JohnK

Veteran Member

- Joined

- Mar 22, 2005

- Posts

- 44,226

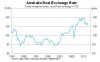

That was being overruled by the 2 female bosses.but strenghtening against the euro...european vacation soon???

The THB baht is all that concerns and we are now nearing 2003 levels. Not good at all.