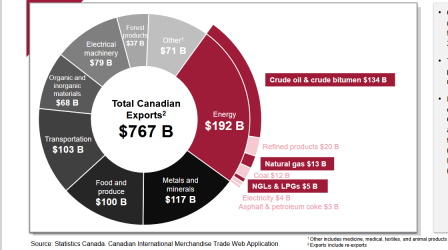

Way out of date info. In 2018 the USA became the worlds largest crude oil producer. In 2020 it first became a net exporter of petroleum products.As usual a certain public figure hasn't properly thought through the consequences of his threats. Almost 50% of US Oil & Mineral imports come from Canada. In a cost of living crisis I imagine huge push back if peoples energy bills and transport costs suddenly increased by huge amount.

Most of the US imports are of heavy crude most being refined in the USA and some then exported as light crude at a higher price.

Oil imports and exports - U.S. Energy Information Administration (EIA)

U.S. crude oil imports sources including OPEC and Persian Gulf, and top five source countries of U.S. oil imports and destinations of U.S. crude oil exports.

So I doubt the US will mind if Canadian oil imports are reduced.

Australia is likely to benefit if US production goes up as the price will come down. Might be good for the little Aussie battler.