And on the 4th day i was asked to come into the bank. Had an existing profile with the bank that required updating however the email that was send did not provide any clarity on what was required. Now complete and card will be underway.Just applied and received immediate conditional approval. Might have been a bit easier than others as I already had a 'shell' CBA profile from back when I banked with them. I didn't have to verify ID as it was already there. Uploaded supporting documents and told online that it will take up to 3 business days.

Painless compared to others, but I think the old relationship I had with them has helped immensely.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Credit Card Offers CommBank Ultimate Awards Card: 100K award points – potentially fee free

- Thread starter Dr Ralph

- Start date

Have been asked into the bank tooAnd on the 4th day i was asked to come into the bank. Had an existing profile with the bank that required updating however the email that was send did not provide any clarity on what was required. Now complete and card will be underway.

Tired today but a 40 minute wait. Will try again next week! Many others seem to be able to get their applications sorted via phone or online but not cba it seems!

"...You need to spend at least $5,000 on eligible purchases (excludes balance transfers, cash advances and any purchase that is reversed or refunded) using your new card within the first 90 days of activation."Commbank Ultimate Qantas Bonus Points offer is upped to 70k now. Still a $30 Qantas Enrolment fee. Better than what they have previously:

Our Ultimate Awards Credit Card - CommBank

Earn unlimited Awards or Qantas Points with the Ultimate Awards credit card, plus international travel insurance when you meet the requirements before you travel.www.commbank.com.au

So, excluded purchases DOESN'T include gov transactions apparently, that makes it easy as a non-primary card.

ChrisMars

Established Member

- Joined

- Sep 16, 2017

- Posts

- 1,290

- Qantas

- Platinum

- Virgin

- Red

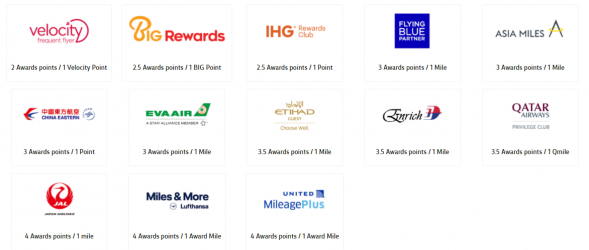

Is the conversion rate to Qantas still a 2.5:1 ? Asking because when comparing signup bonuses. It looks like it is different (better)

The guy who kept ringing me every Friday late afternoon to ask more documents was a real pain. I ended up calling customer services to calmly explain the story and to ask if they could look into it. Got approved next day.

I had a similar story with ANZ security team. They even asked me a second letter from my employer because the first one didn't have the company logo....This application is now turning out to be the pits. I was conditionally approved then asked to supply my pay slips which I did. I was then asked to supply them again, which I did. I was then asked to supply them again to a staff member at a branch. By that time I was getting a bit frustrated but given I'd received a credit enquiry may as well go along with it.

Now I have to provide 3 months of bank statements, a letter from my employer, a bill from two utility companies and last years tax assessment.

I told the person at the branch I'm unlikely to continue, particularly as they tried to help to speak to somebody to clarify the excessive request but they could not even get through.

The guy who kept ringing me every Friday late afternoon to ask more documents was a real pain. I ended up calling customer services to calmly explain the story and to ask if they could look into it. Got approved next day.

GSP

Established Member

- Joined

- Jun 17, 2016

- Posts

- 1,429

Mr H

Established Member

- Joined

- Dec 5, 2013

- Posts

- 3,367

"...You need to spend at least $5,000 on eligible purchases (excludes balance transfers, cash advances and any purchase that is reversed or refunded) using your new card within the first 90 days of activation."

I wonder what would happen if your qualifying purchase was reversed or refunded after the points have been used and the card closed...

You would be smiling all the way to the bank.I wonder what would happen if your qualifying purchase was reversed or refunded after the points have been used and the card closed...

GSP

Established Member

- Joined

- Jun 17, 2016

- Posts

- 1,429

How long does it normally take CBA to credit 100k bonus points after you hit the spending criteria? Anyone could share the experience?

In Post #71 of this thread I mentioned that I received the 90k points (was the offer at the time) 3 weeks after minimum spend.

blacksultan

Established Member

- Joined

- May 1, 2017

- Posts

- 2,289

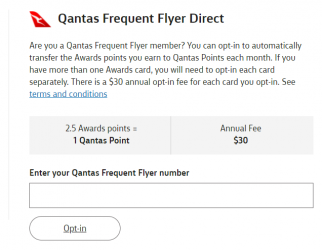

I believe you need to call and ask them to opt you in .Just got this card. I don't recall being provided withthe option to opt into QFF points during the applicationa nd I cant see how to do it online. Anyone have any experience with this?

Dr Ralph

Enthusiast

- Joined

- Jan 21, 2014

- Posts

- 13,523

- Qantas

- Bronze

- Virgin

- Red

Thanks. Seems they don't work weekends. So this will have to wait until Monday. Frustrating, eespecially as you don't know exactly what the statement period is and I need to ensure I spend the $2500 to avaoid the monthly charge.I believe you need to call and ask them to opt you in .

blacksultan

Established Member

- Joined

- May 1, 2017

- Posts

- 2,289

I intend filing a dispute with them . Originally they said I had 2-3 months after closing card to transfer to frequent flyer accounts - after closing card they said I could only redeem for gift cards .Thanks. Seems they don't work weekends. So this will have to wait until Monday. Frustrating, eespecially as you don't know exactly what the statement period is and I need to ensure I spend the $2500 to avaoid the monthly charge.

Also I needed to have qff account linked before closure .

Any experience with filing dispute with ombudsman ?

I will have to request call recordings .

Dr Ralph

Enthusiast

- Joined

- Jan 21, 2014

- Posts

- 13,523

- Qantas

- Bronze

- Virgin

- Red

Yes. My experiences with FOS/AFCA are details in a number of threads - primarirly these related to the failure to award bobus points within the stated timeframe.Any experience with filing dispute with ombudsman ?

I should report back to this this is resolved and card arrived this week and can now be used. Their processing time took more than a week to pick up my file and when they did I had notifications to say I needed to provided a truck of information (already provided). Tried their online chat (took 14 hours for a response) and told to ignore that. All up it took over a month which means I wouldn’t recommend it to someone else!Have been asked into the bank too

Tired today but a 40 minute wait. Will try again next week! Many others seem to be able to get their applications sorted via phone or online but not cba it seems!

GSP

Established Member

- Joined

- Jun 17, 2016

- Posts

- 1,429

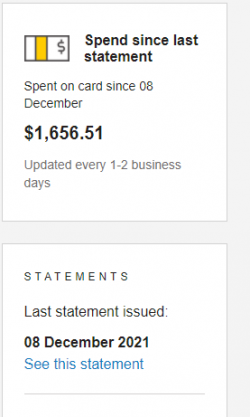

Thanks. Seems they don't work weekends. So this will have to wait until Monday. Frustrating, eespecially as you don't know exactly what the statement period is and I need to ensure I spend the $2500 to avaoid the monthly charge.

Hi Dr Ralph, my input.

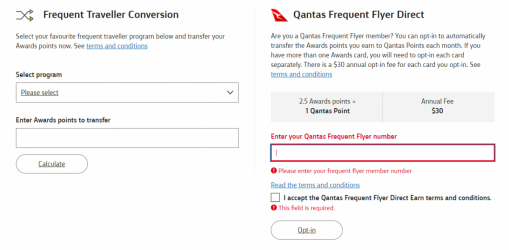

Re: Opting in, I don't believe you need to contact CBA. When you login to your account and navigate your way to the rewards page and then follow the Redeem, then Travel menu options, You will be presented with an option transferring to an airline other than Qantas and an option to transfer to QFF. I've transferred to VFF a couple of times no problem. For the QFF, there is an "Opt In" button. I clicked it to see what would happen but was asked for my QFF number and to accept the terms, I didn't not go further to avoid the $30 fee, but assume that is all that is needed.

Re: Dollar spent, actually CBA are quite good at this, as I'm hanging onto this card for the 12 month to get the other bonus points (per my offer detailed above) and actively watch my spend to spend no more than is necessary than the 2.5k per month and I'm OK with that as earn rate for VFF is quite good when transferring at bonus periods. Anyhow, I've included a grab which shows that they detail how much has been spent in the statement period (note it does not include pending transactions). My experience has found that they show the next statement period end date a couple of weeks prior to it occurring - right now it is not displayed but it does come up, but it is not hard to work out when that would be given the previous months (granted first month maybe not totally clear).

Dr Ralph

Enthusiast

- Joined

- Jan 21, 2014

- Posts

- 13,523

- Qantas

- Bronze

- Virgin

- Red

At this point " When you login to your account and navigate your way to the rewards page and then follow the Redeem, then Travel menu options, " it asks me to log in again and then takes me back to the original screen. Seems no way to see what you have shown in your first two screen shots.Hi Dr Ralph, my input.

Re: Opting in, I don't believe you need to contact CBA. When you login to your account and navigate your way to the rewards page and then follow the Redeem, then Travel menu options, You will be presented with an option transferring to an airline other than Qantas and an option to transfer to QFF. I've transferred to VFF a couple of times no problem. For the QFF, there is an "Opt In" button. I clicked it to see what would happen but was asked for my QFF number and to accept the terms, I didn't not go further to avoid the $30 fee, but assume that is all that is needed.

View attachment 267378

Re: Dollar spent, actually CBA are quite good at this, as I'm hanging onto this card for the 12 month to get the other bonus points (per my offer detailed above) and actively watch my spend to spend no more than is necessary than the 2.5k per month and I'm OK with that as earn rate for VFF is quite good when transferring at bonus periods. Anyhow, I've included a grab which shows that they detail how much has been spent in the statement period (note it does not include pending transactions). My experience has found that they show the next statement period end date a couple of weeks prior to it occurring - right now it is not displayed but it does come up, but it is not hard to work out when that would be given the previous months (granted first month maybe not totally clear).

View attachment 267379

GSP

Established Member

- Joined

- Jun 17, 2016

- Posts

- 1,429

At this point " When you login to your account and navigate your way to the rewards page and then follow the Redeem, then Travel menu options, " it asks me to log in again and then takes me back to the original screen. Seems no way to see what you have shown in your first two screen shots.

How long have you had the card. If I recall correctly I think I also could not get to the rewards site in the first few days and then I was good. Having said that I just went and checked to see if there were any logins under cache or the like and CBA's rewards site is currently under maintenance, so possibly bad timing.

I don't recall that CBA's have a separate login to get to their rewards site (unlike ANZ which definitely do have a separate login with different credentials). I think just haven't been setup yet.

Dr Ralph

Enthusiast

- Joined

- Jan 21, 2014

- Posts

- 13,523

- Qantas

- Bronze

- Virgin

- Red

Received card and activiated card today.How long have you had the card. If I recall correctly I think I also could not get to the rewards site in the first few days and then I was good. Having said that I just went and checked to see if there were any logins under cache or the like and CBA's rewards site is currently under maintenance, so possibly bad timing.

I don't recall that CBA's have a separate login to get to their rewards site (unlike ANZ which definitely do have a separate login with different credentials). I think just haven't been setup yet.

I'm not prepared to start using it until I know I'm enrolled inthe QFF rewards option.

GSP

Established Member

- Joined

- Jun 17, 2016

- Posts

- 1,429

Received card and activiated card today.

I'm not prepared to start using it until I know I'm enrolled inthe QFF rewards option.

You will need to so as to ensure you don't get slugged the $35 fee for not spending 2.5k. I don't think you will have any problems however.

Become an AFF member!

Join Australian Frequent Flyer (AFF) for free and unlock insider tips, exclusive deals, and global meetups with 65,000+ frequent flyers.AFF members can also access our Frequent Flyer Training courses, and upgrade to Fast-track your way to expert traveller status and unlock even more exclusive discounts!

AFF forum abbreviations

Wondering about Y, J or any of the other abbreviations used on our forum?Check out our guide to common AFF acronyms & abbreviations.

Recent Posts

-

-

Everyday Rewards launches Everyday Extra subscription product

- Latest: Freq Flier 2013

-

-

Currently Active Users

Total: 734 (members: 7, guests: 727)