kamchatsky

Established Member

- Joined

- Mar 8, 2006

- Posts

- 3,805

- Qantas

- Qantas Club

- Virgin

- Red

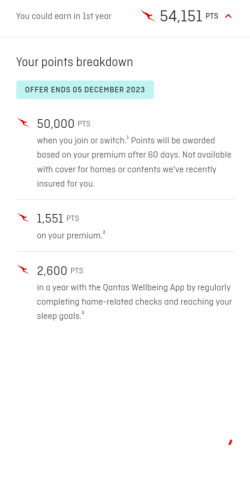

50000 bonus Qantas points for any eligible new car and/or home policy (on top of 1 point per dollar spent). Offer ends 5 December:

If your premium is less than $1550 then you get a percentage of the 50000 points (see table below). But the sweet spot is just over $1550 premium. I've just signed up Landlord Insurance (just over $1550) and their pricing seems to work out well:

Our biggest offer has landed with up to 50,000 Qantas Points for joining

Min. spend $1,550 per policy to earn 50,000 points.1 Points awarded after 60 days.If your premium is less than $1550 then you get a percentage of the 50000 points (see table below). But the sweet spot is just over $1550 premium. I've just signed up Landlord Insurance (just over $1550) and their pricing seems to work out well:

How can I earn Qantas Points for purchasing Qantas Home Insurance?

You could earn Qantas Points with Qantas Home Insurance in three ways:- Earn up to 50,000 Qantas Points when you join or switch by 5 December.1 Min. spend $1,550 per policy to earn 50,000 points. Not available with cover for homes or contents we've recently insured for you.

- Earn 1 Qantas Point for every $1 spent on your premium.2

- Earn 2,600 Qantas Points in a year with the Qantas Wellbeing App by regularly completing home-related checks and reaching your sleep goals.3

How can I earn Qantas Points for purchasing Qantas Car Insurance?

You could earn Qantas Points for purchasing Qantas Car Insurance in three ways:- Earn up to 50,000 Qantas Points when you join or switch by 5 December.1 Min. spend $1,550 per policy to earn 50,000 points. Points will be awarded based on your premium after 60 days. Not available on cars we’ve recently insured for you.

- Earn 1 Qantas Point for every $1 spent on your premium.2

- Earn 2,600 Qantas Points in a year with the Qantas Wellbeing App by regularly completing car safety checks and reaching your sleep goals.3