DJ card is an alliance partnership between AMEX and David Jones, which means retention points must be approved by David Jones not only AMEX. AFAIK, it costs David Jones money to fund those points, and I believe DJ AEMX card is the only type that never offers any retention points.Has anyone been offered a retention or reinstatement offer for any of the David Jones Amexs? I would assume the answer is no, but it can't hurt to ask.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Amex "I'm going to cancel my card" - bonus points given thread.

- Thread starter tinkybelle

- Start date

DJ card is an alliance partnership between AMEX and David Jones, which means retention points must be approved by David Jones not only AMEX. AFAIK, it costs David Jones money to fund those points, and I believe DJ AEMX card is the only type that never offers any retention points.

I think they have, when I held one many years ago before Explorer card came out.

billybrown

Newbie

- Joined

- Jun 6, 2021

- Posts

- 6

I just tried via online chat and got the reply 'as of the regulation change in 2019 we do not do retention offers anymore'. Although seems like you people have had some luck calling up!

My card renewal is the end of October. So I phoned the platinum charge card 1800 number and spoke with Viola in Sydney card accounts, and she then put me through to "the redemption team" - Vanessa, in Manila - who offered just 30k points. I thanked her and said I'd consider her offer. I then HUACA and got Kyle in Manila, who put me through to David in the Sydney card cancellation team. 30k points again. He did say that next week things may change with offers - he referred to this mysterious "algorithm". Can anyone enlighten me on the inner workings of this mysterious thing ? And I'm wondering if it is me - a long time, loyal platinum charge card member, with two supplementary card holders, and a slew of direct debits, who calls up questioning the value of the card given erosion of travel benefits and other offers. Are they calling my bluff ? Why doesn't Amex reward loyal customers ? How can someone new and untested, as in a new card member, be thanked for their "loyalty" in joining, and rewarded with 200k points, plus all the usual benefits?

Dr Ralph

Enthusiast

- Joined

- Jan 21, 2014

- Posts

- 13,552

- Qantas

- Bronze

- Virgin

- Red

No one can explain any of this. Play the game. Loyalty is not rewarded. Churn and burn without hesitation. This strategy has served me well for more than a decade. My only regret is that I didn't realise this sooner.My card renewal is the end of October. So I phoned the platinum charge card 1800 number and spoke with Viola in Sydney card accounts, and she then put me through to "the redemption team" - Vanessa, in Manila - who offered just 30k points. I thanked her and said I'd consider her offer. I then HUACA and got Kyle in Manila, who put me through to David in the Sydney card cancellation team. 30k points again. He did say that next week things may change with offers - he referred to this mysterious "algorithm". Can anyone enlighten me on the inner workings of this mysterious thing ? And I'm wondering if it is me - a long time, loyal platinum charge card member, with two supplementary card holders, and a slew of direct debits, who calls up questioning the value of the card given erosion of travel benefits and other offers. Are they calling my bluff ? Why doesn't Amex reward loyal customers ? How can someone new and untested, as in a new card member, be thanked for their "loyalty" in joining, and rewarded with 200k points, plus all the usual benefits?

- Joined

- Feb 23, 2015

- Posts

- 6,238

- Qantas

- Platinum 1

- Virgin

- Platinum

- Star Alliance

- Gold

And I'm wondering if it is me - a long time, loyal platinum charge card member, with two supplementary card holders, and a slew of direct debits

From what you have said, it's possible Amex isn't worried about losing you. As Dr Ralph mentioned it's anyone's guess - but mine is that high retention offers are fuelled by two factors: annual spend and a customer engagement/loyalty metric calculated by number of years holding the card, repeat payments/direct debits, MR point balance, Amex Offer utilisation, transaction frequency & spend categories etc.

It might sound counter-intuitive but a customer with a high engagement would be less likely to sever ties (due to more self-imposed obstacles in doing so) than a customer with a low engagement, and if the purpose of the offer is to retain a customer, the highly engaged customer would on average need a less enticing offer to stay.

It doesn't seem fair to reward less loyal & engaged customers, but it works on the assumption the retention offers are not discussed publicly by Amex customers...

That is true, and enjoy it - while you can. The other dance game I must play is that my corporate career years are behind me, and as a wealthy self-funded retiree, unless I want to go through the intrusive process of revealing every financial detail - only to be rejected - then I'm at the mercy of holding onto my platinum charge card.No one can explain any of this. Play the game. Loyalty is not rewarded. Churn and burn without hesitation. This strategy has served me well for more than a decade. My only regret is that I didn't realise this sooner.

True - they keep reminding me that I've been a loyal card member since 1998 - though I remind them that period includes corporate credit cards, and that my current (and second) platinum charge card is from 2011. I do have 1.4m points. I was told by David in the cancellation team today that Amex are not able by law to make retention offers ... It does smack of hypocrisy that clearly they do make "One Time Loyal Customer Bonus" offers ...From what you have said, it's possible Amex isn't worried about losing you. As Dr Ralph mentioned it's anyone's guess - but mine is that high retention offers are fuelled by two factors: annual spend and a customer engagement/loyalty metric calculated by number of years holding the card, repeat payments/direct debits, MR point balance, Amex Offer utilisation, transaction frequency & spend categories etc.

It might sound counter-intuitive but a customer with a high engagement would be less likely to sever ties (due to more self-imposed obstacles in doing so) than a customer with a low engagement, and if the purpose of the offer is to retain a customer, the highly engaged customer would on average need a less enticing offer to stay.

It doesn't seem fair to reward less loyal & engaged customers, but it works on the assumption the retention offers are not discussed publicly by Amex customers...

Was that a cancellation offer to go to explorer, or just an email out of the blue?Ended up accepting the Essential card, and received a offer to upgrade to Explorer this week (40k bonus points) which I accepted.

I want to move from essential to explorer card but with bonus points given. Does AMEX ever give upgrade (not downgrade) offers on cancelling?

- Joined

- Feb 23, 2015

- Posts

- 6,238

- Qantas

- Platinum 1

- Virgin

- Platinum

- Star Alliance

- Gold

I want to move from essential to explorer card but with bonus points given. Does AMEX ever give upgrade (not downgrade) offers on cancelling?

Call them and ask if there are any promotions available for you to upgrade from Essential to a higher level Amex MR card. Say that you are interested in the bonus points sign-up promotion but understand these are for new cardholders only, so if there's no card upgrade options available you have no choice but to cancel your card and move your business elsewhere for 18 months.

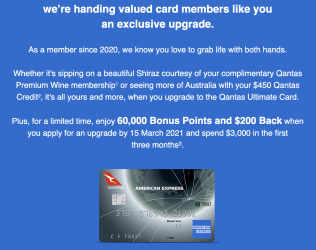

Edit: the short answer is yes, they do. These can be via email or by proactively calling. Here's an example of an email upgrade offer I received to move from Westpac Black Amex (when it was being discontinued and they were moving existing customers to the Amex Elevate card) to the Qantas Ultimate card. I was about half way through 18 month direct issued Amex exclusion period at the time.

After receiving the email I called to say I would be cancelling the Westpac Black/Amex Elevate unless I could sign-up for the Platinum Charge with the full new cardholder sign-up bonus, which they agreed to. After I had received the Plat card I then followed the email upgrade offer and also signed up for the Qantas Ultimate to get the 60k QFF + $200

Last edited:

Oh wow! And you got both of them bonus?Call them and ask if there are any promotions available for you to upgrade from Essential to a higher level Amex MR card. Say that you are interested in the bonus points sign-up promotion but understand these are for new cardholders only, so if there's no card upgrade options available you have no choice but to cancel your card and move your business elsewhere for 18 months.

Edit: the short answer is yes, they do. These can be via email or by proactively calling. Here's an example of an email upgrade offer I received to move from Westpac Black Amex (when it was being discontinued and they were moving existing customers to the Amex Elevate card) to the Qantas Ultimate card. I was about half way through 18 month direct issued Amex exclusion period at the time.

View attachment 259284

After receiving the email I called to say I would be cancelling the Westpac Black/Amex Elevate unless I could sign-up for the Platinum Charge with the full new cardholder sign-up bonus, which they agreed to. After I had received the Plat card I then followed the email upgrade offer and also signed up for the Qantas Ultimate to get the 60k QFF + $200

oz_mark

Enthusiast

- Joined

- Jun 30, 2002

- Posts

- 21,647

He did say that next week things may change with offers - he referred to this mysterious "algorithm". Can anyone enlighten me on the inner workings of this mysterious thing ?

What can be offered is based on what the computer says they can offer. How it comes up with a specific number is anyones guess.

Thanks for the advice. I ended up calling and they offered to upgrade to the platinum edge for 25k points. I didn't do the cancellation dance as didn't have time this morning and I'm not sure if that would evaporate that offer. Will have to think as I was looking into the explorer because of it's overall better points/$ and better insurances (e.g. rental car hire damage)Call them and ask if there are any promotions available for you to upgrade from Essential to a higher level Amex MR card. Say that you are interested in the bonus points sign-up promotion but understand these are for new cardholders only, so if there's no card upgrade options available you have no choice but to cancel your card and move your business elsewhere for 18 months.

Edit: the short answer is yes, they do. These can be via email or by proactively calling. Here's an example of an email upgrade offer I received to move from Westpac Black Amex (when it was being discontinued and they were moving existing customers to the Amex Elevate card) to the Qantas Ultimate card. I was about half way through 18 month direct issued Amex exclusion period at the time.

After receiving the email I called to say I would be cancelling the Westpac Black/Amex Elevate unless I could sign-up for the Platinum Charge with the full new cardholder sign-up bonus, which they agreed to. After I had received the Plat card I then followed the email upgrade offer and also signed up for the Qantas Ultimate to get the 60k QFF + $200

- Joined

- Mar 5, 2019

- Posts

- 3,594

- Qantas

- Platinum

- Virgin

- Platinum

I've got a big expense coming up around Christmas. Not so big, big, but big enough for me to sign up for a new CC and get some points & SC ... Wanted to give AMEX Velocity card a shot (with it's 120K VFF points & 120 SC).

Called up AMEX today morning. Got through to someone in AU. I was told that the AMEX Velocity is only for NEW customers (those that have never had an AMEX before or at least not in the past 18 months, pretty standard response).

I then asked, if there is any offers for me, considering that I've been with AMEX Qantas Ultimate for the past 5 years, spending at least $30K each year ... was told, no, none at the moment. I could add a supplementary card holder and get 5K points, but I don't have anyone to add to my AMEX.

I then asked, if there is any retention offers for customers who have been with AMEX for over 5 years now and seeking for incentives to stay ... Again, a resounding NO

I then thanked the agent for is time and hung up.

Came into work and logged into AMEX website, got a notification that someone has invited me to apply for the AMEX Velocity card .. " <name> has invited you to apply for AMEX VElocity card blah blah"

Hmmm, interesting ... who would know that I was looking to sign up for a new AMEX Velocity card and the timing of the notification was like impeccable ... I finished the phone call and i the next 10 mins, I see an invitation to apply for the VERY SAME CARD ...

I called up the customer service again, in the hopes that the agent I spoke to has worked some magic and somehow got me an exemption to apply for the AMEX Velocity as existing customer and get the bonus points & SC ... but he confirmed that he didn't do any such thing AND reinforced the condition that the bonus points & SC are ONLY for NEW customers. He also said that the invitation came from someone I knew, but I don't know anyone by the name that appeared on the invitation ...

Anyways, long story short - no retention bonus, no exemptions to apply as existing customer & get bonus points & SC ... didn't get anything out of AMEX

UPDATE : As I have to do the expense anyways before Dec 2021, I applied for a Westpac Platinum Velocity card. Given I'm already a customer with Westpac, I was offered $100 off the annual fee (of $300) for the first year. This card comes with 120K (90K after attaining the spending limit in the first 3 months from the date of CC approval, remaining 30K after the first eligible transaction post 1st year anniversary for the card) bonus points after $4K spend in the first 3 months. Unsure if I will keep the card until such time to get the remaining 30K points, but happy (more like didn't have a choice) with this for now.

Called up AMEX today morning. Got through to someone in AU. I was told that the AMEX Velocity is only for NEW customers (those that have never had an AMEX before or at least not in the past 18 months, pretty standard response).

I then asked, if there is any offers for me, considering that I've been with AMEX Qantas Ultimate for the past 5 years, spending at least $30K each year ... was told, no, none at the moment. I could add a supplementary card holder and get 5K points, but I don't have anyone to add to my AMEX.

I then asked, if there is any retention offers for customers who have been with AMEX for over 5 years now and seeking for incentives to stay ... Again, a resounding NO

I then thanked the agent for is time and hung up.

Came into work and logged into AMEX website, got a notification that someone has invited me to apply for the AMEX Velocity card .. " <name> has invited you to apply for AMEX VElocity card blah blah"

Hmmm, interesting ... who would know that I was looking to sign up for a new AMEX Velocity card and the timing of the notification was like impeccable ... I finished the phone call and i the next 10 mins, I see an invitation to apply for the VERY SAME CARD ...

I called up the customer service again, in the hopes that the agent I spoke to has worked some magic and somehow got me an exemption to apply for the AMEX Velocity as existing customer and get the bonus points & SC ... but he confirmed that he didn't do any such thing AND reinforced the condition that the bonus points & SC are ONLY for NEW customers. He also said that the invitation came from someone I knew, but I don't know anyone by the name that appeared on the invitation ...

Anyways, long story short - no retention bonus, no exemptions to apply as existing customer & get bonus points & SC ... didn't get anything out of AMEX

UPDATE : As I have to do the expense anyways before Dec 2021, I applied for a Westpac Platinum Velocity card. Given I'm already a customer with Westpac, I was offered $100 off the annual fee (of $300) for the first year. This card comes with 120K (90K after attaining the spending limit in the first 3 months from the date of CC approval, remaining 30K after the first eligible transaction post 1st year anniversary for the card) bonus points after $4K spend in the first 3 months. Unsure if I will keep the card until such time to get the remaining 30K points, but happy (more like didn't have a choice) with this for now.

Last edited:

- Joined

- Oct 30, 2019

- Posts

- 82

- Qantas

- Silver

- Star Alliance

- Silver

Hello friends so a bit of an update from my conversation with a lovely person on the amex platinum hotline.

So it turns out yes, if you hold a charge card like me (I was calling up coz my annual fee just got charged haha) - if you request a cancellation, that's their unlock to "see if there are any offers" on the proverbial next screen of their computers. She said it a few times to get me to ask her to do it, and she also said charge cards can be reinstated right away, credit cards must be followed through with cancellation wise.

I know we talk about the cancellation dance, but hopefully this makes the dance more straightforward for those who hold the charge card.

Also, she was aware and could have offered my travel credits back as statement credits, but since I had actually managed to use mine here in Singapore... She was like oh darn well. 2022 ey. Let's hope you can use them then!

Also couldn't get any points as ... They could see the 200k I got last year and she suspects given my pretty much 0 spend since then (being in Singers) may have been a factor....

So it turns out yes, if you hold a charge card like me (I was calling up coz my annual fee just got charged haha) - if you request a cancellation, that's their unlock to "see if there are any offers" on the proverbial next screen of their computers. She said it a few times to get me to ask her to do it, and she also said charge cards can be reinstated right away, credit cards must be followed through with cancellation wise.

I know we talk about the cancellation dance, but hopefully this makes the dance more straightforward for those who hold the charge card.

Also, she was aware and could have offered my travel credits back as statement credits, but since I had actually managed to use mine here in Singapore... She was like oh darn well. 2022 ey. Let's hope you can use them then!

Also couldn't get any points as ... They could see the 200k I got last year and she suspects given my pretty much 0 spend since then (being in Singers) may have been a factor....

- Joined

- Mar 5, 2019

- Posts

- 3,594

- Qantas

- Platinum

- Virgin

- Platinum

How come this never happens to meOffered 30k Qantas points to keep the Qantas American Express Ultimate open.

I accepted

This was how it went -

Me - I'm considering cancelling as im not getting value from the card and would like to know if there's any offers available on my account to keep my card open?

Operator - I cant offer retention bonuses, let me tell you all the great reasons to keep this card

- A few mins of her explaining all the details of the card -

Me - Thankyou but none of those are valuable to me, please go ahead and cancel

Operator - Ok i will read through the cancellation terms and then you can ask me any questions once I finish before we cancel

- reads standard cancellation terms regarding balances and direct debits -

Do you have any questions?

Me - Are you sure there are no offers for me to keep the card?

Operator - Oh actually yes the computer has an offer for you of 30k Qantas points, would you like to keep the card?

Me - Is there any better offer on points or removing the annual fee?

Operator - let me check "insert hold music" No sorry that is the best offer. Would you like to keep the card or cancel?

Me - ok thanks, ill keep the card

Operator - ok great, the points will be in your account within 24hrs, you may get a cancellation email, just ignore it

Me - I'm considering cancelling as im not getting value from the card and would like to know if there's any offers available on my account to keep my card open?

Operator - I cant offer retention bonuses, let me tell you all the great reasons to keep this card

- A few mins of her explaining all the details of the card -

Me - Thankyou but none of those are valuable to me, please go ahead and cancel

Operator - Ok i will read through the cancellation terms and then you can ask me any questions once I finish before we cancel

- reads standard cancellation terms regarding balances and direct debits -

Do you have any questions?

Me - Are you sure there are no offers for me to keep the card?

Operator - Oh actually yes the computer has an offer for you of 30k Qantas points, would you like to keep the card?

Me - Is there any better offer on points or removing the annual fee?

Operator - let me check "insert hold music" No sorry that is the best offer. Would you like to keep the card or cancel?

Me - ok thanks, ill keep the card

Operator - ok great, the points will be in your account within 24hrs, you may get a cancellation email, just ignore it

- Joined

- Feb 23, 2015

- Posts

- 6,238

- Qantas

- Platinum 1

- Virgin

- Platinum

- Star Alliance

- Gold

did you call and ask for the card to be cancelled? If you don't mind, how did the conversation unfold?

I've had better results coming at it in a less direct fashion, something like:

I'm reviewing the credit cards I have open and feeling I don't get enough value from card xyz to justify the annual fee (mention any devals for your specific card or if it's travel oriented and you haven't been able to use the benefits). Could you please review my account and advise whether there are any offers to reward customer loyalty? and if not could you please let me know the procedure for closing the account?

knagelli

Established Member

- Joined

- Jul 26, 2019

- Posts

- 1,188

- Qantas

- Bronze

- Virgin

- Platinum

- Star Alliance

- Gold

I have tried that path but negative. Did not get any offers and was straight away asked to confirm if the card can be cancelled. I ended up keeping the card.feeling I don't get enough value from card xyz to justify the annual fee (mention any devals for your specific card or if it's travel oriented and you haven't been able to use the benefits).

Become an AFF member!

Join Australian Frequent Flyer (AFF) for free and unlock insider tips, exclusive deals, and global meetups with 65,000+ frequent flyers.AFF members can also access our Frequent Flyer Training courses, and upgrade to Fast-track your way to expert traveller status and unlock even more exclusive discounts!

AFF forum abbreviations

Wondering about Y, J or any of the other abbreviations used on our forum?Check out our guide to common AFF acronyms & abbreviations.

Currently Active Users

- Highway23

- satirical

- ccmcknz

- ScottHekking

- XWu

- Virgin Bart

- blacksultan

- Steady

- jb747

- RooFlyer

- Larko1

- AIRwin

- JimmyJ

- MacReady

- dylarr

- Flyfrequently

- Forg

- tgh

- Ansett

- AusFlyer57

- Harrison_133

- Scr77

- ramamba

- ausfox

- fifthfre

- ryhu

- stepheng

- Black Duck

- NoName

- frodo

- Doug_Westcott

- jase05

- N860CR

- dajop

- dk_73

- ncm

- flyingfan121

- US_Amex

- Fifa

- agrias

- ABC

- CaptJCool

- Brissy1

- TripleB

- Rich

- Stevo.1702

- jc123

- Vince Alfonzetti

Total: 1,097 (members: 59, guests: 1,038)