You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wise debit card

- Thread starter neils2004

- Start date

- Joined

- Apr 14, 2013

- Posts

- 643

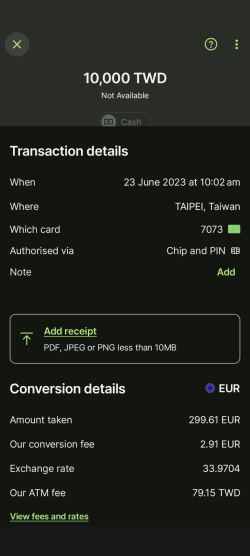

Thanks. Do you know the monthly limit? Is it per country atm withdrawal or overall atm withdrawal per month?This is what it looked like for me last year. Withdrew money at the airport terminal landside (Bank of Taiwan ATM).

The ATM fee was added because I had already gone over the monthly free withdrawal limit.

View attachment 375008

Pretty sure it is AUD 300 per month.Thanks. Do you know the monthly limit? Is it per country atm withdrawal or overall atm withdrawal per month?

- Joined

- May 25, 2013

- Posts

- 1,794

It's on their pricing page and based on the country where your account is based at.Thanks. Do you know the monthly limit? Is it per country atm withdrawal or overall atm withdrawal per month?

Wise Fees & Pricing: Only Pay for What You Use

Banks charge a lot for overseas transfers. We don't. Transfer money abroad easily and quickly with our low cost money transfers.

Close, $350Pretty sure it is AUD 300 per month.

albatross710

Established Member

- Joined

- May 15, 2004

- Posts

- 3,797

Since 2020, I've been using Wise for both business and personal purposes. I recently configured my personal Wise account for an upcoming trip to Japan and thought I'd share my strategy.

1. Setting Up JPY Currency and Jar:

- I opened a new JPY currency account and created a JPY Jar.

- Transferred some holiday funds to Wise in AUD.

- Converted the amount I plan to spend to JPY and moved the remaining funds to an AUD Jar.

- Transferred JPY to the JPY Jar, leaving enough for an airport cash withdrawal (35,000 JPY) and two days' spending.

2. Jar Strategy for Security:

- I use the jar strategy to limit the funds available in case I lose my physical card or if my account details are hacked.

3. Virtual Visa Card:

- I created a new virtual Visa card for online purchases during the trip, such as rail, hotel, entry fees, and rideshare.

- Added this virtual card to my Apple Wallet for PayWave purchases.

- At the end of the trip, I'll delete this virtual card to prevent any future charges or hacks. I'll also close the JPY & JPY jar.

4. Daily Review and Control:

- I review and control the available JPY funds daily.

- Towards the end of the trip, I'll limit conversions to JPY.

- I prefer seeing holiday purchases in the local currency to ensure transactions are processed at the advertised rate.

5. Pro Tip - ProtonMail:

- I use a free ProtonMail email account for travel, signing up for places and services I won't revisit, such as hotels, Japan Rail, free Wi-Fi, and discount coffee deals.

Note:

- Since Wise changed its banking setup to the new BSB last year, Osko payments into Wise from other financial institutions are no longer possible. This change requires me to keep more AUD in Wise than I would prefer.

1. Setting Up JPY Currency and Jar:

- I opened a new JPY currency account and created a JPY Jar.

- Transferred some holiday funds to Wise in AUD.

- Converted the amount I plan to spend to JPY and moved the remaining funds to an AUD Jar.

- Transferred JPY to the JPY Jar, leaving enough for an airport cash withdrawal (35,000 JPY) and two days' spending.

2. Jar Strategy for Security:

- I use the jar strategy to limit the funds available in case I lose my physical card or if my account details are hacked.

3. Virtual Visa Card:

- I created a new virtual Visa card for online purchases during the trip, such as rail, hotel, entry fees, and rideshare.

- Added this virtual card to my Apple Wallet for PayWave purchases.

- At the end of the trip, I'll delete this virtual card to prevent any future charges or hacks. I'll also close the JPY & JPY jar.

4. Daily Review and Control:

- I review and control the available JPY funds daily.

- Towards the end of the trip, I'll limit conversions to JPY.

- I prefer seeing holiday purchases in the local currency to ensure transactions are processed at the advertised rate.

5. Pro Tip - ProtonMail:

- I use a free ProtonMail email account for travel, signing up for places and services I won't revisit, such as hotels, Japan Rail, free Wi-Fi, and discount coffee deals.

Note:

- Since Wise changed its banking setup to the new BSB last year, Osko payments into Wise from other financial institutions are no longer possible. This change requires me to keep more AUD in Wise than I would prefer.

- Joined

- Jan 26, 2011

- Posts

- 29,424

- Qantas

- Platinum

- Virgin

- Red

New to Wise but using it for Japan next year. (I use ING previously and still will). So just checking what the Jar is please? Also the OSKO payments - my transfers from NAB usually appear in Wise almost immediately.Since 2020, I've been using Wise for both business and personal purposes. I recently configured my personal Wise account for an upcoming trip to Japan and thought I'd share my strategy.

1. Setting Up JPY Currency and Jar:

- I opened a new JPY currency account and created a JPY Jar.

- Transferred some holiday funds to Wise in AUD.

- Converted the amount I plan to spend to JPY and moved the remaining funds to an AUD Jar.

- Transferred JPY to the JPY Jar, leaving enough for an airport cash withdrawal (35,000 JPY) and two days' spending.

2. Jar Strategy for Security:

- I use the jar strategy to limit the funds available in case I lose my physical card or if my account details are hacked.

3. Virtual Visa Card:

- I created a new virtual Visa card for online purchases during the trip, such as rail, hotel, entry fees, and rideshare.

- Added this virtual card to my Apple Wallet for PayWave purchases.

- At the end of the trip, I'll delete this virtual card to prevent any future charges or hacks. I'll also close the JPY & JPY jar.

4. Daily Review and Control:

- I review and control the available JPY funds daily.

- Towards the end of the trip, I'll limit conversions to JPY.

- I prefer seeing holiday purchases in the local currency to ensure transactions are processed at the advertised rate.

5. Pro Tip - ProtonMail:

- I use a free ProtonMail email account for travel, signing up for places and services I won't revisit, such as hotels, Japan Rail, free Wi-Fi, and discount coffee deals.

Note:

- Since Wise changed its banking setup to the new BSB last year, Osko payments into Wise from other financial institutions are no longer possible. This change requires me to keep more AUD in Wise than I would prefer.

The idea of a disposable email and eVisa card makes a lot of sense.

MJ_/\_

Junior Member

- Joined

- Jul 16, 2024

- Posts

- 39

That sounds complicated...  I honestly don't get the appeal of Wise, but sounds like you have it all worked out the way you like it, so that's great.

I honestly don't get the appeal of Wise, but sounds like you have it all worked out the way you like it, so that's great.

One thing you might want to research a little is places that don't accept virtual cards... I can't give you any specific examples off the top of my head (as I don't use virtual cards), but I do remember seeing a few notes on my last trip to Japan about physical cards only accepted... tap and go isn't as widespread over there as it is here. A lot of places (and it seems totally random) will either make you swipe your card or insert the chip.

For getting cash out of ATM's I have a Macquarie debit card that has 0% foreign transaction fees and no ATM fees (certainly at 7-11 ATM's at any rate). No need to convert currencies before you go, just has standard AUD in the account. Just select Yen at the ATM and it will use the mastercard daily rate (which is less than 0.5% of the googled rate) and you can get out up to $1,000 per day.

...of course if you loaded Yen into your Wise card a couple of weeks ago you won out with the currency arbitrage, AUD has been in free fall this week!

One thing you might want to research a little is places that don't accept virtual cards... I can't give you any specific examples off the top of my head (as I don't use virtual cards), but I do remember seeing a few notes on my last trip to Japan about physical cards only accepted... tap and go isn't as widespread over there as it is here. A lot of places (and it seems totally random) will either make you swipe your card or insert the chip.

For getting cash out of ATM's I have a Macquarie debit card that has 0% foreign transaction fees and no ATM fees (certainly at 7-11 ATM's at any rate). No need to convert currencies before you go, just has standard AUD in the account. Just select Yen at the ATM and it will use the mastercard daily rate (which is less than 0.5% of the googled rate) and you can get out up to $1,000 per day.

...of course if you loaded Yen into your Wise card a couple of weeks ago you won out with the currency arbitrage, AUD has been in free fall this week!

I was very fortunate to be in Japan two weeks ago and was getting 108 to 108.5 yen for each Australian dollar using my CBA Smart Awards credit card and the Up debit card. I have a Wise card and Revolut card but since the rates were increasing during the plan phase decided not to lock in.

- Joined

- Jan 26, 2011

- Posts

- 29,424

- Qantas

- Platinum

- Virgin

- Red

that’s why I got into the Wise card this time and have loaded up with Yen....of course if you loaded Yen into your Wise card a couple of weeks ago you won out with the currency arbitrage, AUD has been in free fall this week!

VPS

Senior Member

- Joined

- Apr 2, 2011

- Posts

- 9,334

- Qantas

- LT Gold

- Virgin

- Gold

Jar really means another currencyNew to Wise but using it for Japan next year. (I use ING previously and still will). So just checking what the Jar is please? Also the OSKO payments - my transfers from NAB usually appear in Wise almost immediately.

The idea of a disposable email and eVisa card makes a lot of sense.

I use wise for all international travel. I use virtual cards when I buy things on line and for subscriptions that are really hard to cancel

- Joined

- Jan 26, 2011

- Posts

- 29,424

- Qantas

- Platinum

- Virgin

- Red

Jar really means another currency

I use wise for all international travel. I use virtual cards when I buy things on line and for subscriptions that are really hard to cancel

So I have a Jar then.

Do you bother with changing currency prior or just use AUD? I have so many things on the go with Japan. Suica cards loaded on both phones.(for trains) Wise. ING. I know I’m going to forget one.

oz_mark

Enthusiast

- Joined

- Jun 30, 2002

- Posts

- 21,647

For whatever reason, you need to get the email address from Wise that is used as your PAYID. That should allow faster transfers (Add Money, and select PAYID as the method, to get to the email address)Note:

- Since Wise changed its banking setup to the new BSB last year, Osko payments into Wise from other financial institutions are no longer possible. This change requires me to keep more AUD in Wise than I would prefer.

SYD

Enthusiast

- Joined

- Oct 5, 2009

- Posts

- 11,579

- Qantas

- Platinum

- Virgin

- Gold

- Oneworld

- Emerald

That’s certainly one good use case. I had another financial product that did virtual cards but I can’t for the life of me remember which one! I never used that feature. I also have a Wise account - but never used in anger.Now that's what I need a virtual card for... not necessarily the hard to cancel ones, but the ones I forget to cancel, lol

I prefer to take the forex risk on the go. Life’s too short to worry about AUD rising and falling. It is what it is with swings and roundabouts. Just have an international fee free CC and/or DC.

VPS

Senior Member

- Joined

- Apr 2, 2011

- Posts

- 9,334

- Qantas

- LT Gold

- Virgin

- Gold

Usually I transfer it overSo I have a Jar then.

Do you bother with changing currency prior or just use AUD? I have so many things on the go with Japan. Suica cards loaded on both phones.(for trains) Wise. ING. I know I’m going to forget one.

- Joined

- Jan 26, 2011

- Posts

- 29,424

- Qantas

- Platinum

- Virgin

- Red

I guess I like the thrill of the chaseThat’s certainly one good use case. I had another financial product that did virtual cards but I can’t for the life of me remember which one! I never used that feature. I also have a Wise account - but never used in anger.

I prefer to take the forex risk on the go. Life’s too short to worry about AUD rising and falling. It is what it is with swings and roundabouts. Just have an international fee free CC and/or DC.

elanshin

Established Member

- Joined

- Jan 25, 2023

- Posts

- 3,270

- Qantas

- Platinum

- Virgin

- Silver

- SkyTeam

- Elite Plus

This is a case of locking in exchange rates. I know plenty of friends that converted a bunch at 108/109 (its now back to 105).So I have a Jar then.

Do you bother with changing currency prior or just use AUD? I have so many things on the go with Japan. Suica cards loaded on both phones.(for trains) Wise. ING. I know I’m going to forget one.

In theory you could even play Forex market with it although the fees are probably a tad higher than going to a real forex market player.

If you think you'll get better rates later or need AUD now, you can keep it as AUD. Otherwise it lets you hold yen basically.

MJ_/\_

Junior Member

- Joined

- Jul 16, 2024

- Posts

- 39

try 102, lol108/109 (its now back to 105)

SYD

Enthusiast

- Joined

- Oct 5, 2009

- Posts

- 11,579

- Qantas

- Platinum

- Virgin

- Gold

- Oneworld

- Emerald

It’s like the share market. No one rings a bell at the top or the bottom!I guess I like the thrill of the chase

Don’t get me wrong, if there’s a positive uptick that could be short lived, I might consider prepaying hotels etc But once on the ground, meals, drinks etc the difference is really in the noise.

Become an AFF member!

Join Australian Frequent Flyer (AFF) for free and unlock insider tips, exclusive deals, and global meetups with 65,000+ frequent flyers.AFF members can also access our Frequent Flyer Training courses, and upgrade to Fast-track your way to expert traveller status and unlock even more exclusive discounts!

AFF forum abbreviations

Wondering about Y, J or any of the other abbreviations used on our forum?Check out our guide to common AFF acronyms & abbreviations.

Currently Active Users

Total: 396 (members: 12, guests: 384)