That is bizzare....

Yes yes, I have found the same thing...

When I first got the Plat Charge, I thought it was unlimited, like they say on the website..... So I put through 50K in the first few weeks (like I use to on my Plat credit card, so it shouldn't have been any surprise), and they put it on hold..

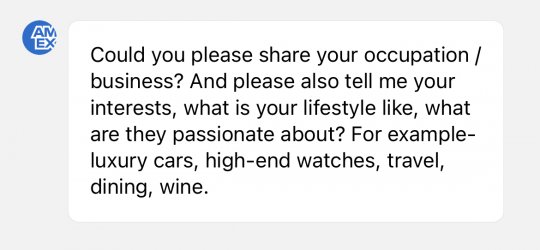

So I call up confused... I thought it was a charge card, with "no pre set limit" as claimed on your website I naively said.....

They wanted fins to let me put through more than 50K a month... I never got around to it, and instead just transferred 50k across immediately to lift the hold, and then kept it to around the 40-50k a month for the first 3 months or so, and then just started nibbling away....

Now a few years later, I've put through over 100k in some months, with a peak balance of like 160K just before I pay the last month, and never a sniff of a hold...

I guess they have some algo's running, and the algo didn't seem to consider my spend or history across the entire AMEX platform, only each individual card/product...

In any case, mad respect! 750K in a month is heavy duty!