You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Superannuation Discussion + market volatility

- Thread starter JohnK

- Start date

- Joined

- Jan 26, 2011

- Posts

- 29,412

- Qantas

- Platinum

- Virgin

- Red

About time the directors and boards face the music. Or at least those in charge of security issues. But no. It's the members again. Hacked on the way in and fined on the way out.If a large super fund gets fined isn’t the fine coming out of their members funds?

- Joined

- Oct 13, 2013

- Posts

- 16,130

I think so unless the fine is on the directors and executives. Essentially the hackers get $$$ and then the govt goes in and gets $$$.If a large super fund gets fined isn’t the fine coming out of their members funds?

Not one cent of the the ACCC fines for QF, VW, Ford went to plaintiffs.

Still having problems signing onto Australian Super but managed to do so yesterday. Personally not unhappy they are taking a bit of time and do have 2FA enabled.There's a lot of articles (a couple of them are well presented) on the credential stuffing incident.

Multiple local super funds hit by coordinated cyberattack

It's only really of concern to pension accounts - they have banking details for regular payments which can be accessed.

From the SMH article, the relevant information:

and

- Joined

- Apr 6, 2018

- Posts

- 2,752

I have some funds in Aus Super and Hesta - able to get into both with no hassles (or loss of funds)Still having problems signing onto Australian Super but managed to do so yesterday. Personally not unhappy they are taking a bit of time and do have 2FA enabled.

- Joined

- Oct 13, 2013

- Posts

- 16,130

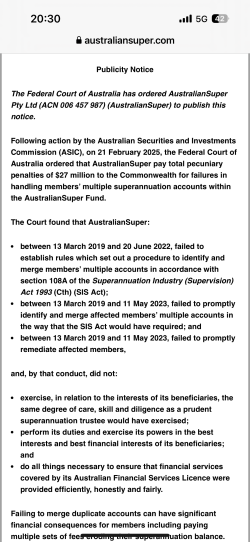

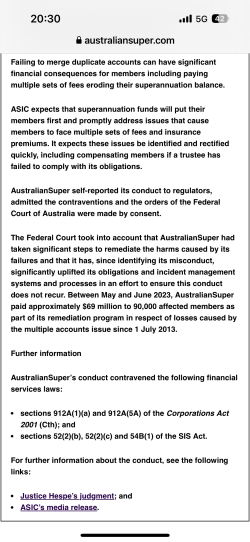

But who holds them to account? Not the super members. This from Australian Super...About time the directors and boards face the music. Or at least those in charge of security issues. But no. It's the members again. Hacked on the way in and fined on the way out.

"Member and Employer Directors are appointed by the Trustee’s shareholders. The shareholders are the Australian Council of Trade Unions (ACTU) (through ACTU Super Shareholding Pty Ltd) and the Australian Industry Group"

MEL_Traveller

Veteran Member

- Joined

- Apr 27, 2005

- Posts

- 29,733

So, not looking for financial advice here - and all the other caveats.

But…

With my super fund I have the ability to determine the investment stream for my money. Ranging from 100% in the bank (just earning simple interest) to ‘high growth’.

I’m currently in high growth,

Any changes I make will be actioned the next business day (in this case, tomorrow).

Given the stock market is likely to have a substantial hit in Australia tomorrow, would it be worth switching to 100% cash for say the next week or so, until the market settles and starts to rebound?

I was lucky doing this in the last financial crisis, but a little earlier. It meant my super balance stayed the same, and I switched back to take advantage of growth after the crash. While everyone else was starting at 80k balance after the crash, my 100k balance was preserved.

So is it too late to go to 100% cash today, to be actioned tomorrow?

But…

With my super fund I have the ability to determine the investment stream for my money. Ranging from 100% in the bank (just earning simple interest) to ‘high growth’.

I’m currently in high growth,

Any changes I make will be actioned the next business day (in this case, tomorrow).

Given the stock market is likely to have a substantial hit in Australia tomorrow, would it be worth switching to 100% cash for say the next week or so, until the market settles and starts to rebound?

I was lucky doing this in the last financial crisis, but a little earlier. It meant my super balance stayed the same, and I switched back to take advantage of growth after the crash. While everyone else was starting at 80k balance after the crash, my 100k balance was preserved.

So is it too late to go to 100% cash today, to be actioned tomorrow?

- Joined

- Jun 20, 2002

- Posts

- 17,753

- Qantas

- Gold

- Virgin

- Platinum

Yes, likely too late as the business day on which the switch request is received is the date of processing (for the selling of the old assets and buying the new investments).

So generally after 11am, the valuations for the previous day is loaded into the system, then everyone will see what Friday's drop on the US markets (in particular) will affect their investment valuations.

Index based funds will have to book losses as the percentage of share market capitalisation versus the overall market will mean they must sell to change to the new percentages. Given 400 of the 500 S&P shares dropped on Thursday (haven't looked at Fridays figures but similar to Thursdays would be likely), that'll be a bloodbath.

Compare the YTD chart: S&P 500 Price, Real-time Quote & News - Google Finance

to that over the last year: S&P 500 Price, Real-time Quote & News - Google Finance

Best way to look at it is that if you were invested in the index, you've back to your balance from 12 month ago.

Then review against the past 5 years: S&P 500 Price, Real-time Quote & News - Google Finance

Trying to time the market is difficult for the average person (but watching what Buffett and Li Ka-shing do shows that you need to sell high and wait for opportunities, as in a recession cash is king). Time in the market, in assets appropriate to your risk profile, makes the most sense. You're investing for the balance of your life on earth, however long that may be.

So generally after 11am, the valuations for the previous day is loaded into the system, then everyone will see what Friday's drop on the US markets (in particular) will affect their investment valuations.

Index based funds will have to book losses as the percentage of share market capitalisation versus the overall market will mean they must sell to change to the new percentages. Given 400 of the 500 S&P shares dropped on Thursday (haven't looked at Fridays figures but similar to Thursdays would be likely), that'll be a bloodbath.

Compare the YTD chart: S&P 500 Price, Real-time Quote & News - Google Finance

to that over the last year: S&P 500 Price, Real-time Quote & News - Google Finance

Best way to look at it is that if you were invested in the index, you've back to your balance from 12 month ago.

Then review against the past 5 years: S&P 500 Price, Real-time Quote & News - Google Finance

Trying to time the market is difficult for the average person (but watching what Buffett and Li Ka-shing do shows that you need to sell high and wait for opportunities, as in a recession cash is king). Time in the market, in assets appropriate to your risk profile, makes the most sense. You're investing for the balance of your life on earth, however long that may be.

Last edited:

MEL_Traveller

Veteran Member

- Joined

- Apr 27, 2005

- Posts

- 29,733

Thank you!Yes, likely too late as the date on which the switch request is received is the date of processing (for the sale price of selling and buying the new ones).

So generally after 11am, the valuations for the previous day is loaded into the system, then everyone will see what Friday's drop on the US markets (in particular) will affect valuations.

Index based funds will have to book losses as the percentage of share market capitalisation versus the overall market will mean they must sell to change to the new percentages. Given 400 of the 500 S&P shares dropped on Thursday (haven't looked at Fridays figures but similar to Thursdays would be likely), that'll be a bloodbath.

[COLOR=rgba(0, 0, 0, 0.62)]Market Summary > S&P 500[/COLOR]

5,074.08-453.83 (-8.21%)past 5 days

[COLOR=rgba(0, 0, 0, 0.62)]4 Apr, 4:35 pm GMT-4 • [COLOR=rgba(0, 0, 0, 0.62)]Disclaimer[/COLOR][/COLOR]

Follow

[COLOR=rgba(0, 0, 0, 0.62)]

1D[/COLOR]

5D

1M

6M

YTD

1Y

5Y

Max

5,527.91 [COLOR=rgba(0, 0, 0, 0.67)]Mon 31 Mar 09:30[/COLOR][COLOR=rgba(0, 0, 0, 0.54)]5,0005,2005,4005,6005,800

1 Apr2 Apr3 Apr4 Apr

[/COLOR]

[td]Open[/td]

[td]5,292.14[/td] [td]High[/td]

[td]5,292.14[/td]

[td]Low[/td]

[td]5,069.90[/td] [td]Prev close[/td]

[td]5,396.52[/td]

[td]52-wk high[/td]

[td]6,147.43[/td] [td]52-wk low[/td]

[td]4,953.56[/td]

So the only thing I could potentially be protecting against would be further fall out and a further fall on Tuesday?

Is there anything to lose by switching to say cash and monitoring it day by day, and perhaps switching back at the end of the week?

SydneySwan

Established Member

- Joined

- Jan 12, 2014

- Posts

- 4,048

- Qantas

- Gold

- Virgin

- Red

Super funds (like managed funds) are priced forward - you get the price after your request is received, not at the time it is received (which is a historical price) so if you request to switch today it will take place after the price for today is calculated which will be after markets close today.Thank you!

So the only thing I could potentially be protecting against would be further fall out and a further fall on Tuesday?

Is there anything to lose by switching to say cash and monitoring it day by day, and perhaps switching back at the end of the week?

I daresay you can switch backwards and forwards between cash and shares frequently but make sure you give your crystal ball a thorough clean so that it is in tip-top condition. The biggest risk is that you will not be nimble enough and if the markets turn around you could miss the 'up' days. In the GFC and Covid many people moved to cash after the falls had started thereby crystallising losses and then were still in cash when the upswing started.

MEL_Traveller

Veteran Member

- Joined

- Apr 27, 2005

- Posts

- 29,733

Noted, thanks!Super funds (like managed funds) are priced forward - you get the price after your request is received, not at the time it is received (which is a historical price) so if you request to switch today it will take place after the price for today is calculated which will be after markets close today.

I daresay you can switch backwards and forwards between cash and shares frequently but make sure you give your crystal ball a thorough clean so that it is in tip-top condition. The biggest risk is that you will not be nimble enough and if the markets turn around you could miss the 'up' days. In the GFC and Covid many people moved to cash after the falls had started thereby crystallising losses and then were still in cash when the upswing started.

I know I have missed today’s pending downturn, but if it continues even tomorrow then I should be in front.

This is only temporary as a one off, for a few days. Not particularly looking to switch back at the best time, just ‘a’ time after the market has gone down. If I miss one day of rebound i’ll habe to wear that too.

RB

Established Member

- Joined

- Nov 17, 2004

- Posts

- 4,310

Still won't know the last day of the falls to calculate only missing 1 day?Noted, thanks!

I know I have missed today’s pending downturn, but if it continues even tomorrow then I should be in front.

This is only temporary as a one off, for a few days. Not particularly looking to switch back at the best time, just ‘a’ time after the market has gone down. If I miss one day of rebound i’ll habe to wear that too.

- Joined

- Oct 13, 2013

- Posts

- 16,130

Not the time to act in an irrational market unless your crystal ball is perfect.

MEL_Traveller

Veteran Member

- Joined

- Apr 27, 2005

- Posts

- 29,733

No, but I don’t mind that. This isn’t ‘exact’. If the market falls tomorrow, i’ll be ahead by whatever that percentage is.Still won't know the last day of the falls to calculate only missing 1 day?

If it doesn’t, i’ve lost one day potentially.

If the market rebounds today, my switch doesn’t take effect until 3pm, so i’ll benefit from that.

- Joined

- Jun 24, 2008

- Posts

- 4,513

- Qantas

- Gold

- Virgin

- Red

This is not financial advice.No, but I don’t mind that. This isn’t ‘exact’. If the market falls tomorrow, i’ll be ahead by whatever that percentage is.

If it doesn’t, i’ve lost one day potentially.

If the market rebounds today, my switch doesn’t take effect until 3pm, so i’ll benefit from that.

IMHO, the time to move to cash was some weeks/months ago. Your crystal ball did not notify you then (nor did mine). What makes you think that it will notify you when is the right time to move back to growth?

Markets go up and down; sit back and relax and enjoy life. Life is too short to be worrying about things like this.

- Joined

- Jan 26, 2011

- Posts

- 29,412

- Qantas

- Platinum

- Virgin

- Red

Well, our crystal ball was clouded by HESTA. We moved a couple of weeks ago to Aust Super. We went from a moderately aggressive portfolio and just selected the one based on our age, much more conservative. That might have saved us a little.This is not financial advice.

IMHO, the time to move to cash was some weeks/months ago. Your crystal ball did not notify you then (nor did mine). What makes you think that it will notify you when is the right time to move back to growth?

Markets go up and down; sit back and relax and enjoy life. Life is too short to be worrying about things like this.

SydneySwan

Established Member

- Joined

- Jan 12, 2014

- Posts

- 4,048

- Qantas

- Gold

- Virgin

- Red

So what is stopping you?I wish I could create a retirement super account now! I’d stuff as much in under my remaining TBC and watch it knock that out of the park when things eventually settle down…

SYD

Enthusiast

- Joined

- Oct 5, 2009

- Posts

- 11,568

- Qantas

- Platinum

- Virgin

- Gold

- Oneworld

- Emerald

Become an AFF member!

Join Australian Frequent Flyer (AFF) for free and unlock insider tips, exclusive deals, and global meetups with 65,000+ frequent flyers.AFF members can also access our Frequent Flyer Training courses, and upgrade to Fast-track your way to expert traveller status and unlock even more exclusive discounts!

AFF forum abbreviations

Wondering about Y, J or any of the other abbreviations used on our forum?Check out our guide to common AFF acronyms & abbreviations.

Currently Active Users

- andyrb

- Duggo

- vt

- jrfsp

- kevrosmith

- lunne

- Thibault

- Flashback

- SYD

- mrsterryn

- ben95

- larry40

- Stone

- SJF211

- JessicaTam

- justinbrett

- semiskilled97

- Buzzard

- laffer

- thebmw

- TheThunderer

- Gladstone Tim

- Quickstatus

- element0

- Shirazclub

- Vekor

- brissie

- Fifa

- 306

- NoName

- SeatBackForward

- HealthyPotato

- jbmarshall90

- US_Amex

- GroupHug

- bellroy26

- B3nno

- Pete98765432

- hill

- Rug

- 1022

- Ninetails23

- funnybrus

- knightfall88

- Rangalad

- m535607

- opusman

- phillyphlyer

- mkoleary

- sidcoffee

Total: 743 (members: 63, guests: 680)