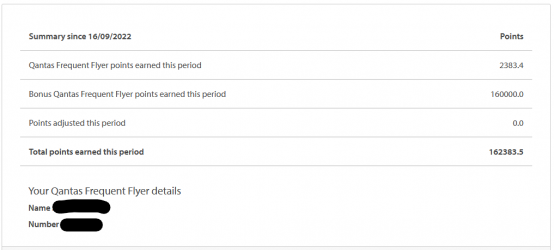

Do you need to wait for second year to get the extra 30K points (130K + 30K) as is the policy for the regular offer (100K + 30K)?

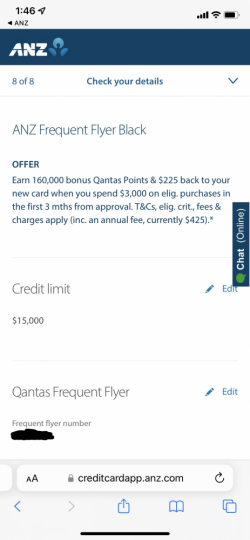

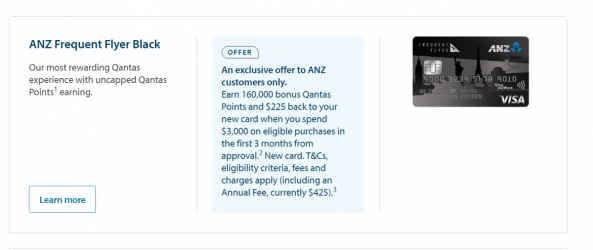

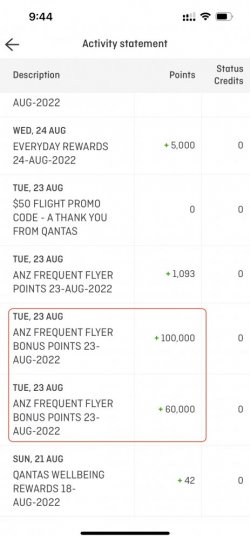

Will have to look at the screenshot I took when I get home (in case this occurred). But I took it as existing customer offer 160k in total after 3k spend.