It would be pretty normal to have the float "ready to go" in the background, with the major work being done some time ago (have worked in the space) - a partial float, in reality. That's what advisers are paid (lots) for - the models (several scenarios) would be updated regularly and instos kept schmoozed.

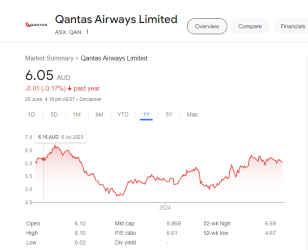

As for the rationale attributed to GyG - that sounds pretty dodgy; maybe more about 'market sentiment' . The best proxy for appetite for VA stock is of course Qantas, and I am surprised to see that their recovery from the bottom last year has stalled a bit.

View attachment 392552

If there is no apparent local prompt for the partial divestiture by Bain, it might be exogenous - a foreign cornerstone investor indicating that they are ready to go.