JohnK

Veteran Member

- Joined

- Mar 22, 2005

- Posts

- 44,431

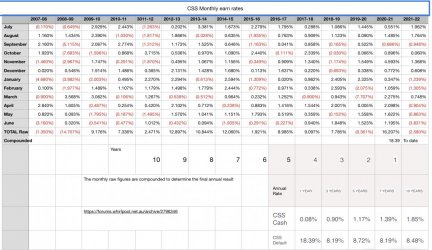

ANZ Smart Choice Super. I think it was OnePath and it's change since. I'm in the 1960s fund. I checked a few years back and they were earning 5%-8% a year.My current super balance is not far above my contributions in that time. That's embarrassing

It's worse than embarrassing.. its criminal.. unless you have set some silly options.

Who is the fund manager..name and shame time...

I'm now beyond stunned they would lose ~10% in 2 quarters. That's awful for a conservative investment. It will take 3+ years to get back to what I was at beginning of this year.