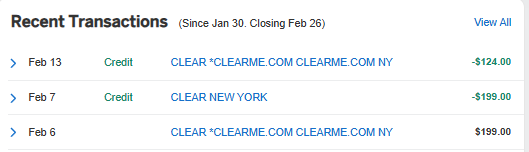

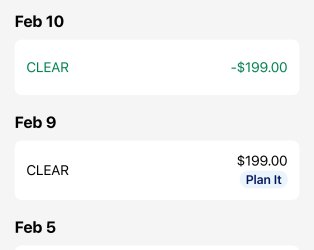

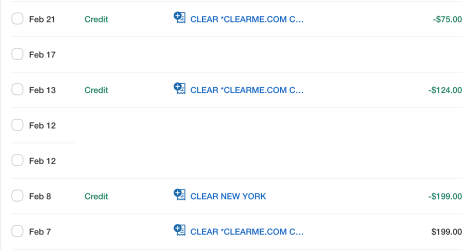

Happened to me. Free $124 in each Amex account. Not complaining if that sticks.bit of drama with this promo. Have you received a refund of $124 from Clear?

Read the comments -

(Update) CLEAR Cancelling Some New Customer Signups & Issuing Partial Refund - Doctor Of Credit

Update 2/18/25: People are now reporting getting a $75 refund as well (two separate refunds: first for $124 and now one for $75). We'll have to see howwww.doctorofcredit.com

Edit: Actually, free $199 now lol

Last edited: