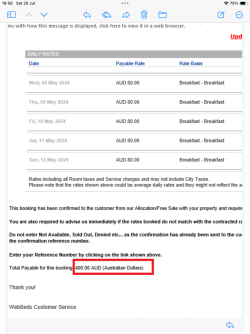

It’s not part of a chain. They gave me a tax invoice, for only the payment they received. They see whole picture, they didn’t see the amount of money I paid booking.coWell it certainly isn't Booking.com

If you go to the booking.com How We Work buried in the very small links at the bottom you will find

So booking.com is relying on being an Agent.

It now gets really murky. Note that they work with "Service Providers" as well as hotels. If you search for WebBeds, you will find that this is a part of Webjet - and it is

So the hotel presumably has some sort of contract with WebBeds who in turn are listed on booking.com. WebBeds looks like it is also an intermediary. As they claim

It appears that they are also strictly an agent (as they would wish to be).

It is most likely the Hotel itself is the principal here.

The attachment you included mentioned Agoda which is another brand / subsidiary of booking.com

You have not mentioned whether the hotel is part of a chain or an independent. The issue may well be that the individual hotel doesn't see the whole picture, or is not privy to the commission or rate structure, but it is likely that someone in the hotel hierarchy is - and that information needs to make its way to those that are responsible for creating tax invoices as well as those that should be responsible for accounting for GST, as they don't appear to be aware that it appears that the hotel is not properly meeting its obligations to supply accurate tax invoices (and pay the right amount of GST). This impacts on the ability of customers to correctly fulfill their own GST obligations.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Qantas Hotels no longer supplying Tax Invoices

- Thread starter Bindibuys

- Start date

- Joined

- Jul 22, 2008

- Posts

- 1,244

- Qantas

- Platinum

- Oneworld

- Emerald

They are not seeing the whole picture then are they?They see whole picture, they didn’t see the amount of money I paid booking.co

oz_mark

Enthusiast

- Joined

- Jun 30, 2002

- Posts

- 22,058

It's one thing seeing the full picture, but they can only generate a tax invoice that shows what they receive from their.point of view and their GST liability.They are not seeing the whole picture then are they?

moa999

Enthusiast

- Joined

- Jun 23, 2003

- Posts

- 13,595

exactly..shows what they receive from their.point of view and their GST liability.

If they (Qantas/ Expedia/ Booking) want to push you to the accomodation provider then the hotel needs to supply you with an invoice for what you actually pay, and then the booking agent needs to separately collect from the accommodation provider (who will then get a gst credit)

That’s what they didIt's one thing seeing the full picture, but they can only generate a tax invoice that shows what they receive from their.point of view and their GST liability.

Post automatically merged:

They couldn’t do it. They had no idea how much I paid.exactly..

If they (Qantas/ Expedia/ Booking) want to push you to the accomodation provider then the hotel needs to supply you with an invoice for what you actually pay, and then the booking agent needs to separately collect from the accommodation provider (who will then get a gst credit)

Post automatically merged:

It’s the only picture they seeThey are not seeing the whole picture then are they?

Attachments

moa999

Enthusiast

- Joined

- Jun 23, 2003

- Posts

- 13,595

Totally agreed.They couldn’t do it. They had no idea how much I paid.

Which shows that they are not acting as booking "agent".

I agree, if they issue an invoice that does not actually reflect the transaction they have entered into that would on the face of it be close to being fraudulent and also not agree with the GST they then pay which would undoubtedly eventually cause concerns with the ATO.It's one thing seeing the full picture, but they can only generate a tax invoice that shows what they receive from their.point of view and their GST liability.

I think what’s causing confusion here is that there are clearly two models in play.

Model 1

The OTA charges the customer $100 but only remits $95 to the hotel.

Transaction 1 between OTA and customer for $100.

Transaction 2 between OTA and hotel for $95.

In this scenario the only transaction involving the customer is Transaction 1 so OTA needs to issue an invoice.

Model 2

The OTA charges the customer $100 and remits $100 in full to the hotel.

Transaction 1 between the customer and OTA for $100 but this is passed in full to the hotel.

Transaction 2 for the commission of $5 between the OTA and hotel.

In this situation then yes, either the OTA or the hotel can issue the invoice.

But in scenario 1 (which it appears is common) the hotel can only issue an invoice that reflects the actual transaction, and it also should be noted the other party in the transaction is actually with the OTA not the customer.

- Joined

- Jul 22, 2008

- Posts

- 1,244

- Qantas

- Platinum

- Oneworld

- Emerald

What they receive and their GST liability are not necessarily the same, as in this case. It is the difference between cash and accrual accounting. What they are receiving is the net of a more than one theoretical transaction - and the components need to be teased out. The Tax Invoice needs to reflect the "transaction" for the supply to the customer, removing the theoretical transaction between the principal and agent.generate a tax invoice that shows what they receive from their.point of view and their GST liability.

The claim to be - but they are withholding information from their principal if they do not disclose the full picture. This is where the "agents" are going to get into trouble with the Australian tax authorities. Whilst you may question the ethics of subsidiaries of Australian companies transacting online business through foreign jurisdictions for tax reasons, it is not illegal. There are specific rulings about agent relationships they are trying to take advantage of, but they will find themselves in a bit of trouble if they are deliberately (especially for commercial reasons) withholding information to which the principal is not only entitled, but needs in order to comply with their accounting and tax obligations.Which shows that they are not acting as booking "agent".

The OTA claims they are not a party to any transaction with the customer (they are only party to a transaction with the hotel for their commission). Even though the net is remitted, there are still two transactions, and the hotel needs to generate the invoice for the underlying transaction between the customer and the hotel.But in scenario 1 (which it appears is common) the hotel can only issue an invoice that reflects the actual transaction, and it also should be noted the other party in the transaction is actually with the OTA not the customer

If you take this multiple transactions part to the limit, what is the situation if the customer pays with a credit card? They don't actually pay the hotel at all. Should the hotel be making the invoice out to their merchant acquirer (could be a bank or Amex etc.) because they actually make the payment? The parties in this transaction would be customer pays (eventually) the issuer of their card, issuer of the card settles with the card scheme provider, card scheme provider settles with the acquirer who provides the merchant facility to the hotel, and that acquirer then pays the hotel. Nobody expects the invoice to follow that chain, and likewise, the hotel needs to remove the OTA and their "commission" from what appears on the invoice they are required to generate. The proposition that the hotel should only generate a Tax Invoice for the net amount they actually receive from an OTA is wrong.

- Joined

- Jul 22, 2008

- Posts

- 1,244

- Qantas

- Platinum

- Oneworld

- Emerald

It would be really interesting to know what justification Expedia gave to Qantas to ask them to stop issuing tax invoices.

The real irony in all of this is that Qantas would have been issuing the correct tax invoice - showing the amount of GST that should be being paid by the hotel.

I have a sneaky suspicion that the reason Expedia have asked Qantas to stop issuing correct tax invoices is that they know that the hotels are not paying the correct amount of GST because they are not passing on enough information to allow them to do so. They want to retain the ability to route the transactions through a foreign jurisdiction without needing to register for or pay GST by asserting that they are only an agent, but don't want to fulfill all the obligations of being an agent by disclosing the full details of the transactions they perform to the relevant principal.

The real irony in all of this is that Qantas would have been issuing the correct tax invoice - showing the amount of GST that should be being paid by the hotel.

I have a sneaky suspicion that the reason Expedia have asked Qantas to stop issuing correct tax invoices is that they know that the hotels are not paying the correct amount of GST because they are not passing on enough information to allow them to do so. They want to retain the ability to route the transactions through a foreign jurisdiction without needing to register for or pay GST by asserting that they are only an agent, but don't want to fulfill all the obligations of being an agent by disclosing the full details of the transactions they perform to the relevant principal.

oz_mark

Enthusiast

- Joined

- Jun 30, 2002

- Posts

- 22,058

The case where a customer is paying at the hotel is non-controversial. The hotel provides a tax invoice.If you take this multiple transactions part to the limit, what is the situation if the customer pays with a credit card? They don't actually pay the hotel at all. Should the hotel be making the invoice out to their merchant acquirer (could be a bank or Amex etc.) because they actually make the payment? The parties in this transaction would be customer pays (eventually) the issuer of their card, issuer of the card settles with the card scheme provider, card scheme provider settles with the acquirer who provides the merchant facility to the hotel, and that acquirer then pays the hotel. Nobody expects the invoice to follow that chain, and likewise, the hotel needs to remove the OTA and their "commission" from what appears on the invoice they are required to generate. The proposition that the hotel should only generate a Tax Invoice for the net amount they actually receive from an OTA is wrong.

When paying an OTA, the question is who should provide it. The agent or the hotel? It's one or the other but not both. The problem with expedia not issuing tax invoices has been going on for years....

- Joined

- Jul 22, 2008

- Posts

- 1,244

- Qantas

- Platinum

- Oneworld

- Emerald

The tax ruling is clear - the hotel must provide it if the OTA does not. Whether or not the OTA should is a different question, but only if the OTA has an ABN and is registered for GST (assuming the hotel is registered as well, but the requirement for an ABN stands). Where it is an offshore OTA without an ABN, then they can't provide the tax invoice. The choice only arises when the OTA is onshore and registered - hence why Qantas Hotels had no issues doing so.When paying an OTA, the question is who should provide it.

The real issue is that the hotels either don't understand, or are not provided sufficient information from the OTA to render a correct tax invoice - but it still remains their obligation to do so.

ian_baker58

Junior Member

- Joined

- Oct 22, 2011

- Posts

- 41

- Qantas

- LT Gold

Goodbye QF Hotels...

I book direct mostly anyway.

I book direct mostly anyway.

Kremmen

Member

- Joined

- Mar 25, 2007

- Posts

- 228

I'm amazed that they get consistent business ... or really any business. It took me almost a whole year to find a use for the $50 voucher on $150+ booking that QF sent out last year that didn't end up losing me money! I booked a bunch of independent hotels in the past year and typically Qantas Hotels would charge, say, $210 when there was another source charging $150, so I'd be $10 worse off even after using the voucher. I finally managed to find a hotel in Japan which was only about $20 more expensive through Qantas Hotels, so I actually got about $30 discount out of it but it wasn't worth the time I spent searching.

TheInsider

Established Member

- Joined

- Jul 7, 2010

- Posts

- 4,214

Because your experience ≠ other peoples experiences.I'm amazed that they get consistent business ... or really any business.

Neil64

Junior Member

- Joined

- May 2, 2024

- Posts

- 36

If I make a payment to a company then I am entitled to a receipt for that payment. If a customer pays Qantas Hotels then my understanding is that Qantas Hotels is obliged to issue a receipt.

I pay my local supermarket for groceries and they issue a receipt. They don’t tell me to contact the suppliers of those groceries if I want proof of purchase.

I pay my local supermarket for groceries and they issue a receipt. They don’t tell me to contact the suppliers of those groceries if I want proof of purchase.

TheInsider

Established Member

- Joined

- Jul 7, 2010

- Posts

- 4,214

Tax invoice and payment summary are the words here. Some get a tax invoice, some get a payment summary.If I make a payment to a company then I am entitled to a receipt for that payment. If a customer pays Qantas Hotels then my understanding is that Qantas Hotels is obliged to issue a receipt.

I pay my local supermarket for groceries and they issue a receipt. They don’t tell me to contact the suppliers of those groceries if I want proof of purchase.

- Joined

- Jul 22, 2008

- Posts

- 1,244

- Qantas

- Platinum

- Oneworld

- Emerald

You are correct, but not understanding the technicalities. You are entitled to a receipt that states X has received Y dollars from Z. (and in this case, it is X acting as agent for W). This is indeed what you get.If I make a payment to a company then I am entitled to a receipt for that payment

A Tax invoice is different from a receipt - it states what supply has been made for what consideration, and the GST components. You may not have paid the total of the invoice and be entitled to a receipt (you may have paid a deposit, used points of anything else - for instance paid the amount previously to their agent).Tax invoice and payment summary are the words here. Some get a tax invoice, some get a payment summary.

In the traditional not pay up front, a company would issue an invoice (be it tax invoice or just an invoice), then the customer would pay and be issued a receipt. In some cases, this is just a re-issue of the invoice showing the payment and nothing still owing, but it could be a totally different document.

Elevate your business spending to first-class rewards! Sign up today with code AFF10 and process over $10,000 in business expenses within your first 30 days to unlock 10,000 Bonus PayRewards Points.

Join 30,000+ savvy business owners who:

✅ Pay suppliers who don’t accept Amex

✅ Max out credit card rewards—even on government payments

✅ Earn & transfer PayRewards Points to 10+ airline & hotel partners

Start earning today!

- Pay suppliers who don’t take Amex

- Max out credit card rewards—even on government payments

- Earn & Transfer PayRewards Points to 8+ top airline & hotel partners

Join 30,000+ savvy business owners who:

✅ Pay suppliers who don’t accept Amex

✅ Max out credit card rewards—even on government payments

✅ Earn & transfer PayRewards Points to 10+ airline & hotel partners

Start earning today!

- Pay suppliers who don’t take Amex

- Max out credit card rewards—even on government payments

- Earn & Transfer PayRewards Points to 8+ top airline & hotel partners

AFF Supporters can remove this and all advertisements

Become an AFF member!

Join Australian Frequent Flyer (AFF) for free and unlock insider tips, exclusive deals, and global meetups with 65,000+ frequent flyers.AFF members can also access our Frequent Flyer Training courses, and upgrade to Fast-track your way to expert traveller status and unlock even more exclusive discounts!

AFF forum abbreviations

Wondering about Y, J or any of the other abbreviations used on our forum?Check out our guide to common AFF acronyms & abbreviations.

Currently Active Users

- MEL_Traveller

- PineappleSkip

- Quickstatus

- RooFlyer

- roslynm

- hugamuga

- Scr77

- WMXWu

- sanne

- mms498

- tgh

- Intra

- larry40

- tassie6

- Aussie_flyer

- cgichard

- Chrizztofa

- MELso

- hydrabyss

- jonboixxx

- JBDflyer

- metaphase

- flyingfan

- mouseman99

- WrenchHammerMcTool

- PerPH

- jase05

- r01x

- VPS

- skflyer

- Forg

- Bighead

- Harrison_133

- exceladdict

- kiwipino

- AIRwin

- jkbaus

- GDSman

- JohnM

- pferos

- Colin 2905

Total: 831 (members: 55, guests: 776)