You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Credit Card Offers CommBank Ultimate Awards Card: 100K award points – potentially fee free

- Thread starter Dr Ralph

- Start date

GSP

Established Member

- Joined

- Jun 17, 2016

- Posts

- 1,429

I haven't received any communication either, I'm not sure how it is supposed to work, and what if it is brought in intra month. I might give them a call next week if I have time.Given that August is only next month and I've had no communication from CBA, is there a chance that this 4k minimum spend rule doesn't apply to existing customers, or is that just wishful thinking?

Given that August is only next month and I've had no communication from CBA, is there a chance that this 4k minimum spend rule doesn't apply to existing customers, or is that just wishful thinking?

I just received an email from CBA about it.

On another topic, does anyone know if you change between CBA Awards & Qantas Awards multiple times in a year, are you charged the $30 (soon to be $60) fee every time you change to Qantas? Or if it's still in the same year will they waive the fee? Also if you changeover to Qantas points, are your existing points in CBA Awards also transferred over?

Received the same emailI just received an email from CBA about it.

On another topic, does anyone know if you change between CBA Awards & Qantas Awards multiple times in a year, are you charged the $30 (soon to be $60) fee every time you change to Qantas? Or if it's still in the same year will they waive the fee? Also if you changeover to Qantas points, are your existing points in CBA Awards also transferred over?

astrosly

Active Member

- Joined

- Mar 4, 2013

- Posts

- 878

Apparently the Ultimate card is now fee free with the Wealth Package. Discovered when I was looking around in Netbank to lock the card before cancelling it and found had secretly been added as an account to the WPackage on 13-Jul-2023.

The email today about Ultimate card also doesn't communicate this change. Called CBA and spoke to 4 people who didn't know/couldn't confirm anything/conflicting information, such as one person said "oh that was just changed this week" to another "Ultimate has always been listed as fee free on Wealth Package". OK, why weren't customers advised of changes to the WPackage product which you are obliged to do? "Ummm, changes are advised on statements" - but I've checked those and nothing about the card being fee free with WPackage and, er, you don't get a 'statement' with the WPackage. Useless.

Anyway, with a bit of digging and raising two complaints (one that you did not advise customers of changes to their products, another that it cost me an annual fee on opening another credit card to replace Ultimate because such changes were not published or communicated to customers) I found out that

(a) yes they did change the WPackage effective 14 July so the Ultimate is an included benefit (because before then only annual fee CCs were included);

(b) now that the bank had attached the card to my WPackage last week without notice Iwon't shoudn't be charged the fee at the end of this month if spend not met

The email today about Ultimate card also doesn't communicate this change. Called CBA and spoke to 4 people who didn't know/couldn't confirm anything/conflicting information, such as one person said "oh that was just changed this week" to another "Ultimate has always been listed as fee free on Wealth Package". OK, why weren't customers advised of changes to the WPackage product which you are obliged to do? "Ummm, changes are advised on statements" - but I've checked those and nothing about the card being fee free with WPackage and, er, you don't get a 'statement' with the WPackage. Useless.

Anyway, with a bit of digging and raising two complaints (one that you did not advise customers of changes to their products, another that it cost me an annual fee on opening another credit card to replace Ultimate because such changes were not published or communicated to customers) I found out that

(a) yes they did change the WPackage effective 14 July so the Ultimate is an included benefit (because before then only annual fee CCs were included);

(b) now that the bank had attached the card to my WPackage last week without notice I

mswindells

Junior Member

- Joined

- Jan 15, 2020

- Posts

- 14

- Qantas

- Qantas Club

- Virgin

- Silver

Apparently the Ultimate card is now fee free with the Wealth Package. Discovered when I was looking around in Netbank to lock the card before cancelling it and found had secretly been added as an account to the WPackage on 13-Jul-2023.

The email today about Ultimate card also doesn't communicate this change. Called CBA and spoke to 4 people who didn't know/couldn't confirm anything/conflicting information, such as one person said "oh that was just changed this week" to another "Ultimate has always been listed as fee free on Wealth Package". OK, why weren't customers advised of changes to the WPackage product which you are obliged to do? "Ummm, changes are advised on statements" - but I've checked those and nothing about the card being fee free with WPackage and, er, you don't get a 'statement' with the WPackage. Useless.

Anyway, with a bit of digging and raising two complaints (one that you did not advise customers of changes to their products, another that it cost me an annual fee on opening another credit card to replace Ultimate because such changes were not published or communicated to customers) I found out that

(a) yes they did change the WPackage effective 14 July so the Ultimate is an included benefit (because before then only annual fee CCs were included);

(b) now that the bank had attached the card to my WPackage last week without notice Iwon'tshoudn't be charged the fee at the end of this month if spend not met

Thanks for this, I just had a look (had to logon to Netbank via PC, not on the App) and it appears my Ultimate has also been added to my Wealth Package as at 13 July 23. So I'd say its automatically been done for everyone.

Which is ok, except would have been good to have been told! Because that definitely makes it better / worthwhile keeping the card (noting I only changed over from Diamond to Ultimate in like April this year before going overseas).

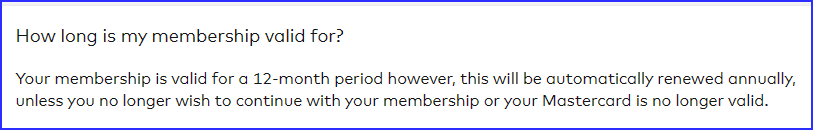

and maybe, just maybe if a person was to switch from Ultimate, to Smart, and then later back to Ultimate again, might reset the Dragonpass qualification. If it doesnt work, like if CBA doesnt change the card number, then sometime after 12 months we could just affect the swap before we go on holidays, and change back later.From the FAQ of the Mastercardtravelpass, it appears to be 12 months from activation.

View attachment 336645

Also on a different subject, i just analysed one months statement and compared past Ultimate Points earn to New Smart points earn, and i get 250 more points with the latter - . Mostly on account of the bonus double points on the single highest value transaction, that would have only earned 1 point under Smart Awards.

On another topic, does anyone know if you change between CBA Awards & Qantas Awards multiple times in a year, are you charged the $30 (soon to be $60) fee every time you change to Qantas? Or if it's still in the same year will they waive the fee? Also if you changeover to Qantas points, are your existing points in CBA Awards also transferred over?

Anyone?

i read somewhere in the fine print you are charged the Qantas fee when you join the program, so if you join twice in 6 months then you pay twice. Seems like a pointless exercise to flip back and forth anyway.Anyone?

I still haven't heard anything. My statement is due tomorrow, so I'm guessing it will be on tomorrow's statement, but if not, they're leaving it very late...Given that August is only next month and I've had no communication from CBA, is there a chance that this 4k minimum spend rule doesn't apply to existing customers, or is that just wishful thinking?

I have my home loan with CBA and have been using the free Diamond card for a long while. Found this thread early this week mentioned about Ultimate card is now free as part of the wealth package, I did the card switch online and now the new Ultimate card is on the way.

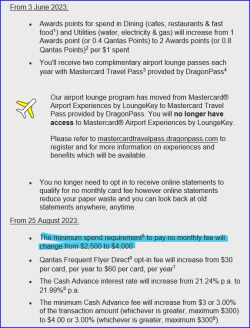

I have the Ultimate card and received an email on 18 July advising of the changes:I still haven't heard anything. My statement is due tomorrow, so I'm guessing it will be on tomorrow's statement, but if not, they're leaving it very late...

"Your new spend criteria will apply to fees being assessed from 25 August 2023. You need to spend at least $4,000 in the statement period to pay no monthly fee from 25 August 2023."

There was no mention of the changes on the latest statement.

Thanks.I have the Ultimate card and received an email on 18 July advising of the changes.

No email yet for me.

Will report back when I get my statement if it is mentioned in the statement or email notification.

I also finally received the email on 18th July advising of the changes

I just got my statement (for the period to 21 July) today (25th July).

Still no notice in the statement, the covering email, or Netbank notices.

My next statement won't arrive until the 25th of August.

Very odd.

I can't imagine that they're not going to raise my threshold, but they're very slow to advise me.

I applied for the Ultimate Awards, conditionally approved for 16k after putting income and expenses. I only wanted 6k limit so thats all i asked for. Application got declined and after querying at the branch, i found out someone had mistakenly coded my home loan as sole owner instead of joint, and that i have an Amex card with few k’s limit (which i am secondary cardholder so it shouldnt even be there!). The branch staff fixed the coding and resubmitted the Application. Card granted the next day. So just be aware and go to branch to ask why, if your application gets rejected. I dont really trust those at call centre, mostly got inexperienced people.

Btw they almost cost me my credit score for nothing , so i made a complaint just so they are aware of the issue.

Btw they almost cost me my credit score for nothing , so i made a complaint just so they are aware of the issue.

Become an AFF member!

Join Australian Frequent Flyer (AFF) for free and unlock insider tips, exclusive deals, and global meetups with 65,000+ frequent flyers.AFF members can also access our Frequent Flyer Training courses, and upgrade to Fast-track your way to expert traveller status and unlock even more exclusive discounts!

AFF forum abbreviations

Wondering about Y, J or any of the other abbreviations used on our forum?Check out our guide to common AFF acronyms & abbreviations.

Currently Active Users

- Junior royal

- jrfsp

- Larko1

- pauly7

- WeeWillyWonka

- justinbrett

- OZDUCK

- DejaBrew

- mattr00

- love_the_life

- Bundy Bear

- Zinger

- RB001

- WrenchHammerMcTool

- Austman

- ghinx

- Harrison_133

- jc123

- Doug_Westcott

- highlyexplosivebomb

- NoName

- Virgin Bart

- bablong

- zig

- marquisite

- Brissy1

- Wing Nut

- Stacycrow

- markis10

- larry40

- #flying

- snooze

- flyingfan

- Le_Champion

- Black Duck

- gaz0303

- Happy Trails

- Scr77

- kpc

- drmatte

- copperman

- Human

- AIRwin

- servicerequired

- carwashhair

- Cottman

Total: 485 (members: 54, guests: 431)