I don't know of anyone in my circle who qualifies. Of course the couples worked all of their lives, so that accumulates assets, like a house

, but that working career pretty much precludes them from qualifying. Some of my friends you'd expect not to qualify (specialists etc) but it has surprised me of others who don't. Maybe singles qualify more easily?

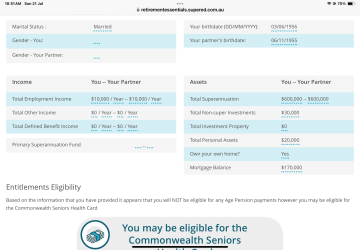

So I just did a dummy calculation.

Couple with $600,000 each in super. Income per year of $10000 each. Home but with mortgage. Personal assets - furniture car etc of $20,000 Savings of $30,000. Is this couple rich? Nope. No pension.

View attachment 398668

I tried again with Zero income. So only the super fund balance. Still no.

It seems like anything more than $450,000 super (total for couple) cuts you out of pension, with minimal cash in bank and 'assets'

Which tallies with several 'Planning your retirement' seminars we've attended put on by various industry funds.

Given how low the Aged Pension is - shouldn't everybody's aim be to achieve the highest retirement savings subject to being able to sleep at night (aka not worrying constantly about exactly what you're invested in & whether the markets are about to crash). When I've talked with friends etc I always describe the Aged Pension as disaster insurance than we pay a small premium for through our working life.

Just like any insurance - the best outcome is never having to claim.

The financial planners presenting the 'Preparing for retirement' virtually always talk about aiming to maximise your access to the age pension seemingly as the No.1 goal of retirement planning.

Sadly, there was an almost identical type of tunnel vision I encountered with Super fund trustees (both Industry fund and company funds) and their 'advisors' except it was directed at paying the least tax on earnings. I always countered with the real life example of AMP No.2 Fund vs BT Australia Retirement Fund (no longer the case since the early 1990s but relevant example).

For the period from 1969 to 1989 the AMP No.2

* Fund paid less tax (most of the time there was no Super Tax of course) than BTAR did. However a series of mandatory redeemable preference share private placements I arranged ended up cutting the amount of Super Tax BT paid by around 40% for a number of years.

* IIRC #1 fund was for Life Insurance & #2 was for Superannuation, it's been a while.

AMP did not pay a smaller relative amount of tax because of clever management, in fact the exact opposite. AMP underperformed BTAR for every rolling 3 year period within that 20 year period, in fact for a company (as many Australian companies did thanks to some creative marketing by AMP) that had placed the same amount with each in 1969 (for example) - by the end of 1989 they had 2.5x the balance (IIRC) with BTAR than AMP BUT had paid less Super Tax on the money with AMP.

Which is the better outcome?

The first few times we rolled out this graph and following slide showing the 3, 5, 7, 10, 15 and 20 yr cost (after all fees & taxes) to a company due to having AMP instead of BTAR - every Wholesale Consultant attedning the Trustee Board meeting said we were wrong. Many Companies sacked those consultants shortly thereafter but we never mentioned that every Wholesale Consulting group (Mercers, Towers Perrin, Forster Crosby, Russell, Aon, etc etc) had done exactly the same with their clients.

Post the early 1990s - the wheels fell off BT. Believing your own PR is always fatal, equally the team size went from 27 (IIRC) on the Investment side (including 2 marketing) to over 50 (5+ marketing) by the mid 1990s.

Just coincidentally, of course, I left in June 1990. Kerr Neilson a few years later but he'd moved out of wholesale some years earlier to focus solely on the Retail Equity fund business, situated around other side of Level 44 next to the retail admin & marketing team.

______________________________________________________

If you never get to access the Age Pension then you've done well!

Just like if your family never collects on Life Insurance.