I think they mean the actual hotel, which is the service provider?On the booking confirmation email I received, all it states is Qantas, no 2nd party provider, so I am getting the feeling I am being fobbed off. Will reply to their email and advise outcome.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Qantas Hotels no longer supplying Tax Invoices

- Thread starter Bindibuys

- Start date

Bindibuys

Established Member

- Joined

- Jul 5, 2011

- Posts

- 1,933

- Qantas

- Gold

- Virgin

- Silver

Got same email today, except they acknowledged that tax invoice supplied by hotel was incorrect and they have asked Expedia to arrange for correct invoices to be sent to us.Got another email today from Qantas............

Thank you for your email. Qantas Hotels and Holidays is not itself the accommodation provider and, as set out in our terms and conditions, the goods and services are provided by the accommodation provider set out in your booking.

Qantas Hotels is acting as agent for the service provider and your agreement in respect of the accommodation is made with the accommodation provider. In these circumstances either party (supplier or its agent) can issue a tax invoice. In the case of Expedia sourced properties, Expedia has required that the hotel is to issue tax invoices in respect of the accommodation services.

May I ask whether you require a actual tax invoice, or is a simple payment receipt required in this situation?......................

On the booking confirmation email I received, all it states is Qantas, no 2nd party provider, so I am getting the feeling I am being fobbed off. Will reply to their email and advise outcome.

Yes but what is ‘correct’? If that’s what they received from Expedia then I’m sure many would argue the invoice correctly what they received (from Expedia, not the customer). If Expedia has received the full amount and then paid the hotel less I think a pretty good case could be made that it’s Expedia that should issue the invoice.Got same email today, except they acknowledged that tax invoice supplied by hotel was incorrect and they have asked Expedia to arrange for correct invoices to be sent to us.

- Joined

- Jul 22, 2008

- Posts

- 1,244

- Qantas

- Platinum

- Oneworld

- Emerald

There is a difference between the settlement of net funds, and the accounting involved. What the hotel received from Expedia is the net - but not what they should be invoicing the customer.If that’s what they received from Expedia then I’m sure many would argue the invoice correctly what they received (from Expedia, not the customer)

In the case of the customer, they should receive the invoice from the hotel for the full amount they paid. Qantas / Expedia is acting as agent, and is paid a commission by the hotel. The fact that they have an arrangement to keep their commission portion and only settle the net with the hotel doesn't change that position.

The agent in theory invoices the hotel, and the hotel pays the commission. This could become important from a GST perspective. As a registered supplied in Australia, the hotel would pay GST on the full amount the customer paid (so 1/11 of the payment is GST). The tax invoice needs to show this, and a business will claim this GST back as an input credit (offset against the GST they pay). The agent would invoice the hotel - but if the Agent is Expedia and offshore, then there would be no GST component in that invoice. The total GST paid by the customer (and sent by the hotel to the ATO) still remains the same, but the hotel doesn't get to claim back 1/11 of the commission as GST, making the commission effectively more expensive to the hotel.

This is how it would work in a perfect world, just like how you pay the insurance company, insurance invoice you full amount, then they sort out the rebate they have to pay the broker.There is a difference between the settlement of net funds, and the accounting involved. What the hotel received from Expedia is the net - but not what they should be invoicing the customer.

In the case of the customer, they should receive the invoice from the hotel for the full amount they paid. Qantas / Expedia is acting as agent, and is paid a commission by the hotel. The fact that they have an arrangement to keep their commission portion and only settle the net with the hotel doesn't change that position.

However, it is simply impossible in the real world, with small hotels around the world, they would not have the software / tech nor the knowledge to suit every jurisdiction on this planet.

Freq Flier 2013

Active Member

- Joined

- Apr 14, 2013

- Posts

- 698

Each hotel should have the correct knowledge and invoice the gross amount based on local laws.This is how it would work in a perfect world, just like how you pay the insurance company, insurance invoice you full amount, then they sort out the rebate they have to pay the broker.

However, it is simply impossible in the real world, with small hotels around the world, they would not have the software / tech nor the knowledge to suit every jurisdiction on this planet.

No business should invoice a $$ net of commissions.

Herein lies the problem. If, as you suggest, the agent invoices the hotel for the commission then the transaction for the customer should be for the full amount and the commission transaction is separate.

The fact that the amount on the invoice is not the same as what the customer paid suggests there are two transactions customer-agent (includes commission), and agent-hotel (excludes commission). If this is the case the first transaction is the one that should be invoiced and the hotel is not a party to that transaction!

Of course in other cases the transaction may proceed as you suggest but then invoice amount should match as commission not yet deducted.

The fact that the amount on the invoice is not the same as what the customer paid suggests there are two transactions customer-agent (includes commission), and agent-hotel (excludes commission). If this is the case the first transaction is the one that should be invoiced and the hotel is not a party to that transaction!

Of course in other cases the transaction may proceed as you suggest but then invoice amount should match as commission not yet deducted.

Yes, you try that in some third world country like Kazakhstan, or where tax evasion brings pride and social standing to your family like Italy or Greece.Each hotel should have the correct knowledge and invoice the gross amount based on local laws.

No business should invoice a $$ net of commissions.

Don't even worry about the other posts on discrepancies in this thread.

- Joined

- Jul 22, 2008

- Posts

- 1,244

- Qantas

- Platinum

- Oneworld

- Emerald

However, it is simply impossible in the real world, with small hotels around the world, they would not have the software / tech nor the knowledge to suit every jurisdiction on this planet.

Don't even worry about the other posts on discrepancies in this thread.

I don't think it is a software or knowledge issue - it is more that Expedia and the like are deliberately muddying the waters. If the seller is indeed acting as an agent, then the hotel most certainly should know the amount the customer has been charged. The fact that the agent settles net would be less to do with software / tech of the hotel to handle it than it is a lack of trust that the hotel would actually pay them.

Where it gets really muddy is that those aggregators are not always necessarily acting as you would expect a true agent to. In some cases they are actually "buying" the rooms from the hotel (or guaranteeing to sell a certain number, which amounts to much the same in a practical sense) at a set rate - then selling them for rates they set themselves. This is why sometime you can find rooms available on booking.com or the like where the hotel direct is claiming to be fully booked.

In these cases, they may not actually be telling the hotel how much they actually charged the customer (it may be a huge margin, but if they had a hard job moving the last rooms, it may actually be less than they committed to pay the hotel. It would make sense in these cases for the agent to issue the invoice (which they can do), but if they choose not to (which they are doing), then they have to tell the hotel (principal) what they charged the customer on behalf of them.

I had the same issue. Needed a tax invoice for work. Booking.com would not issue one as they do not have an ABN. The hotel initially said booking.com had to issue, but booking.com website clearly states the hotel had to invoice. In the end the hotel did an invoice, but not for the whole amount, as they didn’t get my whole payment. I think the government missed out on a bit of GST….Yes but what is ‘correct’? If that’s what they received from Expedia then I’m sure many would argue the invoice correctly what they received (from Expedia, not the customer). If Expedia has received the full amount and then paid the hotel less I think a pretty good case could be made that it’s Expedia that should issue the invoice.

Does Expedia have an ABN?I wonder if it depends if the booking goes through Expedia or that other Qantas-owned company that handles some of their Australian hotels

- Joined

- Jul 22, 2008

- Posts

- 1,244

- Qantas

- Platinum

- Oneworld

- Emerald

The only thing in all of this that the ATO would actually be interested in is the hotels issuing tax invoices for just what they were paid by Expedia, and stating that GST was only 1/11th of that amount, rather than 1/11th of the total including commission. If Expedia are actually acting through an offshore entity (there are certainly Australian Expedia entities that are registered for GST), and not paying GST on their portion, then the GST is being underpaid.

Given Expedia are not issuing tax invoices (to the end customer), then they are not necessarily including an ABN so that you actually know which entity within the group you are dealing with (if they were issuing a tax invoice, it would be required to have an ABN, but a receipt from an offshore entity has no such requirement).

Given Expedia are not issuing tax invoices (to the end customer), then they are not necessarily including an ABN so that you actually know which entity within the group you are dealing with (if they were issuing a tax invoice, it would be required to have an ABN, but a receipt from an offshore entity has no such requirement).

- Joined

- Jul 22, 2008

- Posts

- 1,244

- Qantas

- Platinum

- Oneworld

- Emerald

This is where the ATO would be interested as GST is being underpaid. The hotel needs to issue the invoice for the full amount you paid if booking.com is acting as an agent and not issuing a tax invoice.I had the same issue. Needed a tax invoice for work. Booking.com would not issue one as they do not have an ABN. The hotel initially said booking.com had to issue, but booking.com website clearly states the hotel had to invoice. In the end the hotel did an invoice, but not for the whole amount, as they didn’t get my whole payment. I think the government missed out on a bit of GST….

There are many Expedia entities. There is indeed an Expedia Inc ABN 25 138 063 573, registered for GST, as well as Expedia Australia Pty Ltd ABN 12 101 694 946 also registered for GST. Booking,.com (Australia) Pty Ltd ABN 14 130 562 097 is also registered for GST.Does Expedia have an ABN?

But as you haven't neem supplied a Tax Invoice with an ABN, you have no idea which entity they have actually run the booking through - most likely an offshore subsidiary that is not registered for GST. This would all be fine if the hotel issued the invoice correctly for the full amount.

This all only applies if the booking site is indeed acting as an agent. If they are not, and they are buying the room from the hotel and reselling it to you, then as an Australian supply, they would need to be registered for GST, charge it and supply you a Tax invoice. As they are not, and are trying to use the agent arrangements to avoid them paying the GST, they need to disclose the correct amounts to the hotels, which need to issue the correct tax invoices for the full amount their agent collected on their behalf.

Last edited:

30% of my payment was “missing”, so that’s exactly what the hotel did, issue an invoice for what they were only paid. If these international companies do this to all bookings. The ATO is missing out on millions of unpaid GSTThe only thing in all of this that the ATO would actually be interested in is the hotels issuing tax invoices for just what they were paid by Expedia, and stating that GST was only 1/11th of that amount, rather than 1/11th of the total including commission. If Expedia are actually acting through an offshore entity (there are certainly Australian Expedia entities that are registered for GST), and not paying GST on their portion, then the GST is being underpaid.

Given Expedia are not issuing tax invoices (to the end customer), then they are not necessarily including an ABN so that you actually know which entity within the group you are dealing with (if they were issuing a tax invoice, it would be required to have an ABN, but a receipt from an offshore entity has no such requirement).

Post automatically merged:

This is where the ATO would be interested as GST is being underpaid. The hotel needs to issue the invoice for the full amount you paid if booking.com is acting as an agent and not issuing a tax invoice.

Attachments

- Joined

- Jul 22, 2008

- Posts

- 1,244

- Qantas

- Platinum

- Oneworld

- Emerald

30% of my payment was “missing”, so that’s exactly what the hotel did, issue an invoice for what they were only paid. If these international companies do this to all bookings. The ATO is missing out on millions of unpaid GST

Post automatically merged:

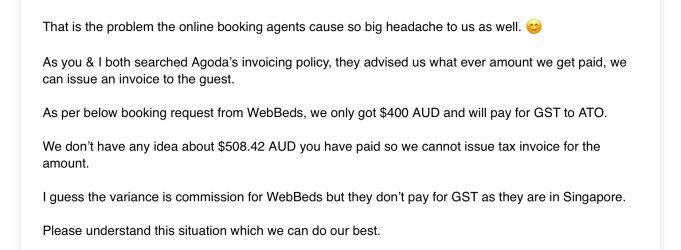

Reading the attachment, "web beds" is causing GST to be avoided. If they are acting as an agent, then they don't have to be registered for GST - but they must disclose to the principal the full amount collected so that a correct invoice can be issued and the correct GST charged.

If they are not acting as an actual agent (in the legal sense) but are the principal (reselling the room), then they would be obliged to be registered for GST.

Read our AFF credit card guides and start earning more points now.

AFF Supporters can remove this and all advertisements

I don’t even know who web beds are , I booked with booking.comReading the attachment, "web beds" is causing GST to be avoided. If they are acting as an agent, then they don't have to be registered for GST - but they must disclose to the principal the full amount collected so that a correct invoice can be issued and the correct GST charged.

If they are not acting as an actual agent (in the legal sense) but are the principal (reselling the room), then they would be obliged to be registered for GST.

Post automatically merged:

Who is the principle? Booking.com or the Hotel?Reading the attachment, "web beds" is causing GST to be avoided. If they are acting as an agent, then they don't have to be registered for GST - but they must disclose to the principal the full amount collected so that a correct invoice can be issued and the correct GST charged.

If they are not acting as an actual agent (in the legal sense) but are the principal (reselling the room), then they would be obliged to be registered for GST.

I never got a full tax invoice

Which they are not even doing.they must disclose to the principal the full amount collected so that a correct invoice can be issued and the correct GST charged.

Funny how they could spend time on international tax, but couldn't be bothered with local compliance.I don’t even know who web beds are , I booked with booking.com

- Joined

- Jul 22, 2008

- Posts

- 1,244

- Qantas

- Platinum

- Oneworld

- Emerald

Well it certainly isn't Booking.comWho is the principle? Booking.com or the Hotel?

If you go to the booking.com How We Work buried in the very small links at the bottom you will find

We make it easy for you to compare Bookings from many hotels, property owners and other Service Providers.

When you make a Booking on our Platform, you enter into a contract with the Service Provider (unless otherwise stated).

So booking.com is relying on being an Agent.We don’t buy or (re-)sell any products or services. Once your stay is finished, the Service Provider simply pays us a commission.

It now gets really murky. Note that they work with "Service Providers" as well as hotels. If you search for WebBeds, you will find that this is a part of Webjet - and it is

So the hotel presumably has some sort of contract with WebBeds who in turn are listed on booking.com. WebBeds looks like it is also an intermediary. As they claimAs an intermediary, we source inventory from travel suppliers, connect, aggregate and merchandise that content in our platform, the WebBeds Marketplace, and distribute it to our global network of travel trade buyers, who sell to the travelling public

It appears that they are also strictly an agent (as they would wish to be).Control your rates.

You control the channels, with real-time oversight and flexibility over rates and inventory through our extranet or channel manager integrations. We will support you in extranet loading & management of static rates, offers and stop sales.

It is most likely the Hotel itself is the principal here.

The attachment you included mentioned Agoda which is another brand / subsidiary of booking.com

You have not mentioned whether the hotel is part of a chain or an independent. The issue may well be that the individual hotel doesn't see the whole picture, or is not privy to the commission or rate structure, but it is likely that someone in the hotel hierarchy is - and that information needs to make its way to those that are responsible for creating tax invoices as well as those that should be responsible for accounting for GST, as they don't appear to be aware that it appears that the hotel is not properly meeting its obligations to supply accurate tax invoices (and pay the right amount of GST). This impacts on the ability of customers to correctly fulfill their own GST obligations.

- Joined

- Jul 22, 2008

- Posts

- 1,244

- Qantas

- Platinum

- Oneworld

- Emerald

For a bit of light relief, the following is part of the booking,.com Supplier Code of Conduct

At all times, business is to be conducted in a manner such that the opportunity for, and incidence of, tax evasion is prevented. Furthermore, any individual or an incorporated or unincorporated body who performs services for or on behalf of our organization must not undertake any transactions which: causes Booking Holdings and/or its subsidiaries to commit a tax evasion offense; or facilitate tax evasion offenses by a third party, who is not a person associated with Booking Holdings.

Freq Flier 2013

Active Member

- Joined

- Apr 14, 2013

- Posts

- 698

Amanzon works in a similar way. Amazon vendor buys the products from the company and sells it at what ever price it wants. Amazon normal is just a selling platform on behalf of the company. Yet it all works perfectly well with no issues. Not sure why Qantas / Expedia can’t get it right.

Become an AFF member!

Join Australian Frequent Flyer (AFF) for free and unlock insider tips, exclusive deals, and global meetups with 65,000+ frequent flyers.AFF members can also access our Frequent Flyer Training courses, and upgrade to Fast-track your way to expert traveller status and unlock even more exclusive discounts!

AFF forum abbreviations

Wondering about Y, J or any of the other abbreviations used on our forum?Check out our guide to common AFF acronyms & abbreviations.

Currently Active Users

- MH_fan

- aus_flyer

- Welsh-Kiwi

- sudoer

- Mur@no70

- AIRwin

- accompanimince

- _TheTraveller_

- Cessna 180

- tigertraveller

- mimosa1

- comehither

- mcbling

- kwailurk

- justinbrett

- wentworthmeister

- ryanmc

- BCons

- flyingsal

- offshore171

- Oubline

- Scr77

- blackcat20

- Mutilla2

- hydrabyss

- Omgwtfitsbbqsauce

- Pete Ramsay

- akky

- dairyfloss

- larry40

- mitti

- Pele

- Rugby

- ChrisW.

- Oscarq

- Harry_Moses

- martindagun

- butters_1313

- ksthommo

Total: 694 (members: 46, guests: 648)