JohnK

Veteran Member

- Joined

- Mar 22, 2005

- Posts

- 44,199

Which super? Conservative investments have realistically increased 5-6% if not less.Super has been accumulating at consistently 15% on average since 2008

Last financial year 20%

Fees still less than $120 pa

Of course that’s all ink on paper and imaginary unless realised now.

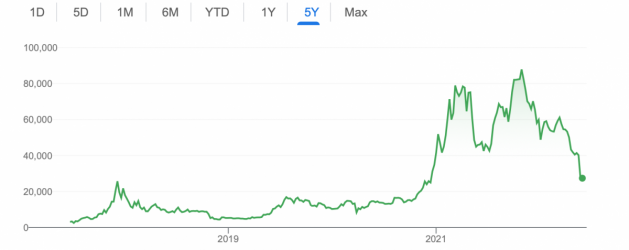

What concerns me is that my super balance has dropped 10% in the past 6 months. For someone close to retirement that's a significant drop.

It took 6-7 years to recover the losses of 2007-2008 and this one looks to be heading the same way.

I'd like to take my entire super as lump sum in 20 months time but as I'll be working another 6-7 years think the best I can do is some sort of transition to retirement.