TJM

Junior Member

- Joined

- Jun 16, 2019

- Posts

- 14

- Qantas

- Platinum

- Virgin

- Platinum

Did other ff see this petition?

Yes, getting FF support is a debacle.

The WA border was not open until March 3 and therefore I could not take xx_XX with the double status credits until after that day and the original routing MEL-ADL-PER return in business with double status points is NOT SHOWING.

Elaine Denise emailed me to contact her which I did by phoning 131313.....five times now.

I tried to follow up on errors in the status credit activity

I called the FF Help Centre today - this was the fifth call to address screenshots showing incorrect status credits.

My anniversary ended on 31 March - starts on April 1 but was renewed on 23 April.

I am not confident with phone consultations without follow up verification by email.

(1) 2054 EXPIRED STATUS CREDITS - not 1854 ;

(2) no STATUS SUPPORT - STATUS CREDIT ROLLOVER;

(3) DOUBLE STATUS CREDITS OFFER NOT HONORED [BORDER WAS CLOSED] - the original routing MEL-ADL-PER return in business with double status points is NOT SHOWING.

(4) GREEN TIER INACCURACIES

(4) FF OFFICE SHOWING DIFFERENT ACTIVITIES TO MY WEB BROWSER AND TELLING ME I'M WRONG

WHO DO YOU GO TO OTHER THAN ANOTHER PROVIDER?

Oh the humanity for the thousands who do it every day (now borders are relaxed)Will only get worst, imagine being squshed in a J seat, or a Y seat on their new ordered 321neo/220 on a dom flight.

PER - SYD/MEL/BNE, vv.

TJM, if you follow the musings on here, and on other parts of the media, your expectations of QF are too high.

Over the years, I joined QFF in 1997, they have enhanced, but they see it as enchancement/improvements over many different facets.

Unless it affects AJ himself, you won't get anywhere with QF/QFF.

Over the years, all they do, QF that is, do is to effectively reduce costs, and keep the funds they do have, but not admitting it.

See it this way, you are a WP with QF, which is one of the higher grade, if your query couldn't be dealt with, without personal intervention from on high, what hope have you got.

They are reducing the ability to print BP at the airport, reducing cost.

They are getting rid over time of their 330 from dom ops, reducing cost.

They are closing service desks at dom counters at Aust airports, reducing cost.

They have outsourced a lot of things, (ground handling, flights to Alliance, catering, call centres, even (most likely) aircraft cleaning, all reducing cost.

No plastic membership card, apart from the QTMC, reducing cost.

Years ago, flying ADL - SYD/BNE earned 15 QFF SC, but now only 10, ie, also reducing cost.

Will only get worst, imagine being squshed in a J seat, or a Y seat on their new ordered 321neo/220 on a dom flight.

PER - SYD/MEL/BNE, vv.

Well, I'm sure the 220 will be an improvement over the 717.Will only get worst, imagine being squshed in a J seat, or a Y seat on their new ordered 321neo/220 on a dom flight.

PER - SYD/MEL/BNE, vv.

It hasn't been open for arrivals for at least 20 years or ever really.It does not remain open for any QF arrivals that are later. So yes, bad luck for anyone arriving on QF later and wanting to sort out a QF disruption of any kind.

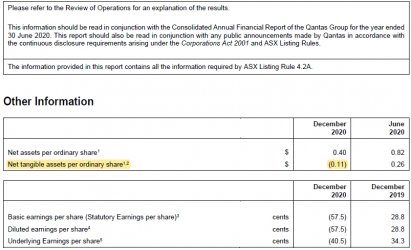

On Monday at the Q media conference it was reported that AJ stated (as I posted around that time and was 'criticised' for making things up) that in mid 2020 Q was just 9 weeks from going bankrupt.The alternative is the airline doesn't reduce costs, can't pay its bills, and goes into administration.

AFF Supporters can remove this and all advertisements