Yes it counts towards your tally for points club +Does anyone know whether the milestone bonus awarded at 250k points in itself counts for progress towards Points Club Plus?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Qantas Points Club Discussion

- Thread starter levelnine

- Start date

Thanks a lot! So really (only) 347.5k points required in total then..Yes it counts towards your tally for points club +

- Joined

- Feb 19, 2009

- Posts

- 3,599

- Qantas

- Platinum

- Virgin

- Silver

- Oneworld

- Emerald

G'day clubbers - I've had a lot of goodness, of late, with playing my wife's WW Rewards account against mine, as we shop, and it seems to be paying dividends in terms of promos and bonus points. I thought this might be worth a reference for others who share shopping duties for a household... or even just if you have or can set up separate WW Rewards accounts to try for the same. Obviously you need a fairly high base spend as well, but I expect many PC members meet that brief.

We noticed that whenever I was doing most of the regular shopping and linking my own WW rewards account, my wife would start to get promos to lure her back to shop, often with med-high spend requirements over a period of time. I/we would then shop for that period using her rewards account number, and then after a few weeks, then I would start getting the lures from WW for my suddenly dormant account, and we'd switch back over at the end of her promo to mine! They run in 3-4 week cycles and generally we just spend what we spend, except for occasional stock ups of something we might not need so much of, right away... (staple items, drinks, etc.)

We used to get roughly 1-2K QFF points per months out of WW Rewards, but since we've been aware of and playing to this, it has increased quite a bit. In the last 12 months to Dec 2021 we have earned close to 60,000 QFF points just off the mostly regular shopping at WW, plus the cc points on top. The last 4 weeks I have been on a $210 per week challenge for a bonus 16,000 WW points (8K QFF points), and as per usual, my wife just got another promo now for a 3-week challenge to spend $30, then $40 then $50 in a week for another bonus 6,000 points. They miss her

Am I an outlier on this, or are people seeing good value and offers from the program? Without regular flying, I was just happy that the WW rewards points could make up for at least the 20K points that I wasn't earning towards PC qualification... but I didn't really expect it to account for more than a third of the target.

Cheers,

Matt.

We noticed that whenever I was doing most of the regular shopping and linking my own WW rewards account, my wife would start to get promos to lure her back to shop, often with med-high spend requirements over a period of time. I/we would then shop for that period using her rewards account number, and then after a few weeks, then I would start getting the lures from WW for my suddenly dormant account, and we'd switch back over at the end of her promo to mine! They run in 3-4 week cycles and generally we just spend what we spend, except for occasional stock ups of something we might not need so much of, right away... (staple items, drinks, etc.)

We used to get roughly 1-2K QFF points per months out of WW Rewards, but since we've been aware of and playing to this, it has increased quite a bit. In the last 12 months to Dec 2021 we have earned close to 60,000 QFF points just off the mostly regular shopping at WW, plus the cc points on top. The last 4 weeks I have been on a $210 per week challenge for a bonus 16,000 WW points (8K QFF points), and as per usual, my wife just got another promo now for a 3-week challenge to spend $30, then $40 then $50 in a week for another bonus 6,000 points. They miss her

Am I an outlier on this, or are people seeing good value and offers from the program? Without regular flying, I was just happy that the WW rewards points could make up for at least the 20K points that I wasn't earning towards PC qualification... but I didn't really expect it to account for more than a third of the target.

Cheers,

Matt.

- Joined

- Aug 21, 2011

- Posts

- 16,467

- Qantas

- Platinum

- Virgin

- Platinum

- SkyTeam

- Elite Plus

- Star Alliance

- Gold

Am I an outlier on this, or are people seeing good value and offers from the program? Without regular flying, I was just happy that the WW rewards points could make up for at least the 20K points that I wasn't earning towards PC qualification... but I didn't really expect it to account for more than a third of the target.

It's definitely not just you. I do a similar thing with other family member accounts. I also play off my Everyday Rewards account against my Flybuys account, splitting my shopping between Woolies/Coles and maximising offers in both programs.

- Joined

- Nov 16, 2004

- Posts

- 48,704

- Qantas

- Platinum

- Virgin

- Platinum

- Oneworld

- Emerald

No, quite a few on this forum and elsewhere do similar.Am I an outlier on this, [?]

On my own backyard, four accounts are about to convert over 70k points.

My own personal QFF will get a 40k boost.

Did better than last year which was only 48K all up.

Last edited:

- Joined

- Feb 19, 2009

- Posts

- 3,599

- Qantas

- Platinum

- Virgin

- Silver

- Oneworld

- Emerald

Very nice! I’m glad I’m not an outlier, by the way. It’s great that there’s programs that can create actual value for participants with little but clever planning or management.No, quite a few on this forum and elsewhere do similar.

On my own backyard, four accounts are about to convert over 70k points

Did better than last year which was only 48K.

I still remember a ‘today tonight’ or ‘a current affair’ expose years ago that said it would take tens of thousands of dollars and many years to ever earn anything meaningful on the shopping program points - I think they were talking about Flybuys only, back then - however this is a year of pretty regular grocery spend, and almost looking at points for a J return to Asia!

Cheers,

Matt.

SYD

Enthusiast

- Joined

- Oct 5, 2009

- Posts

- 13,021

- Qantas

- Platinum

- Virgin

- Gold

- Oneworld

- Emerald

In my experience, Flybuys actually has more consistent and regular bonus points promos than Woollies but obviously they don’t count towards PC! Even after VA joined FBs, we still convert FB points to cash credit. Whereas we value the bonus QF points earn from WWR and will chase some but not all promos.I still remember a ‘today tonight’ or ‘a current affair’ expose years ago that said it would take tens of thousands of dollars and many years to ever earn anything meaningful on the shopping program points - I think they were talking about Flybuys only, back then - however this is a year of pretty regular grocery spend, and almost looking at points for a J return to Asia!

- Joined

- Jan 9, 2016

- Posts

- 2,178

- Qantas

- Platinum

dairyfloss: “Am I an outlier on this, or are people seeing good value and offers from the program? Without regular flying, I was just happy that the WW rewards points could make up for at least the 20K points that I wasn't earning towards PC qualification... but I didn't really expect it to account for more than a third of the target.”

This is just what was described in the AFF Gazette. You are playing the game perfectly. I might have to enlist the help of my bachelor son, sign him up, and then follow the same plan.

edit: I tried to post hours ago but the site would not lodge. “Oops! Try late.”

This is just what was described in the AFF Gazette. You are playing the game perfectly. I might have to enlist the help of my bachelor son, sign him up, and then follow the same plan.

edit: I tried to post hours ago but the site would not lodge. “Oops! Try late.”

Jean Prouvaire

Member

- Joined

- Apr 11, 2012

- Posts

- 448

I'd been wondering how I could maintain Points Club this year (primarily for the status credits on reward flights), when this offer arrived:

So loading - say - A$10,000 would generate 50,000 points. If you're someone who doesn't spend all that much every year, it seems like an easy way of racking up a high number of points without getting a new credit card (something I'm reluctant to do too often).

The negatives are that you'd be locked into whatever FX rate Qantas offers, and you forego any interest your money might have earned. Though given today's low interest rates I'd not be too worried if I had to park the money on the card until I had occasion to use it, and a poor exchange rate might be offset by the value you get from the frequent flier points.

I wonder if would also be possible to unload the money at some point down the track after the bonus points had been credited and wear (or benefit from) any FX fluctuation.

With Qantas Travel Money, you’ll earn even more Qantas points*

To celebrate the festive season, we’re giving you the opportunity to get away with a big points boost when you stock up on foreign currency with the Qantas Travel Money card.*

Here’s how:

There’s no minimum or maximum load amount - just lots of points on offer*.

- Register your card for the offer using the link below.

- Load foreign currency to your card and earn 5 Qantas Points per $1 AUD equivalent.*

*To earn bonus Qantas Points, register and load between 2 December 2021, 12:00am (AEDT) and 11 December 2021, 11:59pm (AEDT). Load directly in foreign currency to receive 5 Qantas Points per AU$1 loaded. You must load directly into foreign currency to take advantage of the bonus points offer. The offer is not available for currency to currency or card to card transfers. The Qantas Points will be credited to your account six to eight weeks after the offer has closed. Not to be used in conjunction with any other promotion. Offer may be extended or withdrawn at any time.

So loading - say - A$10,000 would generate 50,000 points. If you're someone who doesn't spend all that much every year, it seems like an easy way of racking up a high number of points without getting a new credit card (something I'm reluctant to do too often).

The negatives are that you'd be locked into whatever FX rate Qantas offers, and you forego any interest your money might have earned. Though given today's low interest rates I'd not be too worried if I had to park the money on the card until I had occasion to use it, and a poor exchange rate might be offset by the value you get from the frequent flier points.

I wonder if would also be possible to unload the money at some point down the track after the bonus points had been credited and wear (or benefit from) any FX fluctuation.

Not a bad deal if you're planning to spend money in the foreign currency. Converting back to AUD results in another whack with conversion rates, to the point that it's not worth it (IMHO).I'd been wondering how I could maintain Points Club this year (primarily for the status credits on reward flights), when this offer arrived:

So loading - say - A$10,000 would generate 50,000 points. If you're someone who doesn't spend all that much every year, it seems like an easy way of racking up a high number of points without getting a new credit card (something I'm reluctant to do too often).

The negatives are that you'd be locked into whatever FX rate Qantas offers, and you forego any interest your money might have earned. Though given today's low interest rates I'd not be too worried if I had to park the money on the card until I had occasion to use it, and a poor exchange rate might be offset by the value you get from the frequent flier points.

I wonder if would also be possible to unload the money at some point down the track after the bonus points had been credited and wear (or benefit from) any FX fluctuation.

Elevate your business spending to first-class rewards! Sign up today with code AFF10 and process over $10,000 in business expenses within your first 30 days to unlock 10,000 Bonus PayRewards Points.

Join 30,000+ savvy business owners who:

✅ Pay suppliers who don’t accept Amex

✅ Max out credit card rewards—even on government payments

✅ Earn & transfer PayRewards Points to 10+ airline & hotel partners

Start earning today!

- Pay suppliers who don’t take Amex

- Max out credit card rewards—even on government payments

- Earn & Transfer PayRewards Points to 8+ top airline & hotel partners

Join 30,000+ savvy business owners who:

✅ Pay suppliers who don’t accept Amex

✅ Max out credit card rewards—even on government payments

✅ Earn & transfer PayRewards Points to 10+ airline & hotel partners

Start earning today!

- Pay suppliers who don’t take Amex

- Max out credit card rewards—even on government payments

- Earn & Transfer PayRewards Points to 8+ top airline & hotel partners

AFF Supporters can remove this and all advertisements

- Joined

- Feb 19, 2009

- Posts

- 3,599

- Qantas

- Platinum

- Virgin

- Silver

- Oneworld

- Emerald

Good for points, but Qantas Travel Money is a pretty poor deal otherwise, and even an even poorer proposition at this point, with the FX rates on all major pairs at their lowest in some time. Qantas offers their own conversion rates which are effectively a market rate with about 4.5% commission added. Transfer A$10K into USD and you'd get USD$6,778 vs a mid-market value of USD$7,087. I don't see any fees for returning the funds to an AUD account, but it would be at the original value. Actually -I guess it would be hard to buy 50,000 points for less than ~$300 otherwise? Any of the Qantas Wine offers ever come close to that?I'd been wondering how I could maintain Points Club this year (primarily for the status credits on reward flights), when this offer arrived:

So loading - say - A$10,000 would generate 50,000 points. If you're someone who doesn't spend all that much every year, it seems like an easy way of racking up a high number of points without getting a new credit card (something I'm reluctant to do too often).

The negatives are that you'd be locked into whatever FX rate Qantas offers, and you forego any interest your money might have earned. Though given today's low interest rates I'd not be too worried if I had to park the money on the card until I had occasion to use it, and a poor exchange rate might be offset by the value you get from the frequent flier points.

I wonder if would also be possible to unload the money at some point down the track after the bonus points had been credited and wear (or benefit from) any FX fluctuation.

exceladdict

Established Member

- Joined

- Mar 26, 2014

- Posts

- 4,983

- Qantas

- Platinum

- Virgin

- Silver

Have you maxxed out the various credit card offers? Locking in $10k is a bit scary to me.I'd been wondering how I could maintain Points Club this year (primarily for the status credits on reward flights), when this offer arrived:

So loading - say - A$10,000 would generate 50,000 points. If you're someone who doesn't spend all that much every year, it seems like an easy way of racking up a high number of points without getting a new credit card (something I'm reluctant to do too often).

The negatives are that you'd be locked into whatever FX rate Qantas offers, and you forego any interest your money might have earned. Though given today's low interest rates I'd not be too worried if I had to park the money on the card until I had occasion to use it, and a poor exchange rate might be offset by the value you get from the frequent flier points.

I wonder if would also be possible to unload the money at some point down the track after the bonus points had been credited and wear (or benefit from) any FX fluctuation.

- Joined

- Feb 19, 2009

- Posts

- 3,599

- Qantas

- Platinum

- Virgin

- Silver

- Oneworld

- Emerald

I'm the same... who knows where it's headed, but I'd have felt a lot more confident in Feb-21 at AUDUSD=0.80!Have you maxxed out the various credit card offers? Locking in $10k is a bit scary to me.

Jean Prouvaire

Member

- Joined

- Apr 11, 2012

- Posts

- 448

I'm reluctant/unable to churn credit cards too often, and I don't drink wine (generally seen as an efficient way of getting points), which is why this offer is appealing to me.Have you maxxed out the various credit card offers? Locking in $10k is a bit scary to me.

I'm planning trips to the US and UK in the coming year, so am pretty confident I'll spend the money on the card, even if - as dairyfloss pointed out - the FX rate is sub-optimal.

Lynda2475

Suspended

- Joined

- May 1, 2009

- Posts

- 9,395

- Qantas

- Platinum

- Virgin

- Red

- Oneworld

- Emerald

You can get an easy 15k points by switching to red energy, at much lower cost than forex.

If you time credit card churn optimally and choose black card which typically give 100-120k points, you can churn a card every 2 years, add on normal cc spend, woollies, some flying and other shopping bonuses and easily get to 150k early in the year every other year to requalify for remainder of that year and all of the year after.

If you time credit card churn optimally and choose black card which typically give 100-120k points, you can churn a card every 2 years, add on normal cc spend, woollies, some flying and other shopping bonuses and easily get to 150k early in the year every other year to requalify for remainder of that year and all of the year after.

Last edited:

- Joined

- Feb 23, 2015

- Posts

- 6,611

- Qantas

- Platinum 1

- Virgin

- Platinum

- Star Alliance

- Gold

- Joined

- Jan 9, 2016

- Posts

- 2,178

- Qantas

- Platinum

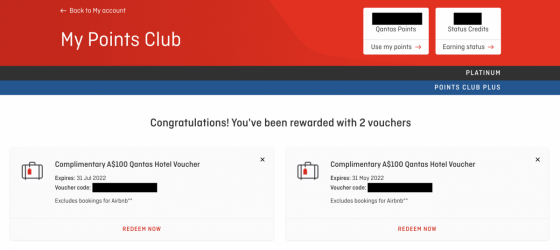

An actual enhancement that does, in fact, enhance! It takes me forever to find where my hotel and flight vouchers are.Just noticed the Points Club page now lists Qantas Hotels vouchers. A much needed improvement.

View attachment 267698

SYD

Enthusiast

- Joined

- Oct 5, 2009

- Posts

- 13,021

- Qantas

- Platinum

- Virgin

- Gold

- Oneworld

- Emerald

I’m still not seeing this on my account. Maybe a PC+ thing getting enhanced first?Just noticed the Points Club page now lists Qantas Hotels vouchers. A much needed improvement.

View attachment 267698

I know I have at least two hotel vouchers sitting in my email inbox and a wine voucher (that I forgot to use yesterday ordering QF wine…

Daver6

Enthusiast

- Joined

- Dec 31, 2011

- Posts

- 11,833

- Qantas

- Platinum

- Virgin

- Gold

I’m still not seeing this on my account. Maybe a PC+ thing getting enhanced first?

I know I have at least two hotel vouchers sitting in my email inbox and a wine voucher (that I forgot to use yesterday ordering QF wine…).

I'm PC+ too and don't have this enhancement yet either.

I don’t have this feature either and I’m a PC+. Think it’s because I never received a voucher generated by the system as my birthday was before they launched the wine/hotel vouchers program and I had to instead get them manually generated by the customer support teams.

Become an AFF member!

Join Australian Frequent Flyer (AFF) for free and unlock insider tips, exclusive deals, and global meetups with 65,000+ frequent flyers.AFF members can also access our Frequent Flyer Training courses, and upgrade to Fast-track your way to expert traveller status and unlock even more exclusive discounts!

AFF forum abbreviations

Wondering about Y, J or any of the other abbreviations used on our forum?Check out our guide to common AFF acronyms & abbreviations.

Currently Active Users

- Colin 2905

- k1s3k1

- dh3mike

- twinaisle

- SYD

- Noah Count

- anat0l

- ewangiles

- bits

- Dmac59

- pacifictraveller01

- kookaburra75

- Titi E

- Scarlett

- Space cadet

- Tangenyahu

- brissie

- kpc

- FlyboyAl

- Haplo

- ADLhighflyer

- Spamam

- bussyboy

- Flyfrequently

- Jonova

- Highway23

- sudoer

- Flyingwombat

- Beano

- Harrison_133

- FrequentFlyer85

- qfflyer

- happysleepy

- FlyingFiona

- darloflyer

- Catweazle

- Cottman

- Austman

- Scr77

- 33kft

- Pete98765432

- DanMateAus

- Daver6

- lwyen

- Cutty

- wenglock.mok

Total: 781 (members: 54, guests: 727)