That's exactly what needs to be done. They're a very small player on the international stage and all Australians should be vested to ensure their perpetual success and growth, not chronically and consistently rally against it online. Qantas have been the victims of brutal domestic events over the past four years, and don't pretend that you don't know anything about it. They're a business that still positively resonate with the silent majority of Australia. They're not a Google. They're not a Meta. They're not an X. They're not a monster. They're not an Amazon. They're not some big shady multinational bully. It would be very difficult to sympathise with these corporations even though they may have contributed to the greater good.

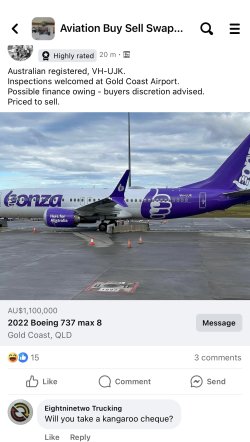

But the owner of Bonza falls into the above category. Bonza's owners are a corporation with significantly deep pockets and are showing signs of serious secrecy, mystery and uncertainty from their (claimed) offices in Miami.

This billion-dollar US corporation has an incredibly chequered, strange and shady history. How could ordinary Australians rally behind this company, and frankly, why should they? This already shady corporation selling Bonza tickets for flights that were already cancelled (in normal national economic conditions!) should have been met with fierce outrage. Are the people who were so bellicose towards QF when they did this during COVID going to express the same level of belligerence?