Mr H

Established Member

- Joined

- Dec 5, 2013

- Posts

- 3,372

This is pretty dodgy tbh - there should always be an option for the customer to turn off auto-renew.

However, as the consumer you do also have the responsibility to check if everything is up to date and being overseas unfortunately isn't really an excuse. I know if I was overseas I'd still try to keep as up to date as possible with anything that comes up, whether it be car insurance, home insurance or just simple bills / paying off my CC on time to avoid any interest etc.

As long as one has functional internet access (and a VPN if required), one should be able to do all this.

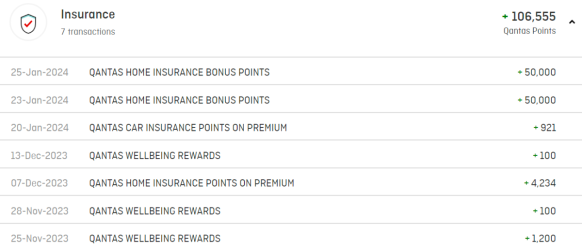

It is not auto-renew. It is a decision by Qantas Insurance to automatically renew a policy in the hope that the customer will not proactively opt out. There is nothing in the terms and conditions to give them permission to do so.

I was not notified of this by email - just by a letter sent by Australia Post. I had no reason to think that there was anything to keep across. I had already set up a new insurance policy with another company to kick in while I was overseas.

I was in Iran and did not have functional internet even with VPNs.