- Joined

- Aug 21, 2011

- Posts

- 16,669

- Qantas

- Platinum

- Virgin

- Platinum

- Star Alliance

- Gold

So what does it cost to operate the 6 737's? (i.e. how long will the PE money last). I assume the overheads for Rex jet won't be that great, due to the already established corporate structure. I note that VA domestic used to cost $3.8b or so to operate in 2018-2019 with a fleet of 125 or so? That's $3.5m/week for a fleet of 6 aircraft. Defrayed by revenue of up to $0.1-0.2m/week (assuming 20 pax per flight paying $100/head). Also how much of this expansion is being financed by PE vs financed by the Australian taxpayer?

The Cost of Operating a Commercial Flight

Ever wondered how much it costs a commercial airline to operate a flight?

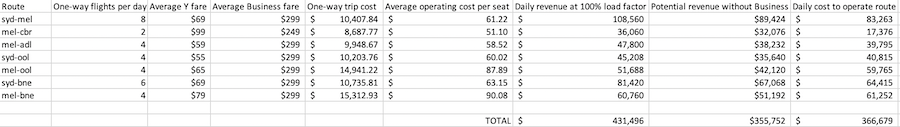

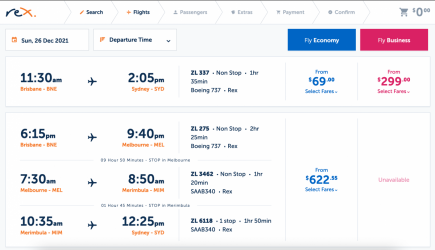

Using the formula from that article, we could estimate that it would cost Rex around AU$366,000 per day to operate their full schedule of 737 flights on the SYD-MEL, MEL-ADL, SYD-OOL, MEL-OOL, MEL-CBR, MEL-BNE and SYD-BNE routes. Perhaps Rex's operating costs are a bit lower than average, which would reduce this amount but we could use that as a guide.

If they sold 100% of available Economy and Business Class seats on every flight, at the current airfares for Economy & Business on each route, they would make around $431,000 in revenue per day of operations. In other words, at the current airfares Rex is charging, they would need to sell 85% of seats across all classes of travel (including selling the J seats at full price) to break even. But clearly Rex is not getting average load factors of even close to 85%.

If Rex sold all Economy seats on every flight, but none of the Business seats, it would make revenue of around $356,000. Which is $10,000 less than the operating costs, give or take.

But even this would be a far better outcome than what is currently happening, with just 20-30 pax on many SYD-MEL flights.

If some fares are sold at higher prices, customers are purchasing ancillaries, Rex is carrying cargo or the airline is getting government subsidies, the revenue situation improves. But most people seem to be paying only the lowest fare and anecdotally, very few J seats are being filled by paying customers.

In a nutshell, Rex is likely losing a lot of money from its 737 operations.

How long can this continue? Well, that depends just how much money Rex is losing from its 737 operations. But if we assumed that the average load factor per flight was currently 50% in Y and 25% in J (I have no idea if this is accurate), that would potentially mean Rex is losing around $169,000 per day. At that rate, it would take around 20 months to burn through the $100 million investment.

Of course, there are lots of assumptions being made here. This is just a "back of the envelope" estimate and could be totally wrong. If you change your modelling assumptions you get a different answer.

For anyone interested, here's my working: