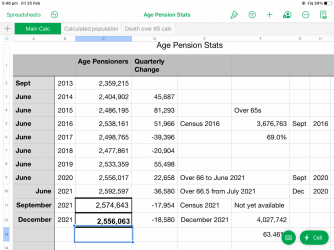

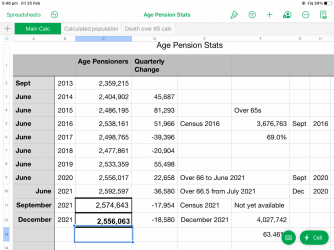

The age pension figures dropped yesterday for September 2021.

down nearly 18,000..... hypothesising those 2021 20% returns plus housing valuations had an impact.

the assets test data suggests so

the age pension figures dropped again today and dropped in the December 2021 quarter ...

so to place into CONTEXT

Already age 65 at Census 2016 3,676,000

At Census 2016, there were 1,299,397 aged 60-64. By Census 2021 August, those now aged above 66 were approx 80% of that group and are now age eligible except for those who hadn’t turned 66 by 30 June 2021 (approx 8% of 20%)

However, the ABS death stats tell us how many died (down to a 5 year split) so we need remove nearly 670,000 for that reason PLUS we need remove the 21.6% not yet reached 66.5 years of age (about 280,000) (recognising some already died and that this is a back of the envelope calculation)

This then leaves about 4 million of which 2.556 million are on age pensions. In effect the entire population increase in the last 5 years of around 350,000 has made no difference to the total age pension figure as departures by death or income or assets test are replaced by a new entrant.

This means about 1.471,000 self-funded superannuation (or other wealth) retirees... (about 1/3 of those aged over 66.5)

As this is an hypothesis, it can be detailed further once Census 2021 figures are released

PS I DID realise after posting that part of the reduction is because in effect, the scheme is “closed to new entrants” because of the age adjustment on 1 July 2021 that extends the waiting period for an additional 6 months