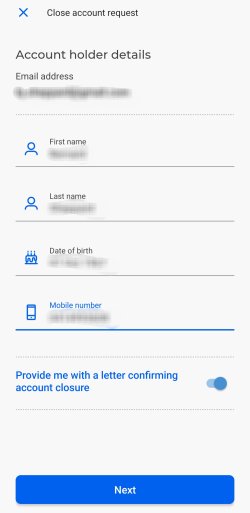

I just discovered that the Android app (and, I am guessing the iPhone app also has this) has an account closure request (and it also confirms that I didn't have to provide my credit limit - it's the same form).

It worked instantly this time.

From Account settings, you should be able to get to Account Closure Request.

Provide name, DOB, mobile (and reason), choose if you want a confirmation email, and submit.

I got the requested and closed emails immediately, and the card was removed from the app a minute or so later.

Thanks for the link, I probably cancel, I may use in the US for October before cancelling, and eat a couple of $8 x 2 fees,

Interesting received this via linkedin.

Dear Bundy Bear.

As an employee of XYZ corporation, you can open up a world of opportunity by becoming a member of HSBC’s Employee Banking Solutions and be part of a network that can provide you with an enhanced level of banking, exclusive offers, and a deeper level of service.

If you’re taking a trip overseas soon and don’t want to be paying fees, then consider the which card best suits your needs. With some cards you could be paying up to 3% on international transaction fees for every purchase or cash withdrawal. So, put your HSBC Everyday Global Visa Debit Card in your wallet or load it on your phone and spend fee-free1 overseas.

With the HSBC Everyday Global Account, you can spend fee-free wherever you go:

· $0 international transaction fee

· Make fee-free withdrawals from HSBC ATMs around the world

· No need for separate accounts for different currencies. Open one account to hold, transfer, and spend in up to 10 currencies: AUD, USD, GBP, EUR, HKD, CAD, JPY, NZD, SGD, and CNY (currency restrictions apply).

· Lock in competitive HSBC Real Time Exchange3 rates anytime, anywhere on the HSBC AU Mobile app.

And remember, you can also use your card for everyday banking - pay your bills and deposit your salary with no monthly account fees1, all with the convenience of a Visa Debit Card.

Apply today at link removed.

Don’t forget to mention you’re a member of HSBC’s Employee Banking Solutions when applying to enjoy all the benefits.

Not sure if this could be better, hopefully someone can give me good or bad news.