I would boycott a shop which has a surcharge on eftpos cards.The other catch is you need to account for any surcharge if close to the full balance

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Woolworths gift card thread

- Thread starter Dr Ralph

- Start date

wombatcountry

Intern

- Joined

- Mar 27, 2006

- Posts

- 86

Thanks for the tip and the reprimand…These are an EFTPOS card. Use in the same way you use any EFTPOS card, although you must swipe and use a PIN.

Can I also strongly suggest that you don't spend $100's buying something you don't understand. Do your research first. Buying these cards isn't for everyone. Saving money/earning points doesn't just happen by accident. It takes work.

wombatcountry

Intern

- Joined

- Mar 27, 2006

- Posts

- 86

Thanks, this is a useful tip. Our vet certainly has an eftpos surcharge, and so does our GP.The other catch is you need to account for any surcharge if close to the full balance

Mr_Orange

Senior Member

- Joined

- Jun 17, 2013

- Posts

- 5,632

Don't worry, Ralphy isn't known round here for pulling his punches. We all get the same treatmentThanks for the tip and the reprimand…I do the work, in more than one country, actually.

Australia's highest-earning Velocity Frequent Flyer credit card: Offer expires: 30 Apr 2025

- Earn 100,000 bonus Velocity Points

- Get unlimited Virgin Australia Lounge access

- Enjoy a complimentary return Virgin Australia domestic flight each year

- Earn 100,000 bonus Velocity Points

- Get unlimited Virgin Australia Lounge access

- Enjoy a complimentary return Virgin Australia domestic flight each year

AFF Supporters can remove this and all advertisements

wombatcountry

Intern

- Joined

- Mar 27, 2006

- Posts

- 86

Oh, I know the type… posting a lot, mostly very useful info, but 0 tolerance for newbies’ somewhat basic questions. I used to be a member of a much larger FF bulletin board up north (FT) and I’ve encountered my share there. C’est la vie…Don't worry, Ralphy isn't known round here for pulling his punches. We all get the same treatment

- Joined

- Jan 29, 2012

- Posts

- 15,784

- Qantas

- LT Gold

- Virgin

- Red

- Oneworld

- Emerald

I spoke too soon. No more variable ones at Drouin and Warragul. The staff just shrugged when I asked if they were getting any more soon.I was able to get some today. Regional Vic.

At least Coles have still got lots of iTunes cards.

For the first time ever I saw bare rows in Newcastle today.

Went to my usual reliable store tonight (low socio-economic regional town in NSW) and there was nil stock.

Never been let down by this particular store before

Well, I had a whinge on the store yesterday, on them being tight. Today, they are sold out! What's going on? (Windsor NSW)

- Joined

- Jul 8, 2007

- Posts

- 1,586

- Qantas

- Platinum

- Virgin

- Red

- Oneworld

- Emerald

Just in case you weren't aware (and at the risk of explaining something you already know), "eftpos" is a term that is very loosely used to denote the system for accepting card payments - be they credit or debit. To make things more complicated, debit cards carrying the VISA or Mastercard logos can generally be used as either debit or credit cards, and are treated differently by the business courtesy of who does the payment processing. In other words, use that card like a credit card and you can expect a surcharge, whereas if you press the "savings" button, there is (typically) no surcharge. Sounds logical I know.Thanks, this is a useful tip. Our vet certainly has an eftpos surcharge, and so does our GP.

The problem is that if you "tap & go", the card will typically default to the "credit" option and will often result in a surcharge. Many merchants are now defaulting to using least-cost routing (LCR) ensuring that the payment is processed through the cheapest routing, but there's no guarantee of this and often no way to know which merchants are leveraging the option (for now, at least).

So, when you say that there is an eftpos surcharge at your vet and GP, it's worth keeping mind that the surcharge may simply be down to how you use your card with their payment terminal. Of course it's also possible that your vet and GP are indeed charging a payment processing fee regardless of the payment routing (which results in a

- Joined

- Jan 29, 2012

- Posts

- 15,784

- Qantas

- LT Gold

- Virgin

- Red

- Oneworld

- Emerald

And to further digress, all AU retailers must provide a zero fee payment option. So if they charge for every form of eftpos, they must still accept cash for example.Just in case you weren't aware (and at the risk of explaining something you already know), "eftpos" is a term that is very loosely used to denote the system for accepting card payments - be they credit or debit. To make things more complicated, debit cards carrying the VISA or Mastercard logos can generally be used as either debit or credit cards, and are treated differently by the business courtesy of who does the payment processing. In other words, use that card like a credit card and you can expect a surcharge, whereas if you press the "savings" button, there is (typically) no surcharge. Sounds logical I know.

The problem is that if you "tap & go", the card will typically default to the "credit" option and will often result in a surcharge. Many merchants are now defaulting to using least-cost routing (LCR) ensuring that the payment is processed through the cheapest routing, but there's no guarantee of this and often no way to know which merchants are leveraging the option (for now, at least).

So, when you say that there is an eftpos surcharge at your vet and GP, it's worth keeping mind that the surcharge may simply be down to how you use your card with their payment terminal. Of course it's also possible that your vet and GP are indeed charging a payment processing fee regardless of the payment routing (which results in a).

wombatcountry

Intern

- Joined

- Mar 27, 2006

- Posts

- 86

Thanks! This is really good info. I know there’s supposed to be a government-mandated change coming in the future re. Eftpos transactions, but in the last couple of years I’ve seen a proliferation of fees for everything but cash or direct bank transfer, up to 1.5 %, at many small businesses in our area. I’ve used the savings + pin option every time with my Woollies eftpos card so far and still got charged a fee - albeit smaller. Other than asking to be invoiced and making a direct transfer, I don’t see any option to avoid a fee with certain merchants - I haven’t used cash for decades, unless it’s really the *only* payment option.Just in case you weren't aware (and at the risk of explaining something you already know), "eftpos" is a term that is very loosely used to denote the system for accepting card payments - be they credit or debit. To make things more complicated, debit cards carrying the VISA or Mastercard logos can generally be used as either debit or credit cards, and are treated differently by the business courtesy of who does the payment processing. In other words, use that card like a credit card and you can expect a surcharge, whereas if you press the "savings" button, there is (typically) no surcharge. Sounds logical I know.

The problem is that if you "tap & go", the card will typically default to the "credit" option and will often result in a surcharge. Many merchants are now defaulting to using least-cost routing (LCR) ensuring that the payment is processed through the cheapest routing, but there's no guarantee of this and often no way to know which merchants are leveraging the option (for now, at least).

So, when you say that there is an eftpos surcharge at your vet and GP, it's worth keeping mind that the surcharge may simply be down to how you use your card with their payment terminal. Of course it's also possible that your vet and GP are indeed charging a payment processing fee regardless of the payment routing (which results in a).

While I agree with the statement I see no evidence this is actually enforced, similar for the requirement that any fees charged must not exceed actual costs. Without enforcement these laws are toothless.And to further digress, all AU retailers must provide a zero fee payment option. So if they charge for every form of eftpos, they must still accept cash for example.

- Joined

- Jul 8, 2007

- Posts

- 1,586

- Qantas

- Platinum

- Virgin

- Red

- Oneworld

- Emerald

Sorry, are you referring to the eftpos gift cards? It's (sadly) becoming increasingly common for merchants to pass on the payment processing fees, but fees for eftpos (i.e. a "cheque/savings" transaction vs a "credit" one) are always lower, so if you absolutely cannot avoid paying a fee for using card, then you can at least be sure that it's going to be the cheapest fee.I’ve used the savings + pin option every time with my Woollies eftpos card so far and still got charged a fee - albeit smaller.

One other thing to further complicate matters... some financial institutions (e.g. Macquarie Bank comes to mind) no longer supply eftpos-enabled cards. They're still debit cards that are facilitated by Visa or Mastercard and can still be used as either a "cheque/savings" or "credit" transaction, but they don't support the cheaper eftpos option. Basically, your card needs to have the eftpos logo on it to support eftpos transactions.

kangarooflyer88

Established Member

- Joined

- May 29, 2021

- Posts

- 4,423

- Qantas

- Gold

- Virgin

- Silver

- Oneworld

- Sapphire

- Star Alliance

- Gold

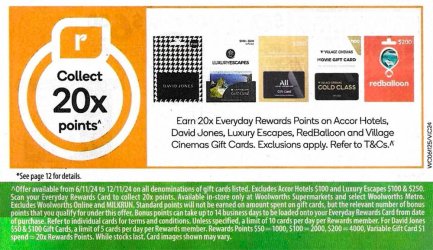

Pretty ho hum if you ask me. Yes, Accor gift cards attract 20x points but there are many caveats to using them including not being able to use them on prepaid bookings, not being applicable for Accor+ rates (at least per the T&Cs) and not all hotels in APAC accepting them on arrival.

-RooFlyer88

You can, I have done it twice. Just screenshot the prepaid no change no refund quote on the Accor web site, then send the picture to the property directly and state that you need them to enter the booking for you because you want to use gift card, then call them again to make sure that they have received your e-mail.Accor gift cards attract 20x points but there are many caveats to using them including not being able to use them on prepaid bookings

- Joined

- Mar 1, 2019

- Posts

- 2,765

- Qantas

- Silver Club

- Virgin

- Platinum

- Oneworld

- Sapphire

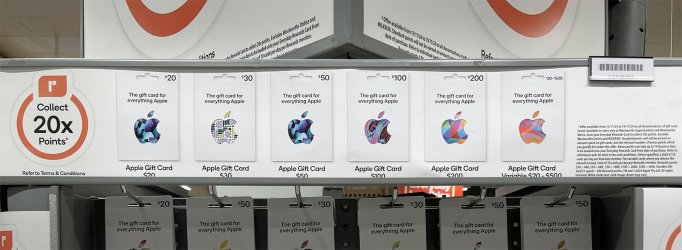

Are these prepaid cards like the Coles ones last week?

Half the points thou.

They're produced by the same company and work exactly the same way.Are these prepaid cards like the Coles ones last week?

Become an AFF member!

Join Australian Frequent Flyer (AFF) for free and unlock insider tips, exclusive deals, and global meetups with 65,000+ frequent flyers.AFF members can also access our Frequent Flyer Training courses, and upgrade to Fast-track your way to expert traveller status and unlock even more exclusive discounts!

AFF forum abbreviations

Wondering about Y, J or any of the other abbreviations used on our forum?Check out our guide to common AFF acronyms & abbreviations.

Currently Active Users

- r21111

- clifford

- JohnM

- ellen10

- Etrust

- _TheTraveller_

- cjd600

- mapnz

- Learned_One

- evaret

- m535607

- wenglock.mok

- n7of9

- aus_flyer

- momad

- flyingfan

- zmoo94

- DejaBrew

- mouseman99

- Austman

- infrequent_flyer

- SomeRando

- RooFlyer

- Traveller X

- Want2flymore

- anat0l

- NoName

- Silvia

- kestrel1977

- Black Duck

- lp137

- gaz0303

- Hawk529

- scotty_mel

- pcal

- JVanSant

- jrfsp

- geoffb78

- roby

- Mort

- A.RK

- I love to travel

- henleybeach

- PDog

- tassie6

- pferos

- concussed

- Daver6

- TheRealTMA

- Cottman

Total: 548 (members: 81, guests: 467)