I got the email even though until this weekend I hadn’t earned a single point or SC for 9 years.

My points all come from EDR, the well-being app or share trading.

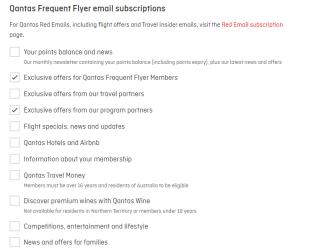

And you're an example of how QF's diversified strategy to entangle many people into the "loyalty" web works to support their end goals. That's why it's not really QF Frequent FLYER anymore, but QF loyalty (and they've not exactly been hiding it).

The two feed right into eachother, specially in a relatively small fishbowl of the Australian market - seems everywhere one looks QF has a tag to get people in - woolies, BP.. I heard a ad for a financial company the other day.. Latrobe? with a bait of QF points.. insurance.. and share trading as you say and many others. All of those things, plus CC/bank tie ins of course, totally work to enhance the profit of QF Loyalty and in turn have those people who do earn points with EDR or BP or whatever then naturally think "well I want to use QF if I can because points"

Sure VA has its swag of partners, but I reckon advertising and things I see and hear that mention QF are far far more than VA.

QF also has had a long standing arrogance towards its dominant position. If it's 60%, 65% whatever.. there's still that point that QF considers, I think, they have the majority of capacity, routes etc that suit most people, and that in turn keeps them in with the "loyalty" tie ins, plus - in most markets anyway - schedule advantage and the like.

I'd also say such a relatively high market share (domestic) leads to a level of complacency in terms of effort (see also - catering on board, customer service efforts, etc) that is quite arrogant.. and the competition is not that strong (but improving). I also wonder if Rex is becoming more than a Mozzie. They seem to be upping capacity (and LF) on key domestic routes and while notwhere near a major thread, probably are becoming more of an issue for QF than, say, Bonza look to be.

There's another thing which may or may not come back into play in the medium term. Both major carriers are wary still after the capacity wars that went on in the period before the pandemic - it hurt them both (VA obviously fare moreso) and they probably don't want to try and return to this kind of behaviour. Right now they don't need to as demand is still very high and supply is still being limited due to various factors as discussed.. but there will be a point where yes, the demand will ease off, prices will come down, and then I reckon the competition will heat right back up again.

we shall see.