- Joined

- Jan 24, 2018

- Posts

- 9,566

- Qantas

- Gold

- Virgin

- Platinum

Yes, forgot AC.Air Canada might be an option again via SYD but that's a long way round.

Less points than EY option and save about $400 on fees.

Can get paid Y from YVR-LHR for under $1k

Yes, forgot AC.Air Canada might be an option again via SYD but that's a long way round.

Czech Airlines is not a partner

OT, would it be a good idea, if they (QA) Czech that is, flew to Aust and had a partnership with VFF and had a very good enviable J class.

AFF Supporters can remove this and all advertisements

Can we add any more obscure airlines

QR will only get you to YUL in Canada, or SEA if you wanted to transit the US.BTW looked at the QA fare sale on at the moment - however "mrs" + "Qatar" not compatible...

Think Bain will be looking at floating part of their VA stake on the ASX later this year and gradually selling down before considering Alliances at this point.Seriously though, what/which airline can VA partner with?

Not *A by the looks of VA not wanting to openly (as a group) join them, they don't seem to want ST either, and OW is out.

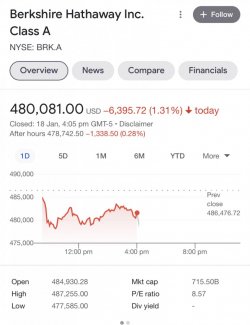

An embittered Buffett said in 2007 investor letter: “If a farsighted capitalist had been present at Kitty Hawk, he would have done his successors a huge favor by shooting Orville Wright down” and referred to a soured bet on US Air in the 1990s.

“The airline industry’s demand for capital ever since that first flight has been insatiable. Investors have poured money into a bottomless pit, attracted by growth when they should have been repelled by it,” he continued.

Fact check? Articles I read suggested he lost a substantial portion of his initial investment of $7b when he sold out at the trough after covid hit. In any event for a $700b valuation of BH, it’s only 1% …. A day’s swing on the marketsWarren Buffett, the world's savviest investor, totally dumped his massive stake (average 10%) in the major US airlines only a year or so back. And lost about $40 BILLION.

Buffett should have re-read his own 2007 newsletter and sage advice! Would have saved him losing $40 Billion or whatever he lost cold in recent years.

...and the Australian Government hasn't been tossing $ into ZL, VA and QF??? (QF being the 'national' carrier)Typo of $40 Billion for $US4 BILLION or so loss.

But what is a mere few BILLION to a Bulletin Board target audience?

Investing in any Airline is insanity.

ONE crash or incident can near destroy consumer confidence.

Many national carriers are there simply as Governments has tossed endless Billions into the black hole to save face, in the past 5 or 10 years.

Thai, Malaysian, Alitalia, Ethiopian, SAA etc, etc.

''The famed investor's Buffett company previously owned between 8% and 11% of American Airlines, Delta Air Lines, Southwest Airlines, and United Airlines. Berkshire spent a total of $7 billion to $8 billion in building those stakes, which were worth over $10 billion at the end of 2019, SEC filings show.

However, shares in the four airline stocks plunged with the broader market when pandemic fears peaked last spring. Buffett and his team dumped their stakes in April, likely netting about $4.5 billion based on the quartet's average trading prices that month.''

Typo of $40 Billion for $US4 BILLION or so loss.

But what is a mere few BILLION to a Bulletin Board target audience? Does not matter WHO lost it, it is still BILLIONS of loss.

''Does not matter WHO lost it, it is still BILLIONS of loss.''

Some folks just do not read.

If James Packer had done it he'd literally be penniless today, to make it easier to understand.