Were you able to resolve this?For anyone using US Global Mail - Amex sent me a letter stating that this is a mail forwarder and that I need a physical address. Looks like I will need to go back to MyUS for physical and use the US global mail as the mailing

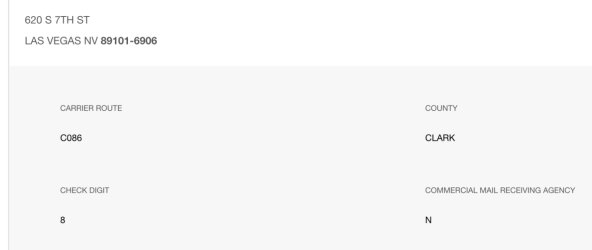

I read where the Nevada address for US Global Mail does not show as a Commercial Mail Receiving Company. That seemed to be the case when I did a USPS look-up, whereas the Miami address indicated a CMRC. So, it may pay to look around before deciding where to live.