You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wise debit card

- Thread starter neils2004

- Start date

- Joined

- Nov 12, 2012

- Posts

- 29,021

- Qantas

- Platinum

- Virgin

- Platinum

- Star Alliance

- Gold

Absolutely they can - a friend just booked some tickets for something in June and I just put the pounds into his wise card and it was instantaneous

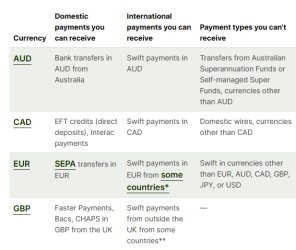

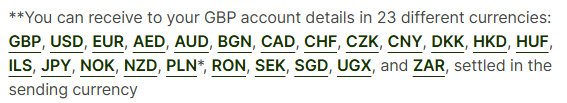

Don't wish to reply to good news with a negative, but according to the table, yes, you can receive GBP from Australia into a GBP account via SWIFT, but for Australian accounts, its only A$ - yea?

You can generate UK bank details so the sender will do a domestic GBP to GBP transfer

That'll land GBP onto my Aussie card? Can you give a quick summary, please?

VPS

Senior Member

- Joined

- Apr 2, 2011

- Posts

- 9,361

- Qantas

- LT Gold

- Virgin

- Gold

You need to set up a UK bucket and you will get a UK bank account number and they will be able to GPB into that bucket with your sort code and account number - hope this helpsDon't wish to reply to good news with a negative, but according to the table, yes, you can receive GBP from Australia into a GBP account via SWIFT, but for Australian accounts, its only A$ - yea?

View attachment 430377

View attachment 430378

That'll land GBP onto my Aussie card? Can you give a quick summary, please?

- Joined

- Nov 12, 2012

- Posts

- 29,021

- Qantas

- Platinum

- Virgin

- Platinum

- Star Alliance

- Gold

You need to set up a UK bucket and you will get a UK bank account number and they will be able to GPB into that bucket with your sort code and account number - hope this helps

Thanks ...hmmmm ... sounds like a project for the weekend .... with a bottle of gin to hand.

VPS

Senior Member

- Joined

- Apr 2, 2011

- Posts

- 9,361

- Qantas

- LT Gold

- Virgin

- Gold

It will take 30 seconds. Call me if you have issues but not tomorrowThanks ...hmmmm ... sounds like a project for the weekend .... with a bottle of gin to hand.

- Joined

- Jul 8, 2007

- Posts

- 1,592

- Qantas

- Platinum

- Virgin

- Red

- Oneworld

- Emerald

That sounds like a challenge!How much Gin can RF drink in 30 seconds?

- Joined

- Nov 12, 2012

- Posts

- 29,021

- Qantas

- Platinum

- Virgin

- Platinum

- Star Alliance

- Gold

That sounds like a challenge!

You've never seen me with alcohol. Never waste a drop. At worst, I'll have a sponge at the ready.

anat0l

Enthusiast

- Joined

- Dec 30, 2006

- Posts

- 11,894

- Qantas

- LT Silver

- Virgin

- Red

- Oneworld

- Ruby

- Star Alliance

- Gold

I'm thinking of jumping on the Wise bandwagon. While I have an ING Everyday Orange and NAB Visa Debit (grandfathered from Citibank Debit), Wise seems versatile enough and I think I should consider it. I have a CurrencyFair account as well, but CF isn't useful when withdrawing for cash unless you hold a bank account in the target country.

Having a quick look at the info and some posts, I'm a bit confused and wondering if it's worthwhile using:

Having a quick look at the info and some posts, I'm a bit confused and wondering if it's worthwhile using:

- There appears to be a fee in using the Wise (physical) card. This could be an issue if trying to use international ATMs to withdraw cash.

- How good are Wise's rates of conversion between currencies compared to midmarket? (That is, when converting deposited AUD in Wise into other currency wallets)

- There appear to be no free withdrawals, and it gets worse once you exceed a certain number of them per month, or a certain amount per month. It's worse than the only 5 transactions on the ING Everyday Orange.

SYD

Enthusiast

- Joined

- Oct 5, 2009

- Posts

- 11,642

- Qantas

- Platinum

- Virgin

- Gold

- Oneworld

- Emerald

Are you likely to be transferring (or receiving) foreign currency to/from Someone else? If not, I really can’t see the point of Wise (even though many here swear by it). I know some like to lock in funds at a certain exchange. If that’s your thing, that’s another advantage.I'm thinking of jumping on the Wise bandwagon. While I have an ING Everyday Orange and NAB Visa Debit (grandfathered from Citibank Debit), Wise seems versatile enough and I think I should consider it. I have a CurrencyFair account as well, but CF isn't useful when withdrawing for cash unless you hold a bank account in the target country.

Having a quick look at the info and some posts, I'm a bit confused and wondering if it's worthwhile using:

My quick survey of a couple of forums (including this one) seems that people are very happy with this and the product comes highly recommended.

- There appears to be a fee in using the Wise (physical) card. This could be an issue if trying to use international ATMs to withdraw cash.

- How good are Wise's rates of conversion between currencies compared to midmarket? (That is, when converting deposited AUD in Wise into other currency wallets)

- There appear to be no free withdrawals, and it gets worse once you exceed a certain number of them per month, or a certain amount per month. It's worse than the only 5 transactions on the ING Everyday Orange.

Otherwise, Your ING card will give the VISA rate (which is good) at ATMs (no 3% or ATM usage fee if you meet the monthly criteria). Also excellent for purchases.

The NAB card is also fine (should be the same good rate for purchases).

Ubank and Macquarie are other good options. Leave your AUD in the high interest account (5.5%) until you need to withdraw or spend.

Last edited:

CMA222

Active Member

- Joined

- Oct 15, 2009

- Posts

- 928

Log in. On the Wise "Home" page across the screen are the currency buckets you already have. At the end of the horizontal list there is a + sign with the note "Add another currency to your account". Click and add GBP and the account will generate a new tile in your list with a zero balance. Click on the new tile and it will open. Directly below the balance is a a small tile with several numbers. Click on that tile and all the GBP account details will be displayed. It should take about 30 seconds as already noted.Thanks ...hmmmm ... sounds like a project for the weekend .... with a bottle of gin to hand.

- Joined

- Jan 26, 2011

- Posts

- 29,511

- Qantas

- Platinum

- Virgin

- Red

It's quite easy to do and I've done it with Yen and Rupiah. Exchanged both at a great rate. Now if only the Aud versus USD could get its act together I'll have four buckets.Thanks ...hmmmm ... sounds like a project for the weekend .... with a bottle of gin to hand.

The ING is still active but need to remember to do the addition of $1000 and five transactions the month before.

- Joined

- Jul 8, 2007

- Posts

- 1,592

- Qantas

- Platinum

- Virgin

- Red

- Oneworld

- Emerald

I have use Wise and really like the product, but in saying that, @SYD does make some very valid points. It's certainly a horses for courses type of product. Some of my thoughts from using it now over multiple trips (and other uses)...I'm thinking of jumping on the Wise bandwagon. While I have an ING Everyday Orange and NAB Visa Debit (grandfathered from Citibank Debit), Wise seems versatile enough and I think I should consider it. I have a CurrencyFair account as well, but CF isn't useful when withdrawing for cash unless you hold a bank account in the target country.

Having a quick look at the info and some posts, I'm a bit confused and wondering if it's worthwhile using:

My quick survey of a couple of forums (including this one) seems that people are very happy with this and the product comes highly recommended.

- There appears to be a fee in using the Wise (physical) card. This could be an issue if trying to use international ATMs to withdraw cash.

- How good are Wise's rates of conversion between currencies compared to midmarket? (That is, when converting deposited AUD in Wise into other currency wallets)

- There appear to be no free withdrawals, and it gets worse once you exceed a certain number of them per month, or a certain amount per month. It's worse than the only 5 transactions on the ING Everyday Orange.

- The ability to hold multiple currencies on one card and clearly understand how much of each currency you have at any given time is helpful for budgeting and knowing precisely what you have available to spend locally

- Locking in high exchange rates has been helpful and mitigates random events killing the exchange rate. Of course this is a double-edged sword, so it's a calculated risk.

- No fee for using the card to pay for things. Obviously, card payment surcharges levied by the store can't be avoided.

- The ATM withdrawal fees do need to be considered, but it's worth understanding the details of them as in practise, they can be mitigated/minimised with appropriate planning. You get 2 free withdrawals per month (keeping in mind that the ATM operator may still levy a fee) up to and including 350 AUD per month. Beyond this, there is a 1.75% fee levied on the amount over 350 AUD, and 1.5 AUD for the 3rd withdrawal onwards. Will be an issue for some, but personally not a major concern for me.

- I've found Wise's conversion rates to be competitive and one nice thing is that when you set up a deposit, it will lock and hold the spot conversion rate for a period of time. If the rates go down, you still get the better rate. If the rates go up, you can cancel and set up a new deposit at the better rate.

- Wise allows you to set up digital cards that can be very useful for overseas online shopping and/or limiting which cards are provided to a third party. For example, I registered a digital card with Kakao Taxi for a South Korea trip and then froze the card once I had left the country.

- Joined

- Nov 12, 2012

- Posts

- 29,021

- Qantas

- Platinum

- Virgin

- Platinum

- Star Alliance

- Gold

Are you likely to be transferring (or receiving) foreign currency to/from Someone else? If not, I really can’t see the point of Wise (even though many here swear by it). I know some like to lock in funds at a certain exchange. If that’s your thing, that’s another advantage.

Otherwise, Your ING card will give the VISA rate (which is good) at ATMs (no 3% or ATM usage fee if you meet the monthly criteria). Also excellent for purchases.

What I’m looking to do is to allow someone from the UK to pay me some money they owe me in a easy way for them and a useful way for me.

Hence wishing to get them to pay me GBP on my existing Wise card so I can easily spend it later in the UK without losing stuff on exchange which even within Wise there is a level.

Yup, that's definitely easy to do with Wise. I have a UK, US and Euro buckets with Wise and each has bank account details.What I’m looking to do is to allow someone from the UK to pay me some money they owe me in a easy way for them and a useful way for me.

Hence wishing to get them to pay me GBP on my existing Wise card so I can easily spend it later in the UK without losing stuff on exchange which even within Wise there is a level.basically creating a UK bank account.

VPS

Senior Member

- Joined

- Apr 2, 2011

- Posts

- 9,361

- Qantas

- LT Gold

- Virgin

- Gold

Yep that’s what you will be able to doWhat I’m looking to do is to allow someone from the UK to pay me some money they owe me in a easy way for them and a useful way for me.

Hence wishing to get them to pay me GBP on my existing Wise card so I can easily spend it later in the UK without losing stuff on exchange which even within Wise there is a level.basically creating a UK bank account.

CMA222

Active Member

- Joined

- Oct 15, 2009

- Posts

- 928

As set out above in #131 the account you open gives you a GBP account into which anyone can transfer GBP by interbank or on-line transfer into your Wise GBP account. It becomes part of your Wise GBP balance when received. I had some money that was to be transferred to me by the BoE. I opened a GBP bucket with Wise which immediately provided me with an account number. As soon as I provided the BoE with the Wise GBP account details it was deposited the same day. I am uncertain whether cash can be deposited, although it might be possible to do an over the counter cash transfer into the account at a UK bank branch.What I’m looking to do is to allow someone from the UK to pay me some money they owe me in a easy way for them and a useful way for me.

Hence wishing to get them to pay me GBP on my existing Wise card so I can easily spend it later in the UK without losing stuff on exchange which even within Wise there is a level.basically creating a UK bank account.

- Joined

- Nov 12, 2012

- Posts

- 29,021

- Qantas

- Platinum

- Virgin

- Platinum

- Star Alliance

- Gold

yes, thanks. I wasn’t ignoring your helpful reply, just making it clear what my objective was to others.As set out above in #131 the account you open gives you a GBP account into which anyone can transfer GBP by interbank or on-line transfer into your Wise GBP account.

SYD

Enthusiast

- Joined

- Oct 5, 2009

- Posts

- 11,642

- Qantas

- Platinum

- Virgin

- Gold

- Oneworld

- Emerald

Yes, that’s one of the good use cases of Wise.What I’m looking to do is to allow someone from the UK to pay me some money they owe me in a easy way for them and a useful way for me.

Hence wishing to get them to pay me GBP on my existing Wise card so I can easily spend it later in the UK without losing stuff on exchange which even within Wise there is a level.basically creating a UK bank account.

I was responding to another general question about getting a Wise account. For someone who just wants to get cash from an ATM OS, there are easy / better options IMHO.

Certainly, if I ever need to send /receive money to a person, I’d use my Wise account - which is currently quite neglected and gathering virtual dust.

oz_mark

Enthusiast

- Joined

- Jun 30, 2002

- Posts

- 21,647

I agree, for the use case of getting cash out at on overseas ATM, I use options other than Wise (although it is a backup of my backup)I was responding to another general question about getting a Wise account. For someone who just wants to get cash from an ATM OS, there are easy / better options IMHO.

Become an AFF member!

Join Australian Frequent Flyer (AFF) for free and unlock insider tips, exclusive deals, and global meetups with 65,000+ frequent flyers.AFF members can also access our Frequent Flyer Training courses, and upgrade to Fast-track your way to expert traveller status and unlock even more exclusive discounts!

AFF forum abbreviations

Wondering about Y, J or any of the other abbreviations used on our forum?Check out our guide to common AFF acronyms & abbreviations.

Currently Active Users

- dsdavidc

- meljfk

- somebol

- Strikes

- Foz

- A321

- Tangenyahu

- schmoots

- Colin 2905

- flyingfan

- Bundy Bear

- jc123

- KSC

- L2.

- dairyfloss

- ellen10

- New to this

- jase05

- Quickstatus

- BJReplay

- n7of9

- redbigot

- Auer_Rods

- jbmarshall90

- woocalla

- Ikara

- markis10

- utaussiefan

- EuroKick

- deka2

- WrenchHammerMcTool

- Oscarq

- Brissy1

- Chris1985

- asterix

- sidereal

- kpc

- SYD

- Cottman

- There'sOnlyOneJimmy

- Saab34

- Beachy55

- texter

Total: 660 (members: 48, guests: 612)