- Joined

- Aug 27, 2004

- Posts

- 17,721

- Qantas

- LT Gold

- Virgin

- Red

- Oneworld

- Sapphire

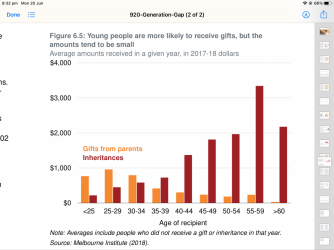

We are still waiting to receive our inheritance - 3 out of 4 parents still plodding on. My plan is to use any inheritance we receive to pay off our kids' HEX debts so they can be in a similar situation to me when I received a free tertiary education and not be shackled by debt at the start of a working career.We are in the fortunate position of being given permission to spend the kids inheritance.